In this article, we’ll learn how to purchase stocks or any other asset from a marketplace.

What is an Order?

To buy or sell an asset from an exchange, we must provide a broker with an order that includes the asset’s name, quantity, order type, price, and direction (buy or sell). This order enables the broker to execute the transaction on our behalf.

- Name / Symbol / Ticker

- Quantity

- Order Type and Price

- The Direction (BUY or SELL)

What is a Ticker?

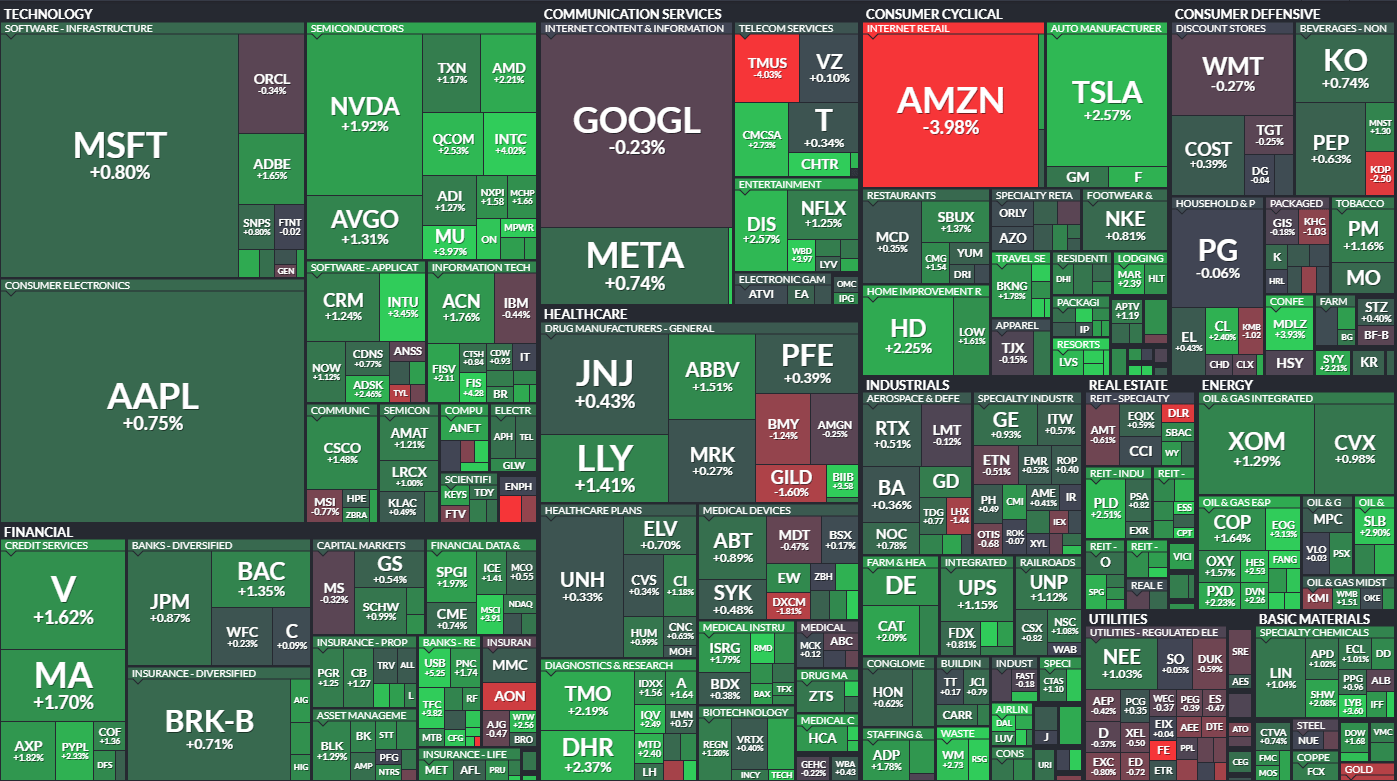

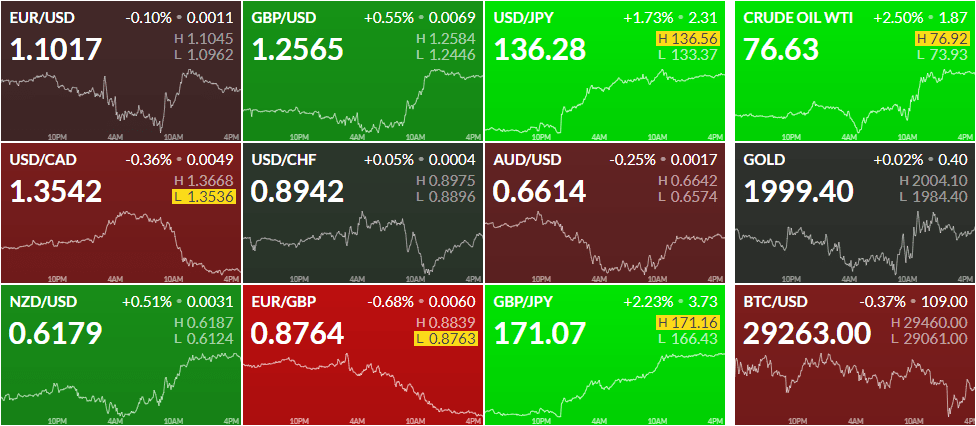

Different markets refer to assets by various names, such as tickers for stocks, coins and tokens for crypto, and fx pairs for currencies.

However, each asset has its unique code or name. and that’s what we give it to our brokers. here are some examples.

| STOCK | CRYPTO | FOREX | OTHERS |

|---|---|---|---|

| AAPL | BTC | EUR/USD | GOLD |

| ABBV | ETH | GPB/USD | SILVER |

| AMZN | XMR | AUD/CAD | OIL |

| MSFT | DOT | USD/JPY | SUGAR |

| TSLA | BNB | EUR/JPY | CORN |

| GOOG | USDT | GBP/USD | COAL |

| F | TRX | USD/LKR | GAS |

What is a Pair?

As trading instruments, most of the time you see something like this EURUSD, AUDCAD, GBPUSD, BTCUSDT, ETHBTC, these are called pairs.

A currency pair represents the exchange rate between two currencies in the foreign exchange market (Forex).

It is expressed as the amount of one currency needed to purchase another currency.

If EURUSD is trading at 1.09761, it indicates that 1 unit of the European currency (EURO) can be used to purchase 1.09761 units of the United States dollar (USD).

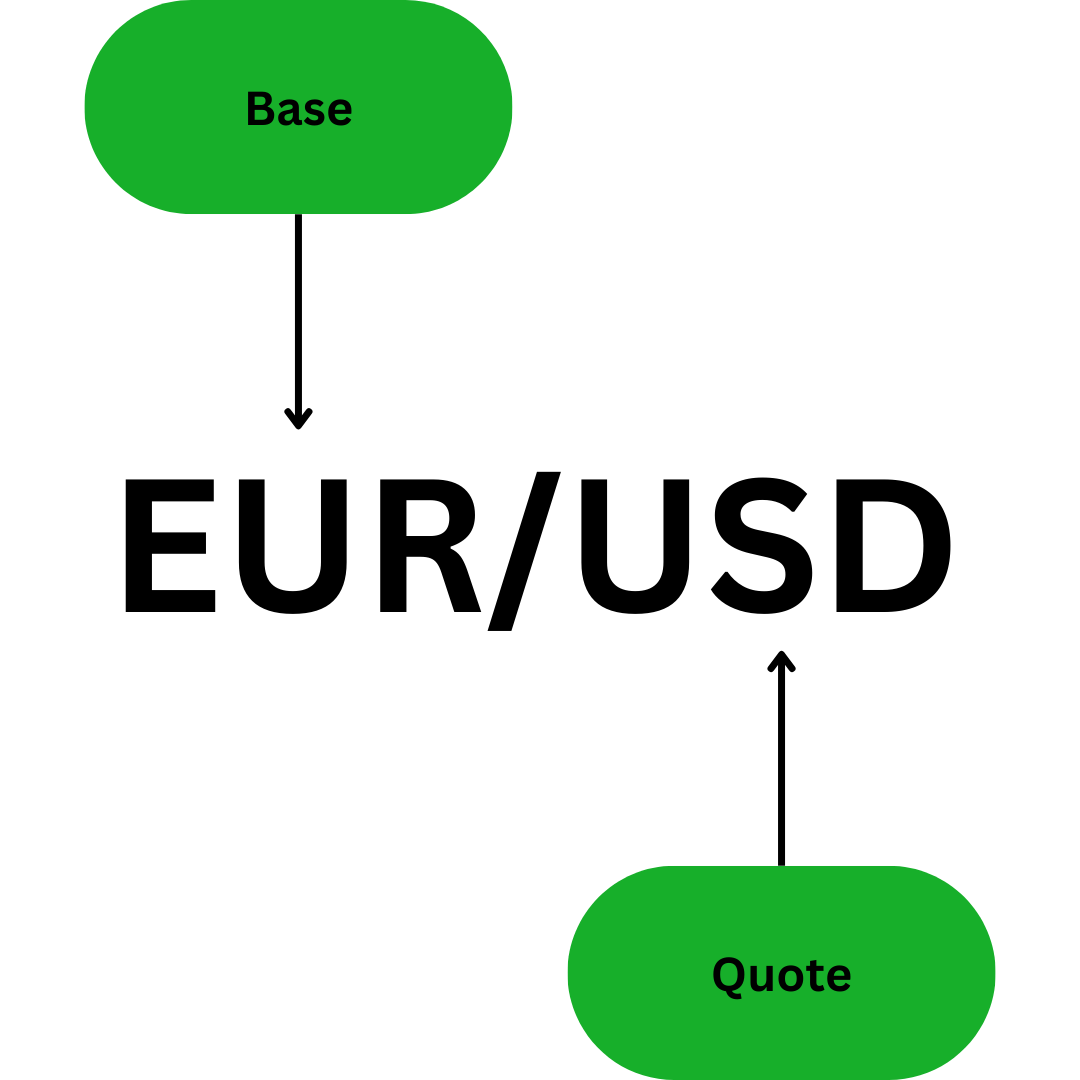

In a currency pair, the base currency is the first currency listed and represents the “base” value against which the exchange rate is quoted. The quote currency, on the other hand, is the second currency listed and represents the value that one unit of the base currency can be exchanged for.

The base currency is important because it is the reference point for all calculations involving the currency pair. It also represents the currency that is being bought or sold in the forex market. The quote currency, on the other hand, represents the currency used to pay for the base currency.

Choosing the Quantity of the Asset

Order size or quantity refers to the number of units of a financial asset that a trader wishes to buy or sell in a single transaction.

The order size is a key component of a trading order, which is a set of instructions given by a trader to a broker or trading platform to execute a trade on their behalf.

It is usually specified in the base currency of the financial asset being traded, such as shares of a stock, futures contracts, or currency pairs.

For example, a trader may place an order to buy 500 shares of a particular stock at a specific price like $10, or to sell 100 futures contracts at a certain price level.

The order size is important because it determines the amount of capital that will be allocated to a particular trade. It is also a factor in determining the liquidity of the market.

The order sizing technique used in forex is known as “lots”, which differs slightly from other markets. we’ll cover that later.

What are the Order Types in Trading?

We know that these markets are auction markets where the price is determined by the highest price the buyer is willing to pay (bids), and the lowest price the seller is willing to take (offers).

There are several types of orders that traders can use to specify the conditions under which they want to buy or sell a financial asset. Here are some of the most common order types:

Market Orders:

A market order is an instruction to buy or sell a financial asset at the current market price. This type of order guarantees execution but does not guarantee a specific price. Market orders are typically used when speed of execution is more important than price.

Limit Orders:

A limit order is an instruction to buy or sell a financial asset at a specific price or better. This type of order guarantees a specific price but does not guarantee execution. If the market does not reach the specified price, the order will not be executed.

Stop Orders:

A stop order is an instruction to buy or sell a financial asset once the price reaches a specific level, called the stop price. Once the stop price is reached, the order becomes a market order and is executed at the best available price.

Stop Limit Orders:

A stop-limit order is similar to a stop order, but instead of becoming a market order when the stop price is reached, it becomes a limit order with a specified price range. This type of order provides more control over the execution price, but there is a risk that the order may not be executed if the market does not reach the specified price range.

Trailing Stop Orders:

A trailing stop order is an instruction to buy or sell a financial asset once the price reaches a specific level, but the stop price is adjusted as the market price moves in favor of the trade. This type of order is used to protect profits or limit losses.

These are just a few examples of the many order types that are available in finance. the choice of order type depends on the trader’s trading strategy, risk tolerance, and market conditions. but we probably going to use either market or limit order most of the time.

Immediate or Cancel (IOC) Orders:

IOC orders execute immediately at the best available price or are canceled entirely if the entire order cannot be filled immediately. This order type is useful in fast-moving markets or when traders aim to capitalize on short-term price movements without accepting partial fills.

Fill or Kill (FOK) Orders:

FOK orders must be executed in their entirety immediately or canceled entirely. They are employed when traders require a large order to be filled all at once, avoiding the risk of accumulating partial fills and unwanted positions.

Good ‘Til Canceled (GTC) Orders:

GTC orders remain active until filled or canceled by the trader. Unlike day orders, which expire at the end of the trading day, GTC orders can remain open indefinitely, allowing traders to pursue longer-term strategies without constant monitoring.

Trade Direction (BUY/SELL)

The direction of a trade refers to whether a trader is buying or selling a financial asset.

A buy trade involves purchasing a financial asset with the expectation that its value will increase in the future, enabling the investor to sell it at a profit.

A sell trade, on the other hand, involves selling a financial asset with the expectation that its value will decrease in the future, enabling the investor to buy it back at a lower price and profit from the difference.

But how do you sell something that you don’t own? Well, it’s called Shorting or Short Selling.

What is Short Selling?

Short selling is a trading strategy that involves selling borrowed securities with the expectation that their price will decline, so they can be bought back at a lower price in the future, thereby generating a profit.

To short-sell security, a trader must borrow the security from a broker or another investor and sell it in the market.

The trader must then buy back the same security at a later time to close the position, ideally at a lower price, and return the borrowed security to the lender.

If the price of the security falls as anticipated, the trader can buy it back at a lower price, make a profit on the difference between the sale price and the purchase price, and return the borrowed security to the lender.

Short selling is a risky strategy because if the price of the security rises instead of falling, the trader will incur a loss.

There is also a risk of unlimited loss if the price of the security rises significantly, as there is no limit to how high the price can go. Therefore, it is important for traders to have a sound understanding of the risks involved in short selling and to implement appropriate risk management strategies, such as setting stop-loss orders, to limit potential losses.

Conclusion

Here are some examples of orders:

| TICKER : TSLA | TICKER : MSFT |

| DIRECTION : BUY | DIRECTION : SELL |

| QUANTITY : 1000 | QUANTITY : 100 |

| ORDER TYPE : MARKET ORDER | ORDER TYPE : LIMIT ORDER |

| PRICE : AT MARKET | PRICE : 279.60 |

I hope you have gained some knowledge. If you were already familiar with these concepts, then congratulations, you have a good grasp of the basics and are ready to move on to the more exciting aspects of financial markets.

In the following section, we will delve into the fundamental elements of trading, namely orders, level II, and time of sales. These are essential concepts that form the backbone of trading.