Hello, and welcome to xlearn’s daily price action forex forecast for day traders. If this is your first time here, I recommend reading our guide on how to use our market analysis article before diving into this one.

The Federal Reserve recently cut its interest rate to a range of 4.75%-5.00%, signaling greater confidence that inflation is moving toward their 2% target, although there are concerns about the labor market cooling. This decision has led to a shift in market sentiment, with expectations of further rate cuts, which could influence USD pairs significantly in the coming months.

Meanwhile, market optimism continues for a “soft landing” despite signs of economic slowdown, including rising unemployment and contracting manufacturing activity. The S&P 500 is up 18% for the year, and small-cap stocks have shown strong performance as well, suggesting investors are preparing for a lower interest rate environment.

In Canada, recent data showed a decline in home sales and a moderate GDP growth forecast, reflecting a mixed economic outlook. Keep an eye on CAD pairs as the market reacts to these developments.

These factors, along with ongoing shifts in market leadership and the upcoming earnings reports, could drive volatility across major currency pairs, especially USD, CAD, and JPY.

Now, before we get into the analysis, let’s quickly review the major economic events that could impact the market.

Key Economic Events This Week

These events encompass important global news, macroeconomic reports, and economic indicators. For more details, you can check the forex factory.

2024.09.23

- There are no major events that could really impact the forex market on this day.

2024.09.24

- 0:30 ET: Australia will release its Interest Rate Statement, which sets the rate on overnight loans between financial institutions. This happens 8 times a year. The current and expected rate is 4.35%. If the actual rate is higher than forecast, it’s good for the currency. Although the rate is often anticipated by the market, traders pay more attention to the RBA Rate Statement for future outlook. Short-term interest rates are key in currency valuation, so this event will impact AUD pairs.

- 1:05 ET: BOJ Gov Ueda Speaks. He is scheduled to speak at a meeting with business leaders in Osaka. A more hawkish tone than expected is good for the currency. His speeches often cause volatility as traders look for clues on interest rate changes. As head of the central bank, which controls short-term interest rates, he has significant influence over the nation’s currency value. Traders closely analyze his words, as they often provide subtle hints about future monetary policy and rate changes, impacting JPY pairs.

- 10:00 ET: US CB Consumer Confidence report will be released, showing the level of a composite index based on surveyed households. The previous reading was 103.3 and the forecast is 103.9. If the actual number is higher than forecast, it’s good for the currency. Financial confidence is a leading indicator of consumer spending, which drives most economic activity, so this will impact USD pairs.

- 13:10 ET: BOC Gov Macklem Speaks. He will participate in a fireside chat at the Institute of International Finance and Canadian Bankers Association Canada Forum in Toronto. Audience questions are expected. A more hawkish stance than expected is good for the currency. His speeches can cause volatility as traders look for hints on interest rate changes. As the head of the central bank, which sets short-term interest rates, he has the most influence over the nation’s currency value. Traders closely analyze his public appearances, as they often contain subtle clues about future monetary policy, impacting CAD pairs.

- 21:30 ET: Australia will release its CPI y/y, showing the change in the price of goods and services purchased by consumers. The previous reading was 3.5% and the forecast is 2.7%. If the actual result is higher than forecast, it’s good for the currency. Consumer prices are a major component of overall inflation, and higher inflation can lead the central bank to raise interest rates to control it. This will impact AUD pairs.

2024.09.25

- There are no major events that could really impact the forex market on this day.

2024.09.26

- 3:30 ET: The Swiss National Bank will release its Monetary Policy Statement and Interest Rate decision. This is the main tool the SNB Governing Board uses to communicate its monetary policy stance to investors. It includes their decision on interest rates and comments on the economic factors influencing that decision. The previous rate was 1.25%, and the forecast is 1.00%. If the actual rate is higher than forecast, it’s good for the currency. This statement also projects the economic outlook and hints at future rate decisions, which makes it crucial for CHF pairs. The decision is often anticipated by the market, so focus shifts to the Monetary Policy Assessment for future guidance. Short-term interest rates are key to currency valuation, so this is a highly volatile event for CHF pairs.

- 4:00 ET: SNB Press Conference with the SNB Chairman and Governing Board Members. A more hawkish tone than expected is good for the currency. The conference lasts about an hour and has two parts: first, the prepared statements are read, followed by a Q&A session with the press. The unscripted answers during the Q&A often create market volatility. This is one of the main tools the SNB Governing Board uses to communicate monetary policy and the economic outlook to investors, impacting CHF pairs.

- 8:30 ET: US Final GDP q/q will be released, showing the annualized change in the inflation-adjusted value of all goods and services produced by the economy. The previous and forecast figures are both 3.0%. If the actual result is higher than the forecast, it’s good for the currency. This data is reported quarterly but in an annualized format. There are three versions of GDP data released a month apart—Advance, Preliminary, and Final—with the Advance release usually having the most impact. However, the Final release can still influence USD pairs.

- 9:20 ET: Fed Chair Powell Speaks. He will deliver pre-recorded opening remarks at the US Treasury Market Conference in New York. A more hawkish tone than expected is good for the currency. His speeches often cause market volatility as traders look for hints on future interest rate changes. As head of the central bank, which sets short-term interest rates, he has the most influence over the nation’s currency value. Traders closely analyze his public statements for clues about future monetary policy, impacting USD pairs.

2024.09.27

- 8:30 ET: Canada will release its GDP m/m, showing the change in the inflation-adjusted value of all goods and services produced by the economy. The previous figure was 0.0%, and the forecast is 0.1%. If the actual result is higher than forecast, it’s good for the currency. As the broadest measure of economic activity and the primary gauge of the economy’s health, this report will impact CAD pairs.

- 8:30 ET: The US Core PCE Price Index m/m will be released, showing the change in prices of goods and services purchased by consumers, excluding food and energy. The previous and forecast figures are both 0.2%. If the actual result is higher than forecast, it’s good for the currency. Unlike Core CPI, this index only measures items consumed by individuals and weights them by total expenditure, providing valuable insights into consumer spending behavior. While CPI is released earlier and gets more attention, Core PCE is the Federal Reserve’s preferred inflation measure. Higher inflation often leads to rate hikes to control prices, impacting USD pairs.

Price Action Forex Forecast

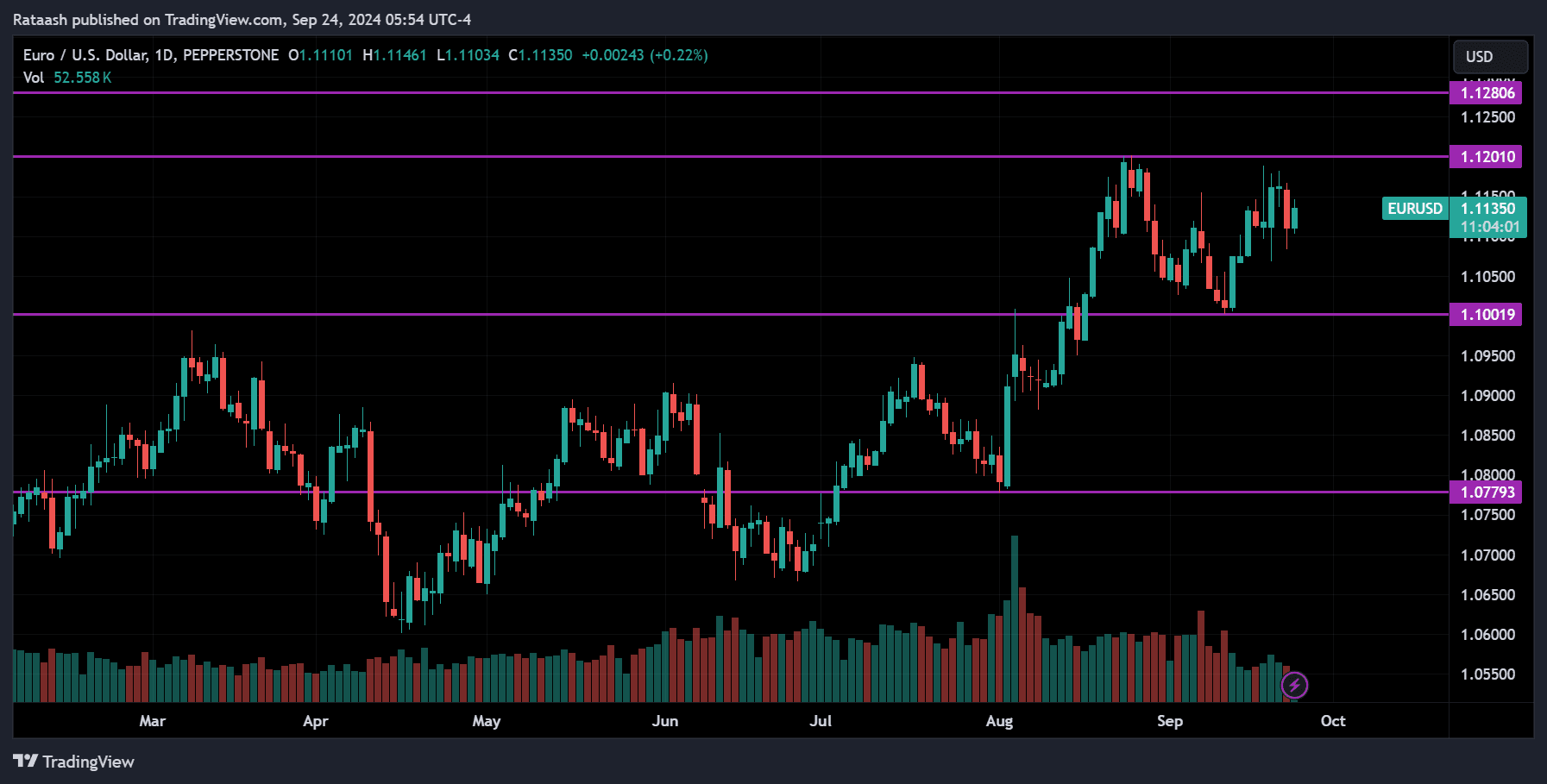

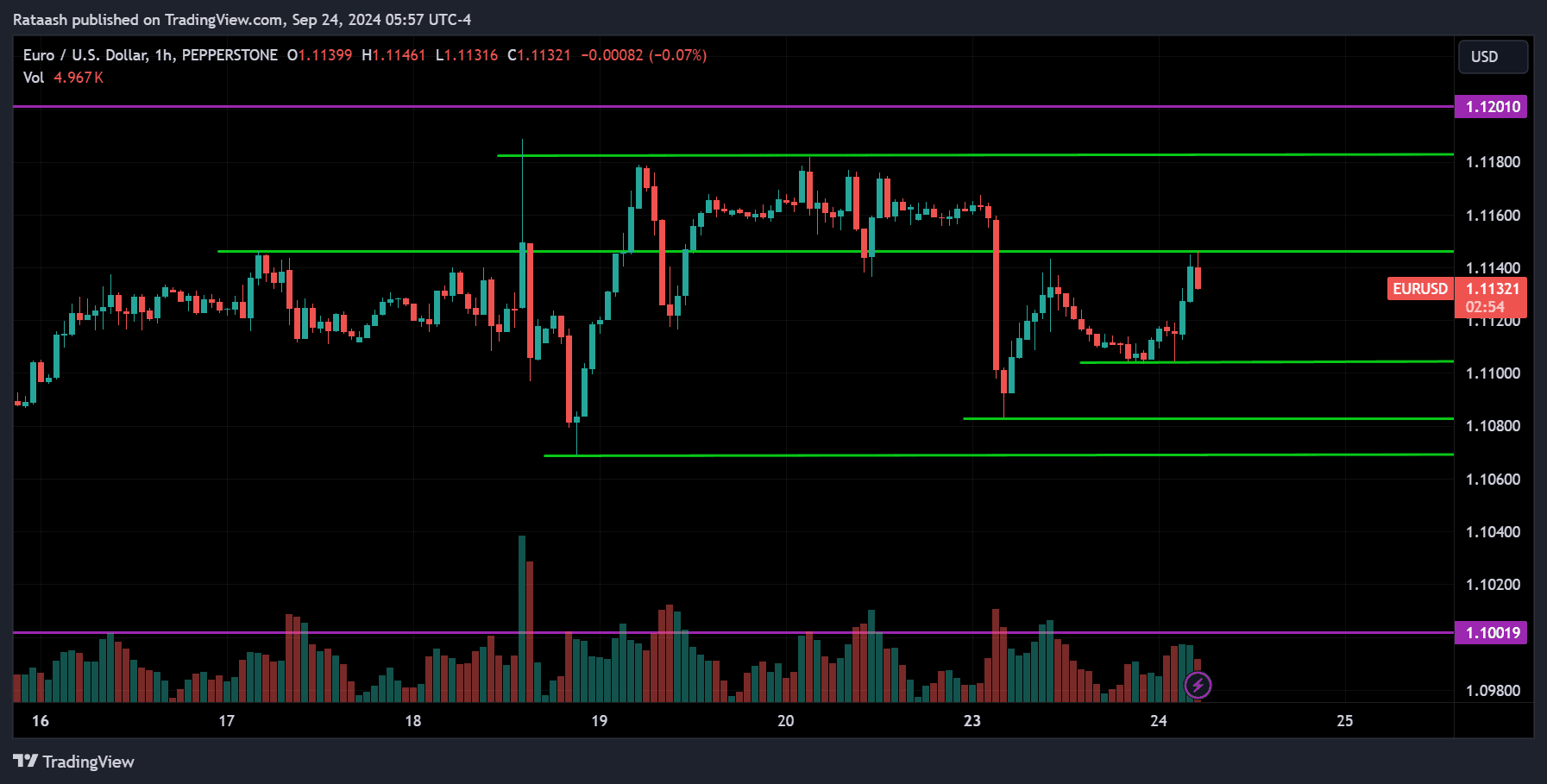

EURUSD:

EURUSD is in an overall uptrend, with the price currently approaching the major resistance level of 1.12000. On the 1-hour chart, the price has pulled back and is now climbing again, currently around the 1.11500 resistance zone. Given the bullish trend, a break above this resistance could lead the price towards 1.11800, and if that level is surpassed, it may continue to 1.12000. A breakout above 1.12000 would signal the continuation of the uptrend. However, if the price starts to decline and breaks below the support at 1.10700, we could see it drop further towards 1.10000.

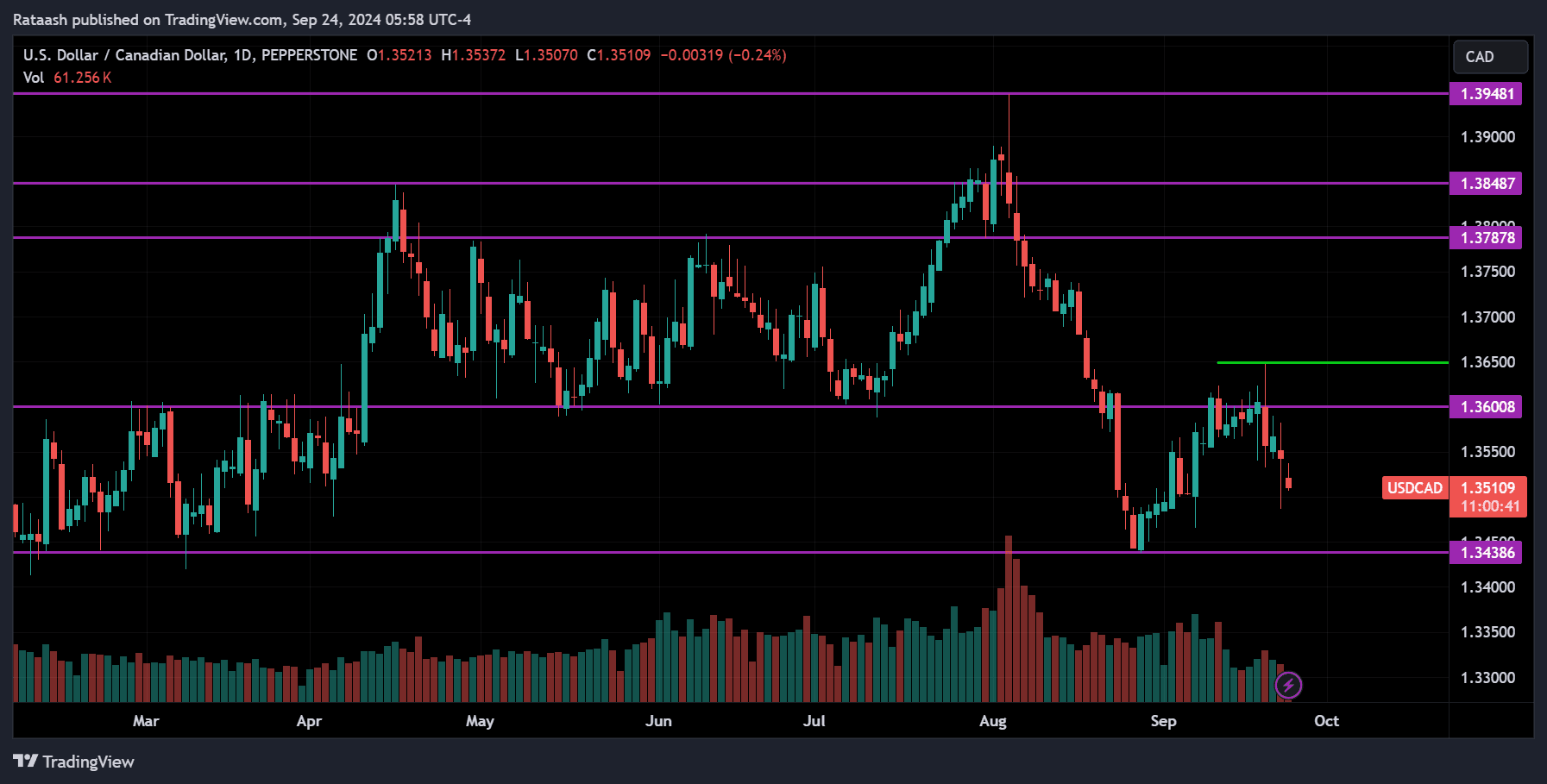

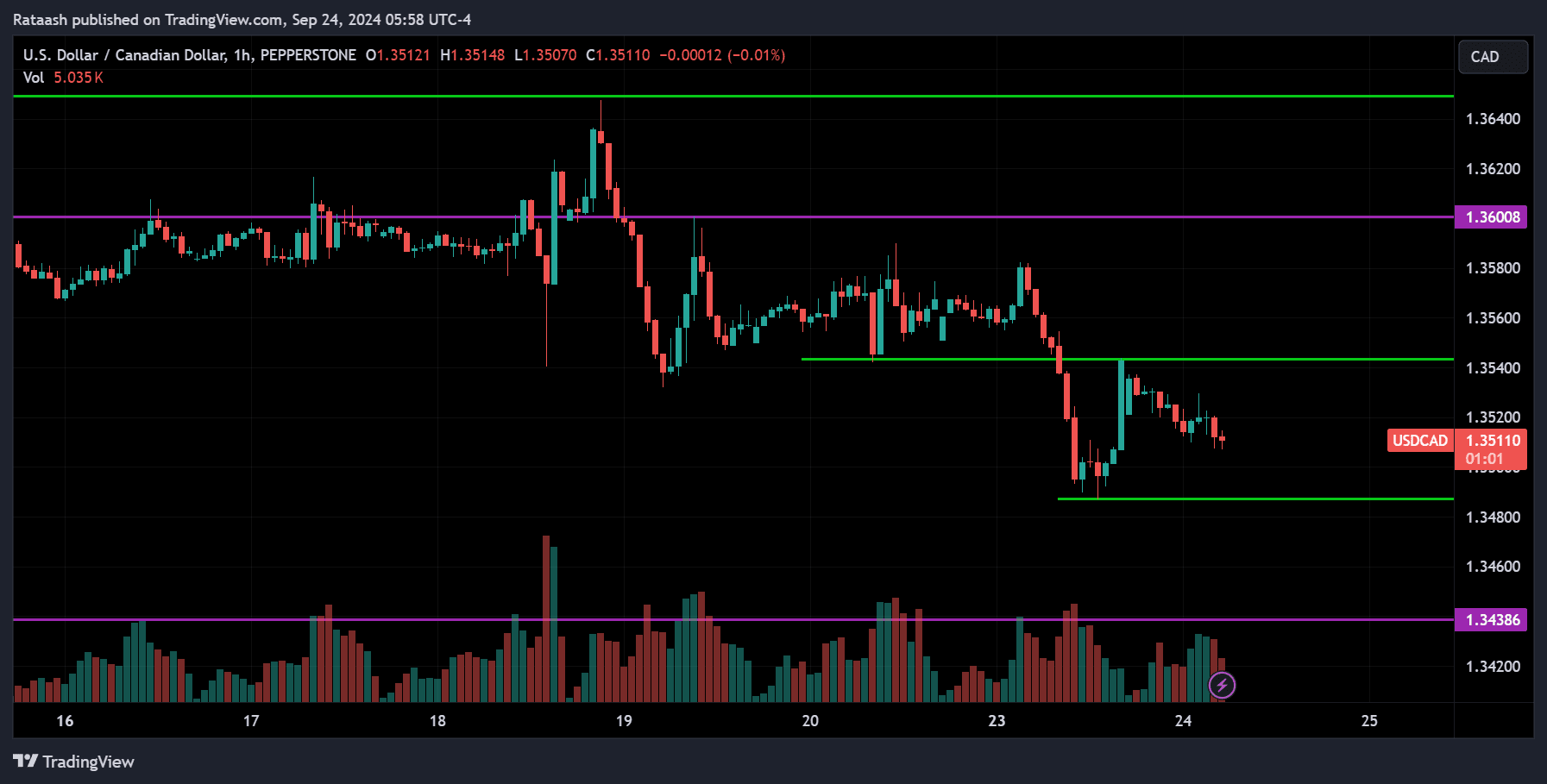

USDCAD:

USDCAD is in a downtrend, with the price approaching the major support level around 1.34400. On the 1-hour chart, the price recently pulled back from the 1.34800 support and rose to the 1.35400 resistance before starting to drop again. Given the bearish trend, a break below the 1.34800 support could lead the price down to 1.34400, where a pullback or breakout may occur. Conversely, if the price breaks above the 1.35400 resistance, it could continue up towards the major resistance at 1.36000, where a pullback or breakout could happen.

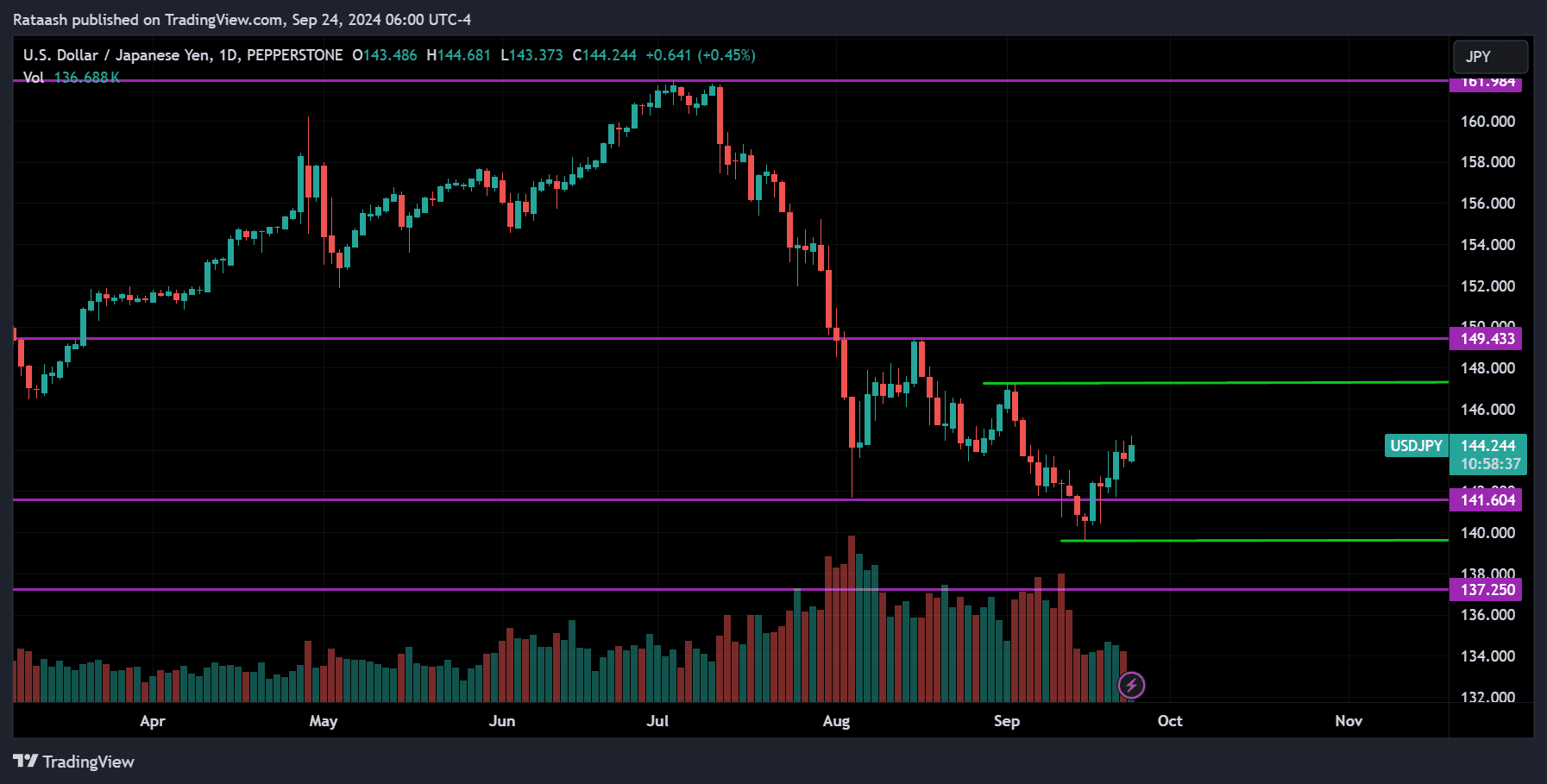

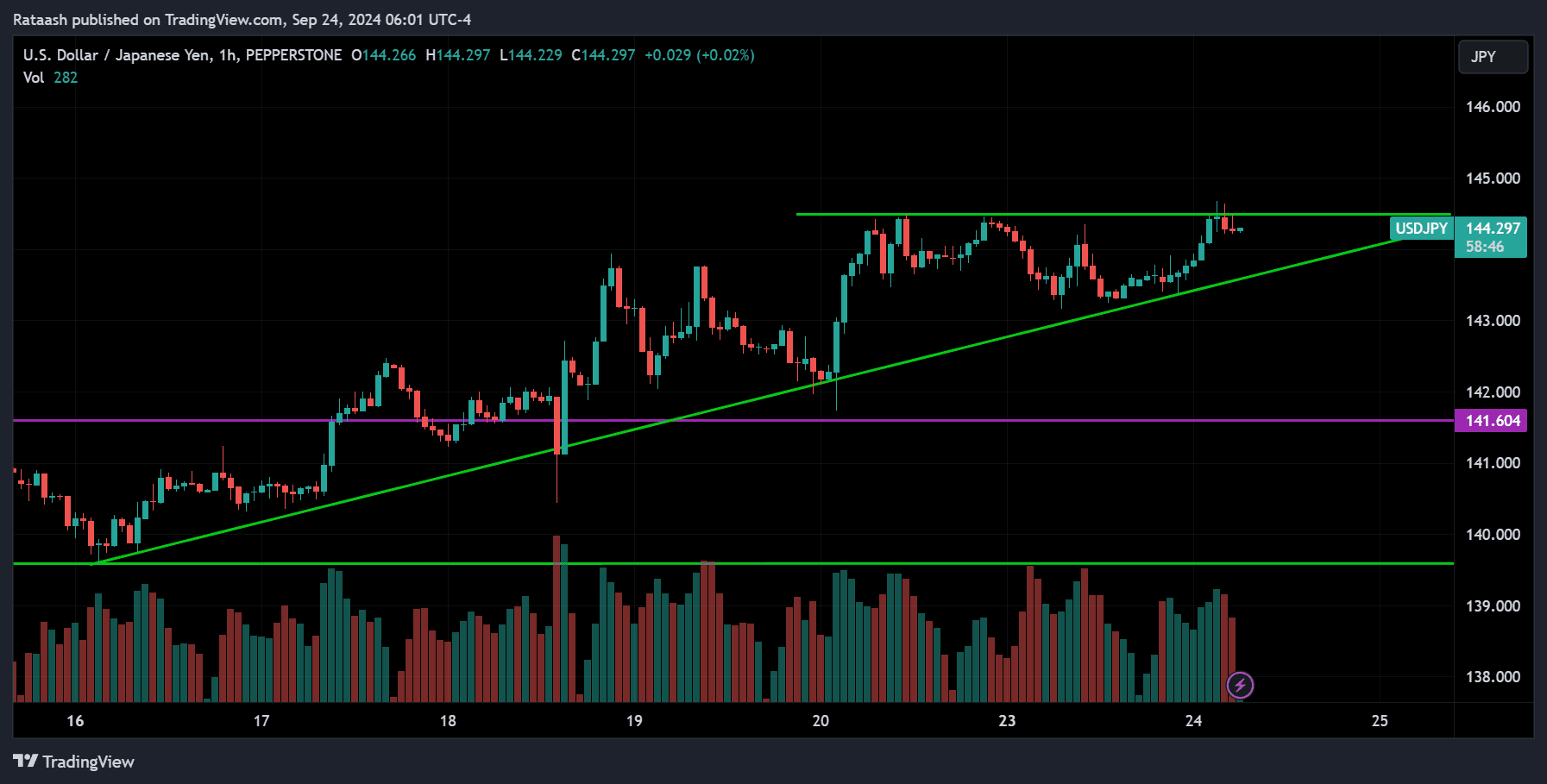

USDJPY:

USDJPY is in an overall downtrend, currently pulling back from the 140 support level. On the 1-hour chart, the price is steadily climbing, approaching the resistance around 145. If the price breaks above this resistance, it could continue upwards towards the 148 resistance range, and if that level is broken, it may reach the 149.450 range. However, since the overall trend is bearish, a break below the trend line could lead to a drop towards the 141.600 range, and if that level is breached, the price could fall further to the 140 level.

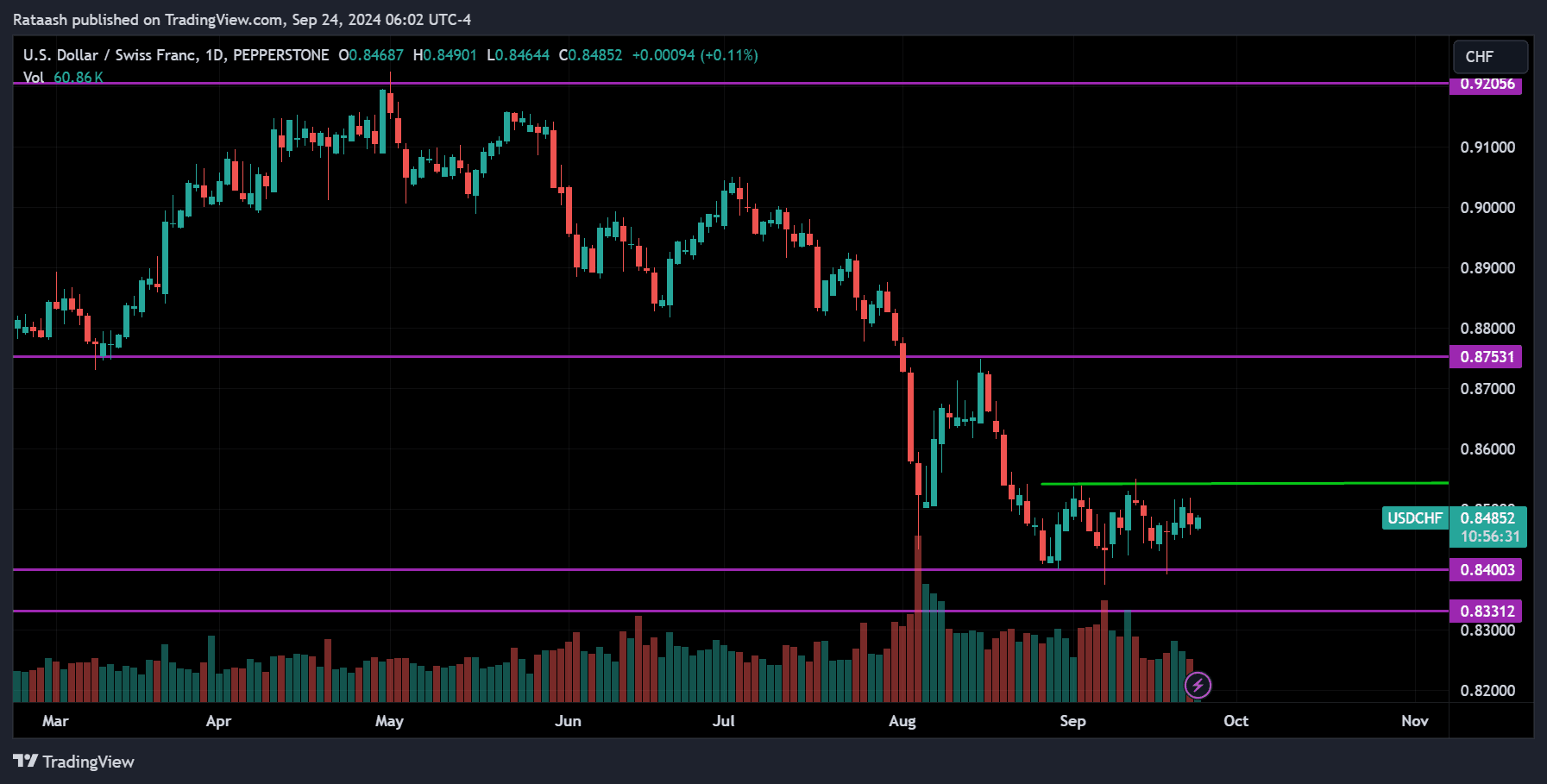

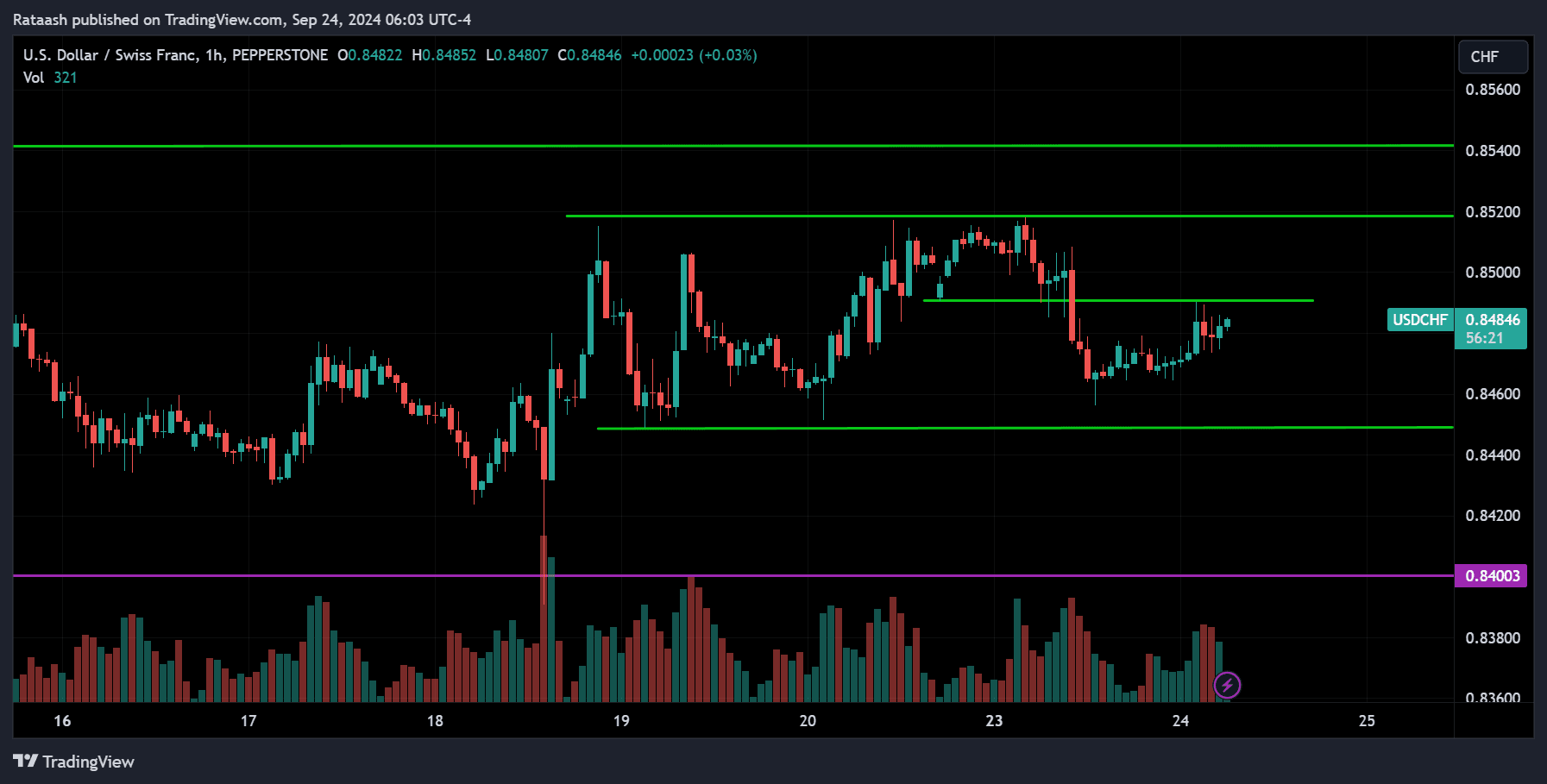

USDCHF:

USDCHF is trending down but has entered a consolidation phase. On the 1-hour chart, the price is consolidating between the support at 0.84500 and the resistance at 0.85200. There is a minor resistance around 0.85000—if the price breaks above it, we can expect a move towards 0.85200, and if that level is broken, the price may rise to 0.85400. A break above 0.85400 could signal the beginning of an uptrend towards the 0.87500 range. Conversely, if the price breaks below the 0.84500 support, we can expect it to drop to the 0.84000 range, and if that level is broken, the next target would be around 0.83300.

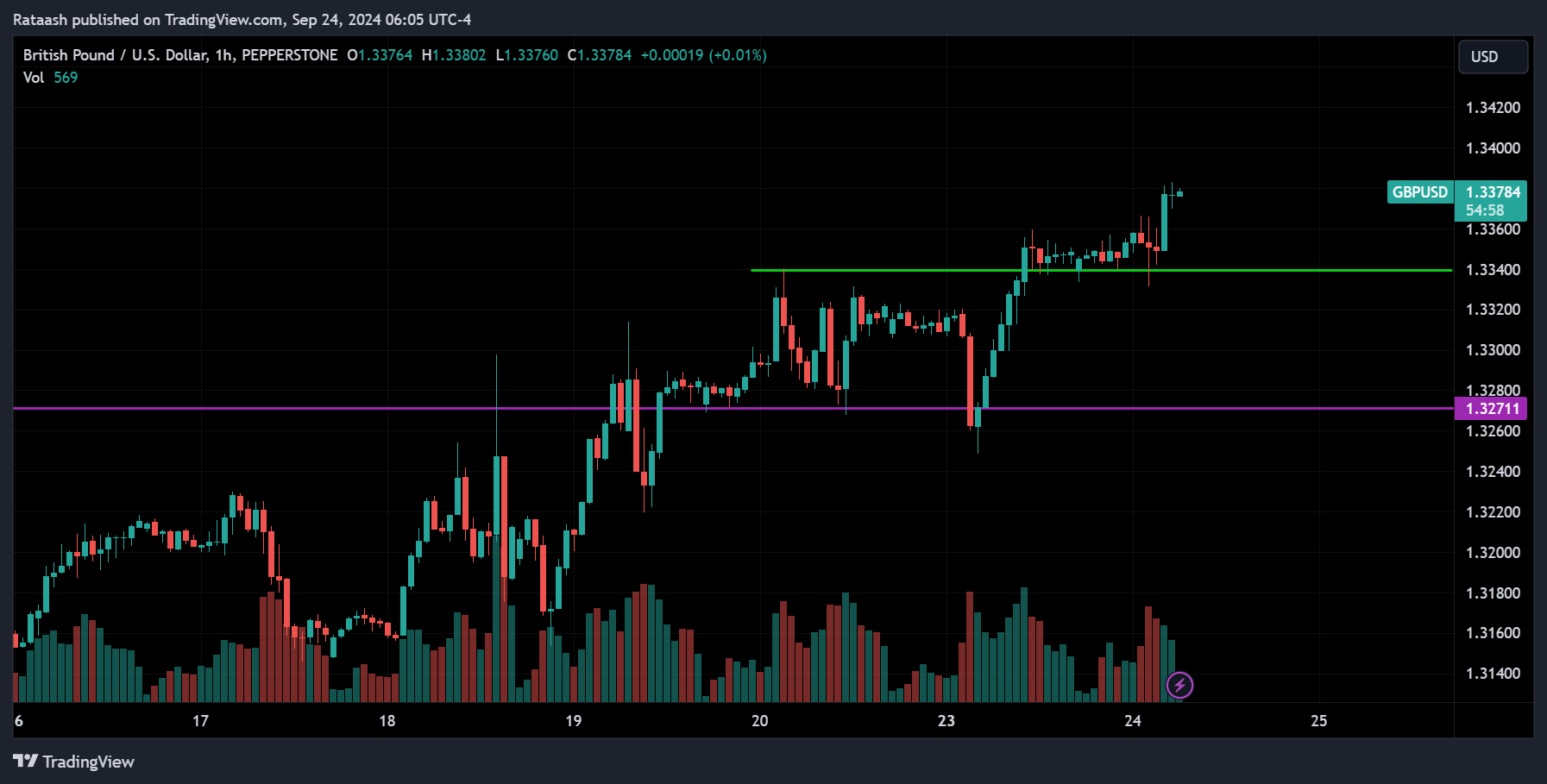

GBPUSD:

GBPUSD is trending upwards, having recently broken above the 1.33400 resistance level, which now acts as support. We can expect the bullish momentum to continue. However, keep an eye on the 1.32700 support level—if the price breaks below it, this could indicate a trend reversal or a potential correction.

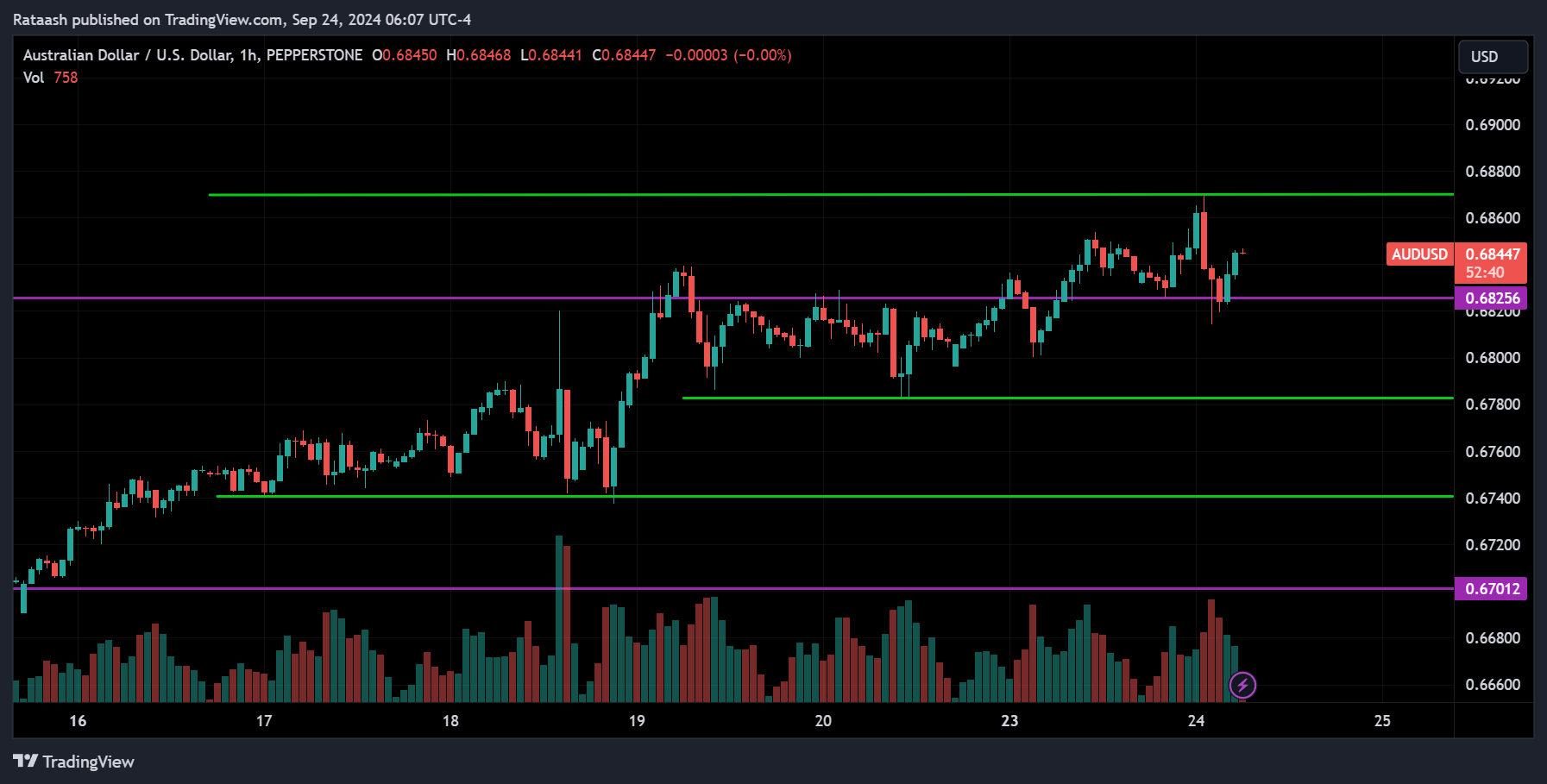

AUDUSD:

AUDUSD is in an overall uptrend, currently trading near the resistance level around 0.68700. If the price breaks above this resistance, we can expect the uptrend to continue. On the downside, 0.68250 serves as strong support. A break below this level could indicate a potential reversal, but for better confirmation, wait for the price to break below 0.67800. If that happens, the price is likely to head towards the 0.67400 range or further down to 0.67000.

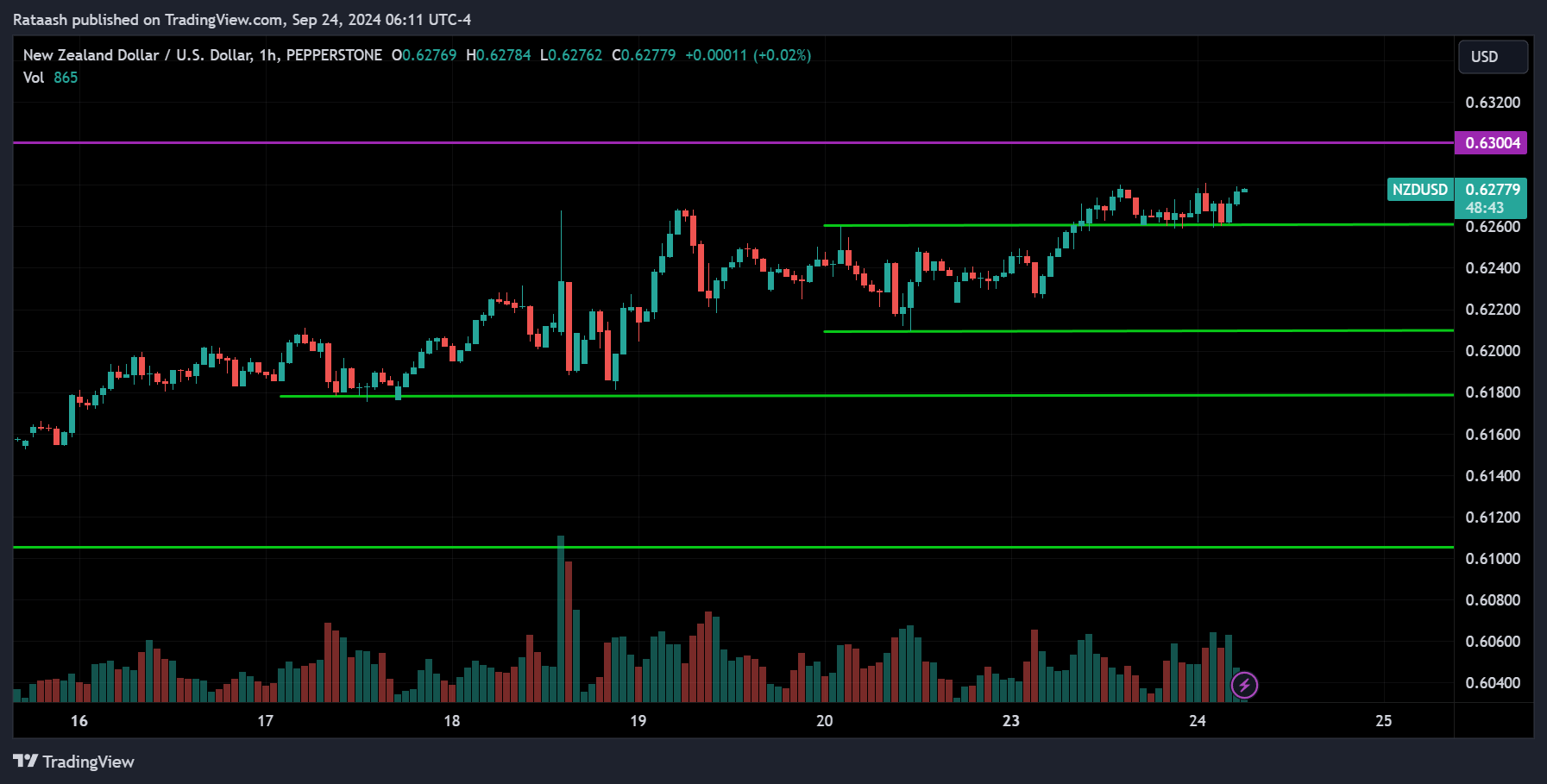

NZDUSD:

NZDUSD is trending up and currently trading near the major resistance at 0.63000. If the price breaks above this resistance, we can expect the upward momentum to continue. However, if the price breaks below the 0.62600 support, it may drop to the 0.62100 range, and if that level is also broken, it could fall further to 0.61800. A break below 0.61800 could lead the price down to the 0.61000 range. Since the price is consolidating overall, expect a potential drop from higher levels unless the price breaks above the 0.63000 range, which would confirm a continuation of the uptrend.

Conclusion & Disclaimer

Subscribe to our Telegram channel to get instant updates on new articles.

Please provide your feedback on how we can improve this article. Thank you!

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!