Asset allocation is a strategic investment approach that involves distributing a portfolio’s investments among different asset classes to achieve a balance between risk and return.

Asset classes are broad categories of investments with similar characteristics and behaviors. The main asset classes include stocks, bonds, crypto and commodities.

Diversification is the core principle of asset allocation. By spreading investments across different asset classes, geographic regions, and industries, investors can reduce the impact of poor performance in any single investment on the overall portfolio. Diversification helps manage risk and enhance the stability of returns.

Asset allocation begins with an assessment of the investor’s financial goals, risk tolerance, and investment time horizon.

There are two ways to be a stock investor: you can be a passive investor or an active investor. A passive investor follows a market index and joins in its yearly return, typically around 10% for U.S. markets. On the other hand, an active investor aims to outperform the market, striving to make more than 10% each year.

If you decide to be a passive investor, your main decision is how much of your portfolio should be in the stock market, alongside other assets like bonds and crypto. This is because the stock allocation is already set by the ETF (Index) you pick for your investment. (SPY,VOO)

The S&P 500’s asset allocation is determined by the market capitalization of its constituent companies. The index includes companies from various sectors. The weight of each sector in the S&P 500 is proportional to the market value of the companies within that sector. This market-capitalization-weighted approach means that larger companies have a more significant impact on the index’s performance.

If you want to be an active investor and decide your own stock allocation, it’s known as active asset allocation. This means you’re now choosing how much of each sector, or a specific sector, or a stock should be in your portfolio. This creates a different asset allocation compared to the S&P 500 index.

For instance, if the technology sector makes up 25% of the S&P 500, and you decide you want 40% of your portfolio in the technology sector or you want value stocks or whatever, that’s active asset allocation. You’re shifting away from the overall U.S. market asset allocation and making your own allocation.

Example:

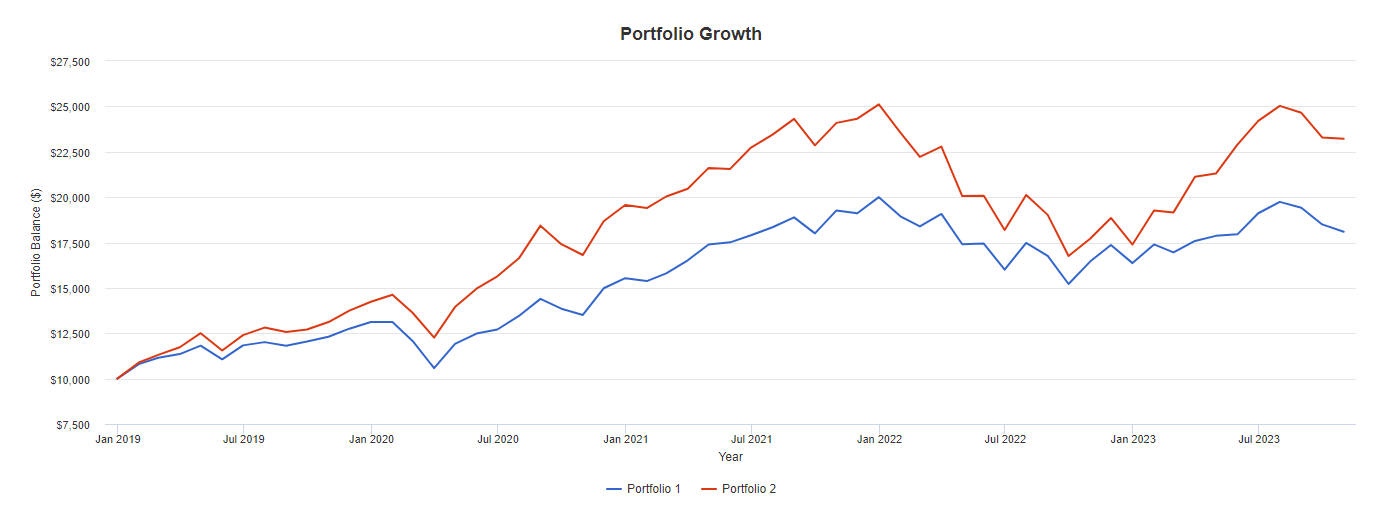

Let’s backtest two portfolios: one with 100% in SPY and the second with two ETFs—60% in XLK (technology sector) and 50% in XLC (communication sector).

You can notice that by having a different asset allocation, we managed to outperform the market for a specific duration.

How do we decide on asset allocation?

It’s personal preference.

When you opt to be an active investor, the assets you choose to invest in depend on your personal preferences and risk tolerance. Some folks prefer technology stocks, while others lean towards stable consumer staples stocks. There are those who favor growth companies, and others who prefer value companies. I can’t advise you on which to invest in—it’s your personal choice based on your comfort with risk.

What’s important to keep in mind is not to focus too much on a particular sector or industry. Be mindful of diversification.

Some folks aren’t fans of diversification. They believe it’s not practical for investing because by spreading your money across various assets, you might miss out on significant gains. However, it’s entirely your call whether to diversify or not. Still, not diversifying is risky because you could lose your investment if a stock or sector performs poorly.

Before you decide to invest in something, make sure to do thorough research. Once you feel confident and safe about the asset, then you can decide how much of it should be in your portfolio. it have to be based on your outlook.

Now, there are few asset allocation strategies out there.

1. Asset allocation by age

We understand that having bonds in our portfolio can make the risk of the stock market crashing lower. But if you’re a younger investor who won’t need the money for many years, you may not need to worry too much about stock market crashes or ups and downs. Over a long time, the stock market tends to do better than many other types of investments. However, if you’re an older investor who needs money soon, it’s safer to have a larger part of your portfolio in bonds than stocks to avoid potential losses in case of a market crash.

A simple rule is to subtract your age from 100 to find the percentage of your portfolio that should be in stocks. This means your age is the percentage of bonds you should have. For instance, if you’re 30, consider having 30% of your portfolio in bonds and 70% in stocks.

As you age, you put more into bonds and less into stocks.

In my view, if you’re in your 20s or even 40s, you might not need to stress about the market crashing because you still have plenty of time for your money needs. So, in my opinion, adding bonds to your portfolio after your 40s is a good move, if you’re a passive investor.

Here’s another formula: (Age-40) multiplied by 2. This formula follows what I mentioned earlier. If the result is negative, you might be too young for bonds. Once it turns positive, that’s the percentage of your portfolio that should be in bonds and when you might start considering them.

For instance, if you’re 50 years old, (50 – 40) multiplied by 2 equals 20. So, at the age of 50, you might consider having 20% in bonds. According to this formula, you start getting bond exposure in your portfolio only after the age of 40.

These formulas are for passive investing. An active investor might decide to include bonds early on to try to outperform the markets — this is known as tactical asset allocation. Remember, for active investors, there are no set rules. It’s all up to you. You can make any decision for your portfolio if you believe it’s secure and beneficial.

2. Strategic asset allocation

Strategic Asset Allocation (SAA) is a long-term investment strategy where investors create a predetermined mix of different asset classes based on their financial goals, risk tolerance, and investment horizon. This approach emphasizes diversification across asset classes, such as stocks, bonds, and cash equivalents, to manage risk and achieve a balance between potential returns and acceptable risk levels.

SAA typically involves a passive approach, using index funds or ETFs to track broad market indices. Although the overall allocation is intended for the long term, periodic reviews and rebalancing are conducted to ensure the portfolio aligns with the investor’s objectives. The strategy provides a disciplined framework for investors, focusing on a stable, well-thought-out asset allocation to navigate various market conditions over an extended period.

3. Tactical asset allocation

Tactical Asset Allocation (TAA) is a dynamic investment strategy that involves making short-term adjustments to a portfolio’s asset allocation based on current market conditions, economic trends, or other relevant factors.

Unlike the long-term focus of Strategic Asset Allocation (SAA), TAA allows for flexibility and active decision-making. Investors employing TAA may increase or decrease exposure to specific asset classes or sectors to capitalize on short-term opportunities or mitigate risks.

This strategy requires continuous monitoring of market dynamics and economic indicators, enabling investors to adjust their portfolios to navigate changing conditions and potentially enhance returns. TAA complements SAA by providing a more responsive approach to exploit market inefficiencies or trends.

4. Dynamic asset allocation

Dynamic Asset Allocation (DAA) is an investment strategy characterized by ongoing adjustments to a portfolio’s asset allocation based on changing market conditions and economic indicators. This approach is more active than Strategic Asset Allocation (SAA) and Tactical Asset Allocation (TAA), involving frequent reviews and modifications to the portfolio’s composition.

Investors employing DAA continuously analyze economic trends, market performance, and other relevant factors to make timely adjustments. The goal is to respond swiftly to evolving market dynamics, potentially capturing opportunities and managing risks more effectively.

DAA requires a high level of monitoring, research, and a proactive approach to optimize the portfolio’s performance in various market environments. It offers flexibility to adapt to rapidly changing conditions and can be a valuable strategy for investors seeking a dynamic and responsive investment approach.

5. Constant weight asset allocation

Constant Weight Asset Allocation is a strategy where an investor maintains a fixed percentage allocation to each asset class within their portfolio, regardless of market conditions. Unlike other dynamic approaches, the constant weight strategy does not involve frequent adjustments based on short-term market movements.

In this approach, the investor initially determines the desired percentage allocation for each asset class (e.g., stocks, bonds, cash) and aims to keep these weights constant over time. However, due to market fluctuations, the actual weights of the asset classes may deviate from the target weights. Periodic rebalancing is then performed to bring the portfolio back to the original allocation.

The key features of Constant Weight Asset Allocation include a disciplined and systematic approach, simplicity in implementation, and a focus on maintaining a consistent risk-return profile over the long term. This strategy provides a structured framework for investors who prefer a more passive and less frequently adjusted approach to managing their portfolios.

6. Core-satellite asset allocation

Core-Satellite Asset Allocation is an investment strategy that combines two components: a core portfolio and satellite positions. The core portfolio consists of passively managed, broad-market index funds or exchange-traded funds (ETFs), providing exposure to the overall market. The satellite positions, on the other hand, involve actively managed funds or individual securities that complement the core holdings.

In this strategy, the core forms the foundation of the portfolio, capturing the broad market’s performance. The satellite positions are selected to enhance returns, manage risks, or achieve specific objectives. This combination aims to leverage the benefits of both passive and active management.

The core provides diversification and broad market exposure, which is cost-effective and helps capture overall market trends. The satellite positions offer an opportunity for active management, allowing investors to capitalize on specific market opportunities or align with targeted investment goals.

Core-Satellite Asset Allocation provides a balanced approach, blending the stability and efficiency of passive investing with the potential for outperformance through active management. Investors can tailor the satellite positions based on their preferences, risk tolerance, and specific investment objectives while maintaining a diversified and cost-effective core.

7. Equity-first asset allocation

Equity-First Asset Allocation is an investment strategy that places a significant emphasis on equity investments, particularly stocks, as the primary component of a portfolio. The core principle of this approach is to prioritize assets with the potential for capital appreciation and long-term growth. Investors adopting an Equity-First strategy allocate a substantial portion of their portfolio to equities, aiming to harness the historically higher returns associated with this asset class.

This strategy is well-suited for investors with a higher risk tolerance who are seeking long-term growth and are willing to withstand the inherent volatility of equity markets. By focusing on stocks, which have shown the potential for substantial returns over extended periods, investors aim to capitalize on the growth potential of individual companies, industries, or the overall market.

While Equity-First Asset Allocation leans heavily towards equities, diversification remains an important consideration within the equity portion of the portfolio. Investors may diversify across different sectors, geographic regions, and market capitalizations to mitigate specific risks associated with individual stocks or industries.

The success of an Equity-First approach hinges on a long-term perspective, allowing the portfolio to weather short-term market fluctuations. Investors need to actively monitor market conditions and economic trends to make informed decisions, as the performance of equities is influenced by various external factors. The strategy requires ongoing diligence and a commitment to staying informed about the evolving landscape of the stock market.

In summary, Equity-First Asset Allocation is a strategy tailored for those seeking higher returns through a substantial allocation to equities. It involves a willingness to accept higher levels of risk, making it crucial for investors to align their risk tolerance, investment goals, and time horizon with the inherent characteristics of equity-centric portfolios.

Conclusion

After reading about these asset allocation strategies, I believe you can grasp the concept of asset allocation. If you want to be an active investor, you have the freedom to choose your own asset allocation for your portfolio. This allows you to try to outperform the market or enjoy other advantages like income and stability.