Portfolio rebalancing is a strategic process in investment management that involves adjusting the composition of a portfolio to maintain a desired level of risk and return.

This is typically done by buying or selling assets within the portfolio. The primary goal of rebalancing is to ensure that the portfolio’s allocation aligns with the investor’s financial objectives and risk tolerance.

Maintaining a well-balanced portfolio is essential for achieving long-term investment objectives. Over time, market movements can cause certain asset classes to outperform or underperform, altering the original asset allocation. Without periodic rebalancing, portfolios may become skewed, exposing investors to unintended levels of risk or failing to capitalize on emerging opportunities.

Principles of Portfolio Rebalancing:

Asset Allocation Strategy:

- Establish a clear asset allocation strategy based on financial goals, time horizon, and risk tolerance.

- Define target percentages for each asset class, such as stocks, bonds, and cash.

Regular Monitoring:

- Regularly monitor the performance of the portfolio to identify deviations from the target allocation.

- Utilize quantitative and qualitative methods to assess the impact of market fluctuations.

Trigger Points and Thresholds:

- Set trigger points or thresholds that, when breached, signal the need for rebalancing.

- Determine acceptable ranges for asset class percentages to guide decision-making.

Buy and Sell Decisions:

- When trigger points are reached, make informed decisions to buy or sell assets to restore the desired asset allocation.

- Consider the relative performance, risk, and future prospects of different asset classes.

Tax Considerations:

- Be mindful of tax implications associated with selling assets, such as capital gains or losses.

- Optimize the timing of rebalancing to minimize tax impact, especially in taxable investment accounts.

Reinvestment:

- Reinvest proceeds from selling assets into underrepresented asset classes.

- Capitalize on market inefficiencies and opportunities to enhance overall portfolio performance.

Periodicity and Discipline:

- Choose a rebalancing frequency that aligns with financial goals and market conditions.

- Maintain discipline in adhering to the rebalancing strategy, avoiding impulsive decisions driven by short-term market fluctuations.

These are some well-known details about rebalancing. Now, let’s explore how this operates in real-life situations.

Example:

Imagine you own a collection of stocks, and you want to keep just two stocks in it. You aim to split it evenly: half in Stock A and half in Stock B. With $10,000 to invest, you put $5,000 in Stock A and $5,000 in Stock B.

Let’s say Stock A is priced at $5 per share, and you buy 1,000 shares. Stock B is at $50, and you buy 100 shares. Now, the prices of these stocks may not move the same way. Stock A could rise from $5 to $10 per share, doubling your initial investment to $10,000. On the other hand, Stock B might drop from $50 to $25 per share, reducing your $5,000 investment to $2,500.

At this point, your portfolio has increased in value, going from $10,000 to $12,500. However, your original 50:50 balance is off. Now, 80% of your portfolio is in Stock A, and only 20% is in Stock B. This misalignment is where rebalancing becomes crucial.

Rebalancing involves periodically reviewing your portfolio. In this case, you might realize you have too much in Stock A. To get back to the desired 50:50 split, you calculate that half of $12,500 is $6,250. As you already have $10,000 in Stock A, you need to sell $3,750 worth of Stock A shares and use that money to buy $3,750 worth of Stock B.

By doing this, you bring your allocation back to 50% in each stock, ensuring a balanced and aligned portfolio according to your initial asset allocation strategy.

As the prices go up and down, the amounts you have in each stock will change from the way you initially set them. If you want them to stay the way you first planned, you need to rebalance your portfolio.

The idea behind rebalancing is simple. As the prices of stocks go up and down, what you do is sell the ones that have gone up, using that money to buy the ones that have gone down. Essentially, you’re selling when the prices are high and buying when they’re low, which is a smart move.

Then, maybe in the next quarter or the next year, the situation flips. The ones that went down might go up, and the ones that went up might go down. Now, your balance changes again. So, you sell the ones that went up and buy back the ones that went down. It’s like a zigzag – selling some of what went up and buying some of what went down, keeping your portfolio in check.

Now, there have been many studies conducted on rebalancing, and there are arguments both in favor of and against it. It’s not a one-size-fits-all solution. There are situations where rebalancing might not be the best choice.

For instance, if Stock A is consistently rising while Stock B is falling, and you rebalance, what happens if this trend continues over the next year or the next five years? It might not be ideal because you’re selling a part of Stock A to buy more of Stock B, and if Stock B isn’t performing well, you’re essentially investing more in an underperforming stock while selling the one that’s growing.

This is a drawback of rebalancing; it doesn’t always work. It’s most effective when both stocks are showing fluctuations, like a zigzag pattern. However, if one stock is consistently rising while the other is consistently falling, the rebalancing strategy may not be the most beneficial. For example, applying this strategy to a stock like Amazon, which has been consistently rising, and another company that’s consistently declining, you might have been better off not rebalancing.

Some folks choose to rebalance within sectors rather than individual stocks. If a particular stock is performing well, they might allow it to continue its upward trend. This approach is often seen on a sector basis, and it’s a common practice among mutual funds and professionals. For instance, someone might decide to allocate 25% of their portfolio to the tech sector and another 25% to the financials sector. The goal is to periodically rebalance to maintain these sector percentages.

You have the flexibility to rebalance your portfolio daily, weekly, monthly, quarterly, or yearly—it’s your choice. However, the most effective approach is typically either quarterly or yearly. Additionally, it’s beneficial to establish a deviation band. For instance, if you set a rule to rebalance every quarter only when your assets deviate by 10% from their initial allocation, like if your initial allocation for the tech sector is 50% and it deviates by 10% (either 45% or 55%), then you rebalance. Rebalancing for minor deviations, such as 1% or 2%, may not be worth the effort.

Benefits of portfolio rebalancing

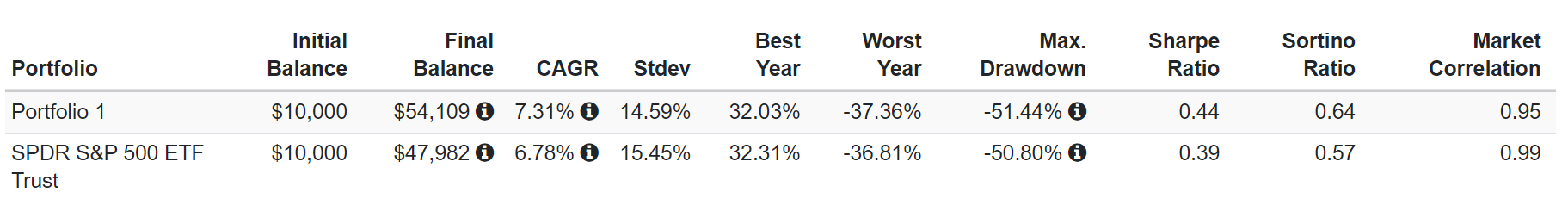

Let’s look at an example once more. We’ll compare a portfolio that includes XLK, XLU, XLF, XLV, each at 25%, to SPY with rebalancing every quarter, and we’ll also examine the scenario without rebalancing from the year 2000 to 2023. you can use Portfolio Visualizer website to do this.

Looking at the last 23 years, it’s clear that this portfolio couldn’t outperform the SPY. The market actually delivered better returns than this portfolio without rebalancing. However, with quarterly rebalancing, the portfolio surpassed the market performance.

By rebalancing, you can also lower the risk in your portfolio. This means that instead of focusing too much on a particular sector or asset, rebalancing helps spread out and diversify your risk.

Rebalancing becomes even more beneficial when you have a portfolio that includes both stocks and bonds, and it truly shines when your portfolio contains assets that are not strongly connected or have low correlations. For instance, let’s say you aim for a 40% allocation in bonds and 60% in stocks. If there’s a market crash and stocks drop faster than bonds, your bond allocation could become larger than the intended 40%, and stocks may be less than the targeted 60%.

In such a scenario, you’d sell some bonds to buy stocks. During, for example, the 2008 crash, stocks experienced a significant drop, but bonds didn’t fall as rapidly. So, by selling some bonds to buy stocks, you’re essentially selling something that hasn’t dropped as much to buy something that dropped more, and you’re acquiring stocks at a better price—a kind of averaging in.

As the market climbs higher, surpassing your 60% target in stocks, you’ll need to sell some stocks to return to the 60% target and use the proceeds to buy bonds, getting back to the 40% target. This disciplined approach pays off when the next market crash occurs. By rebalancing, you won’t have as much in stocks as you would if you didn’t rebalance, resulting in lower losses during market downturns.

In simple terms, rebalancing is beneficial when there’s a crash, so it’s strongly recommended for portfolios that include both stocks and bonds.

Conclusion

In my view, rebalancing works best when done across various sectors. It’s especially beneficial when your portfolio includes more than just stocks – like having bonds, gold, or other assets. The real advantage of rebalancing comes into play when you’re adjusting between different asset classes. This is where the true strength of rebalancing lies because one asset class might experience a significant increase while another lags behind. Since these assets are uncorrelated, there are more opportunities compared to the stock market, where everything tends to move together to some extent. So, when things are truly uncorrelated, that’s when rebalancing shines even more.