The stock market is divided into sectors to categorize companies based on the industry or business they operate in. Within each sector, there are multiple industries.

The Global Industry Classification Standard (GICS) is a widely used system for categorizing companies into sectors and industries in the global stock market. GICS was developed jointly by MSCI (formerly Morgan Stanley Capital International) and S&P Dow Jones Indices, and it serves as a standardized framework to classify publicly traded companies based on their primary business activities.

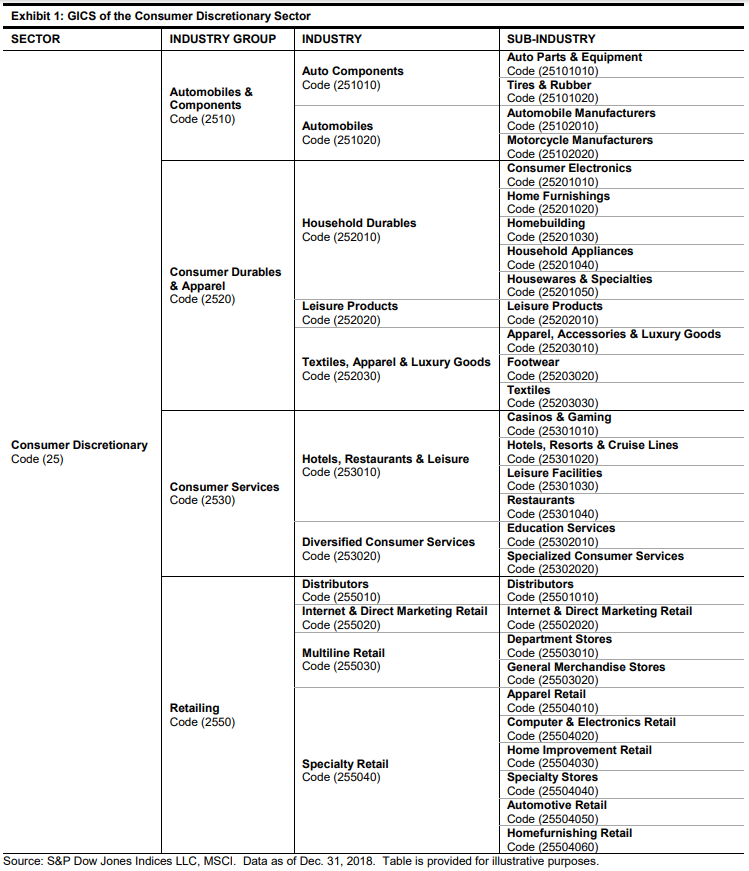

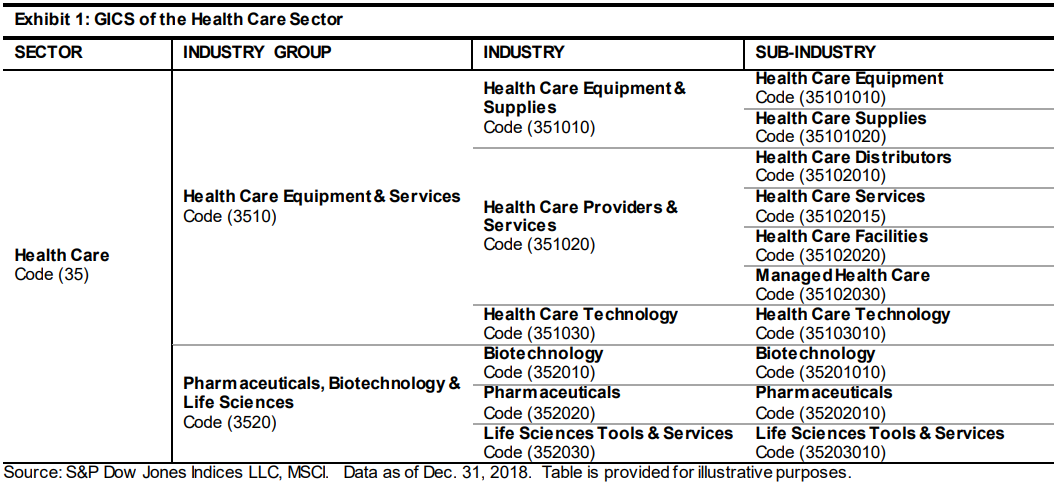

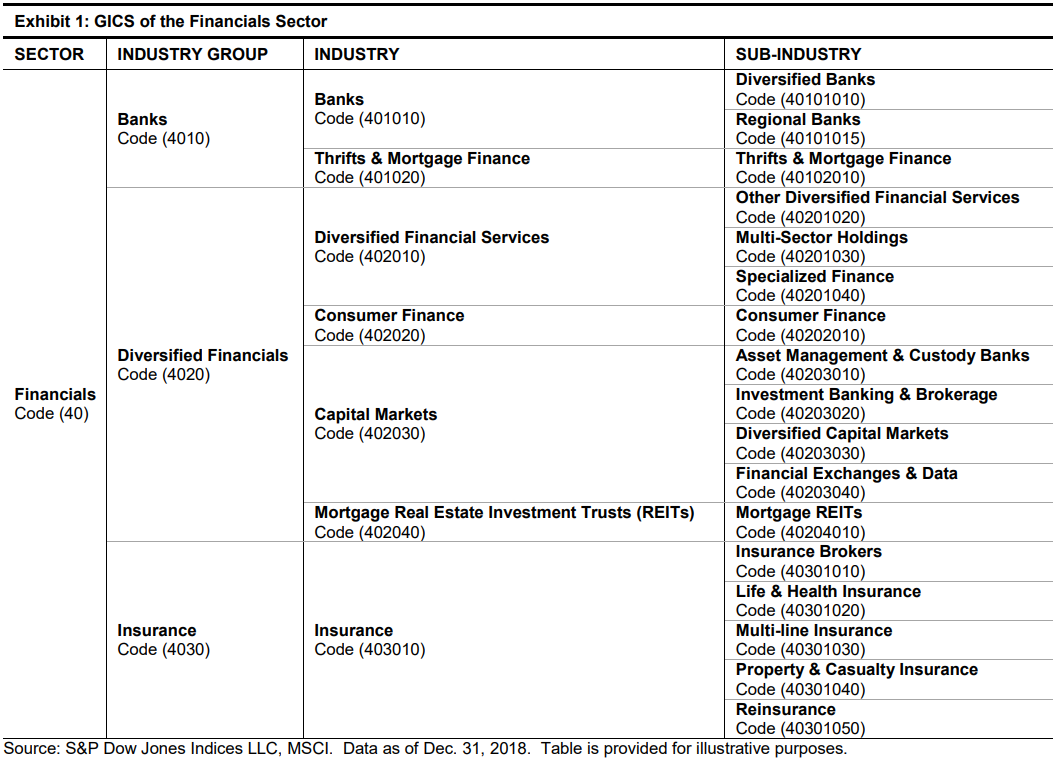

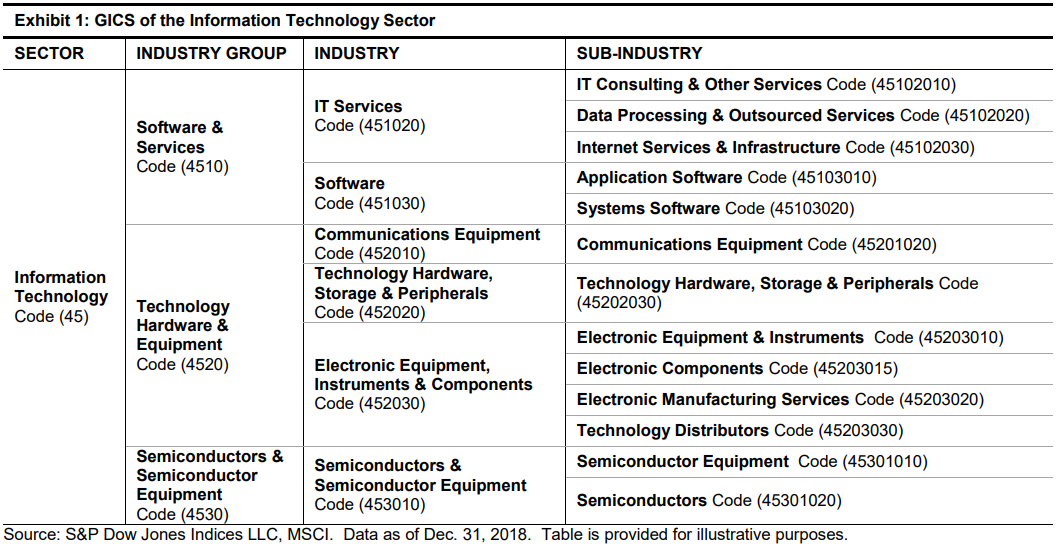

GICS has a hierarchical structure with four main levels:

Sector: This is the broadest level of classification and represents the highest-level grouping of related industries. There are 11 sectors in total, such as Technology, Health Care, Financials, Energy, Consumer Discretionary, etc.

Industry Group: Each sector is further divided into industry groups. These groups represent a more specific set of industries within the sector. For example, the Technology sector includes industry groups like Software & Services, Hardware, and Semiconductors & Semiconductor Equipment.

Industry: The industry level provides even greater granularity. It classifies companies based on more specific commonalities in their core business activities. For instance, within the Software & Services industry group, you might find companies involved in software development, IT consulting, or internet services.

Sub-Industry: This is the most detailed level of classification, identifying companies within a very specific niche of an industry. For example, within the Software industry, you might have sub-industries like Enterprise Software or Application Software.

GICS is designed to provide a consistent and standardized framework for classifying companies globally. This means that companies from different countries and regions can be compared more easily because they are categorized in the same way.

GICS is periodically updated to reflect changes in the business landscape and the emergence of new industries. This rebalancing ensures that the classification system remains relevant and accurate. Companies can also change their GICS classification if their primary business activities shift significantly.

Investors and analysts use GICS to segment the stock market into different sectors and industries, allowing them to analyze and track the performance of companies within specific categories. It helps investors make informed decisions about portfolio allocation and risk management.

Many stock market indices, such as the S&P 500 or the MSCI World Index, are based on GICS classifications. These indices provide benchmarks for the performance of different sectors and industries.

In the United States, when you analyze the composition of the S&P 500, finviz offers an illustrative tool in the form of a heat map, which effectively visualizes the performance of individual sectors. For instance, when you focus on the technology sector, you’ll notice distinct sub-industries like software and semiconductors, and within these sub-industries, you can identify specific companies such as Microsoft, Nvidia, and Apple.

Moreover, it becomes clear that the technology sector holds considerably more weight in the index compared to the industrial sector. Additionally, you can discern disparities in the performance of sectors, with some demonstrating robust performance while others fall behind.

What I’m emphasizing is that when a specific sector undergoes a decline, it usually has an adverse impact on the performance of most, if not all, companies within that sector. Conversely, when it performs well, the majority of companies within that sector tend to thrive as well.

The composition of sectors within the S&P 500 index fluctuates over time. Each sector’s representation is quantified as a percentage of the index’s total weight, and these percentages change as new industries emerge or experience significant growth, leading to some sectors expanding while others contract.

How the Economic Cycle Affects Stock Market Sectors?

Various sectors exhibit varying behaviors across the different phases of the economic cycle, which consists of four stages: early, mid, late, and recession. Different sectors outperform the overall market during specific phases. For instance, the consumer staples sector tends to outperform the market during a recessionary period.

To gain a better understanding, please refer to the table provided below.

| SECTORS | EARLY | MID | LATE | RECESSION |

|---|---|---|---|---|

| FINANCIALS | + | |||

| REAL ESTATE | ++ | — | ||

| CONSUMER DISC. | ++ | – | — | |

| TECHNOLOGY | + | + | — | — |

| INDUSTRIALS | ++ | — | ||

| MATERIALS | + | — | ++ | |

| CONSUMER STAPLE | ++ | ++ | ||

| HEALTH CARE | — | ++ | ++ | |

| ENERGY | — | ++ | ||

| COMMUNICATION | + | – | ||

| UTILITIES | — | – | + | + |

(+ indicates sectors performing better than the market, – indicates sectors performing worse than the market, and empty cells indicate performance on par with the market.)

Now, let’s delve into each sector individually and examine their respective performance.

Consumer Staples:

Consumer staples encompass the goods that individuals use in their daily lives, such as food, beverages, cleaning supplies, personal hygiene items, toothpaste, alcoholic beverages, tobacco, and cosmetics. These are the items people consistently purchase, irrespective of the economic conditions, whether the economy is thriving or facing challenges.

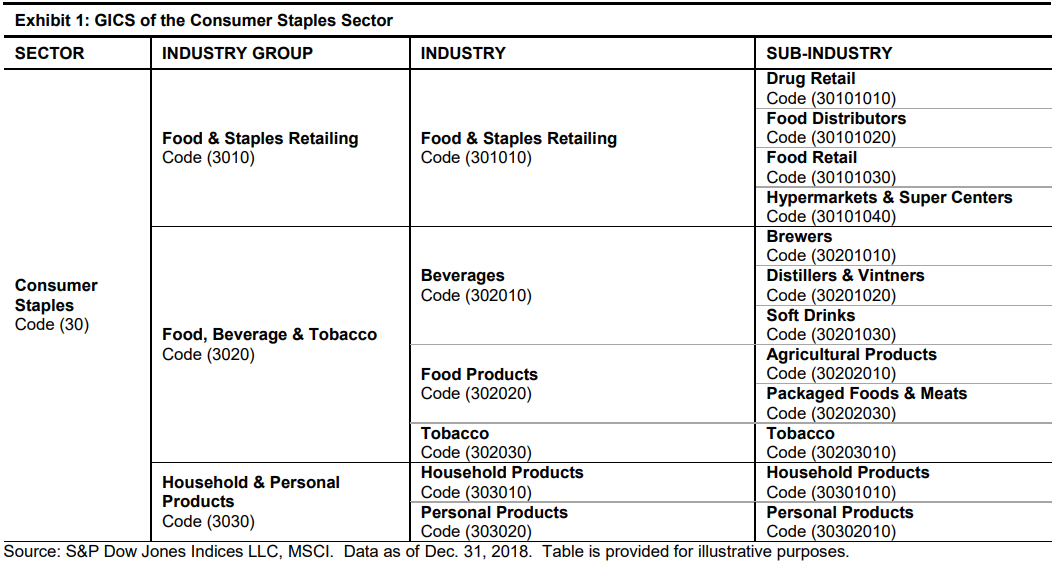

Within the consumer staples sector, there are various industries, and within each of these industries, you’ll find sub-industries. For instance:

Consumer staples are noncyclical, meaning that whether the economy is in an upswing or a downturn, consumer staples don’t fluctuate in sync with economic cycles. This stability stems from the fact that the demand for these products remains relatively constant regardless of economic conditions.

The exchange-traded fund (ETF) representing the consumer staples sector is identified as XLP

Energy:

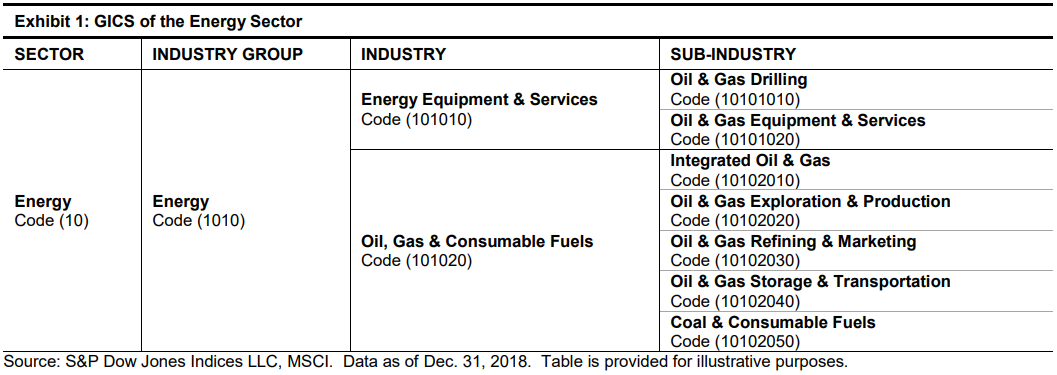

The energy sector refers to a broad category of the economy that encompasses companies and activities related to the production, distribution, and consumption of energy.

The energy sector exhibits cyclical behavior, which implies that it is influenced by economic conditions, as well as factors such as commodity prices for oil and gas, and political events and regulations. All of these occurrences can exert an impact on the sector.

The exchange-traded fund (ETF) representing the energy sector is identified as XLE

Materials:

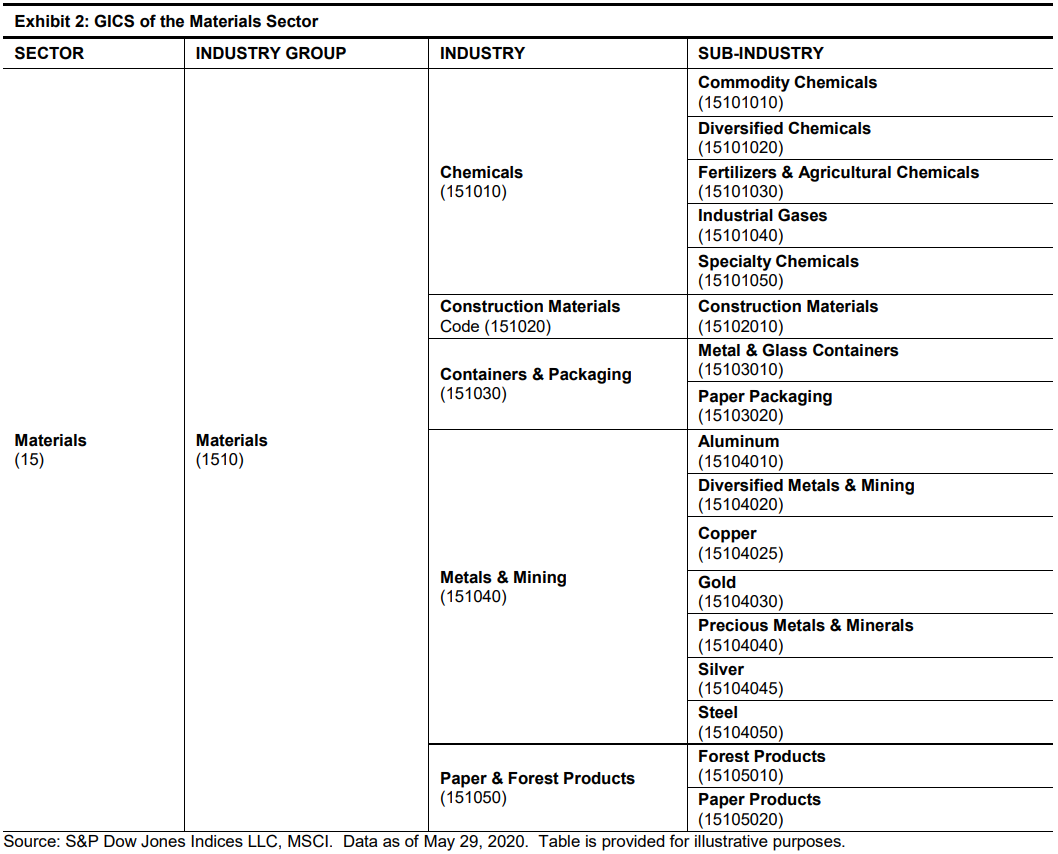

The materials sector, also known as the basic materials sector, is a category of the economy that encompasses companies and industries involved in the extraction, processing, and production of raw materials and commodities.

The materials sector’s performance is influenced by the health of the economy, the state of housing markets, and the demand for consumer goods, making it a sector that tends to follow economic cycles.

The exchange-traded fund (ETF) that represents the materials sector is known as XLB

Industrials:

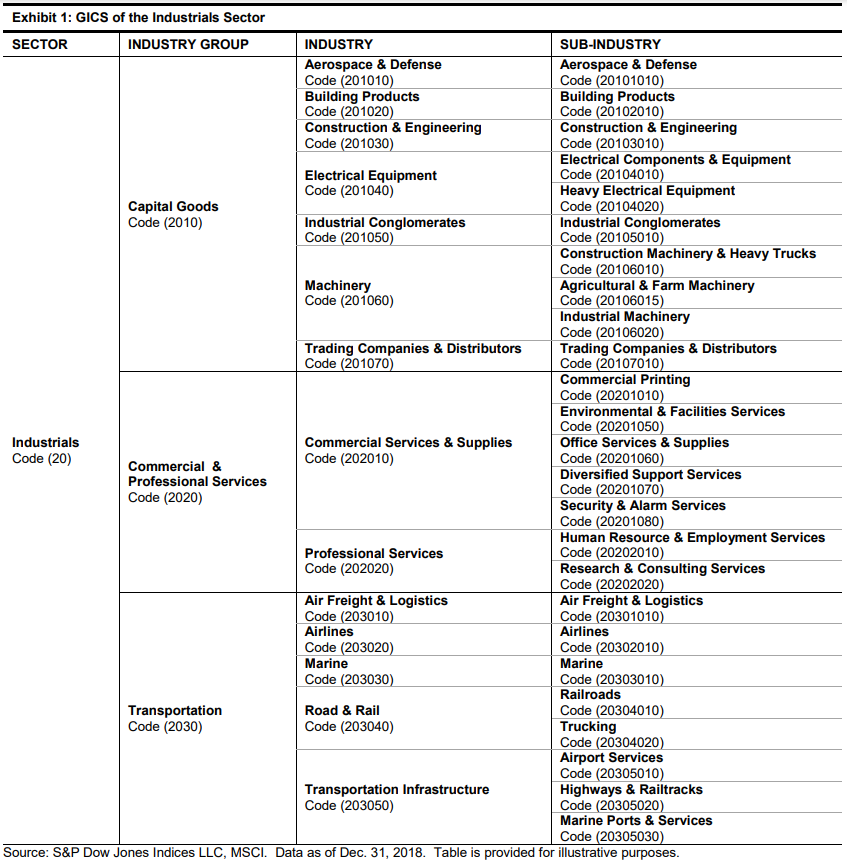

The industrial sector consists of businesses offering commercial and industrial products and services. While it shares some similarities with the materials sector, there are two significant distinctions.

Firstly, in the industrial sector, companies produce finished goods rather than raw materials. Secondly, the industrial sector encompasses companies providing both products and services, whereas the materials sector primarily focuses on product manufacturing.

The performance of the industrial sector is closely influenced by the overall economic health, consumer goods demand, and housing market conditions.

The exchange-traded fund (ETF) that represents the industrial sector is denoted as XLI

Consumer Discretionary:

The consumer discretionary sector, often referred to as the consumer cyclical sector, is a segment of the economy that includes companies and industries involved in producing goods and services that are considered non-essential or discretionary.

These are products and services that consumers typically purchase when they have disposable income or during periods of economic prosperity, but they may cut back on when facing financial constraints or economic downturns.

The sector’s performance is influenced by economic fluctuations, the level of disposable income, and consumer confidence.

The exchange-traded fund (ETF) representing the consumer discretionary sector is identified as XLY

Healthcare:

The healthcare sector encompasses enterprises engaged in delivering medical services, producing medical equipment or pharmaceuticals, offering medical insurance, or aiding in the delivery of healthcare to patients.

The healthcare sector is typically noncyclical, with consistent demand irrespective of economic conditions, but it can be influenced by government policies.

The exchange-traded fund (ETF) representing the healthcare sector is denoted as XLV

Financials:

The financial sector comprises companies offering financial services to both businesses and consumers. These services encompass loans, credit, mortgages, insurance, wealth management, and real estate.

This sector is responsive to the initial stages of economic cycles and changes in interest rates.

The exchange-traded fund (ETF) representing the financial sector is recognized as XLF

Information Technology:

The technology sector encompasses stocks associated with the research, advancement, and distribution of products and services based on technology.

The technology sector’s performance is linked to the state of the economy, typically showing strong performance during the early or mid stages of an economic cycle and weaker performance during the late stages or in times of recession.

The exchange-traded fund (ETF) representing the information technology sector is designated as XLK

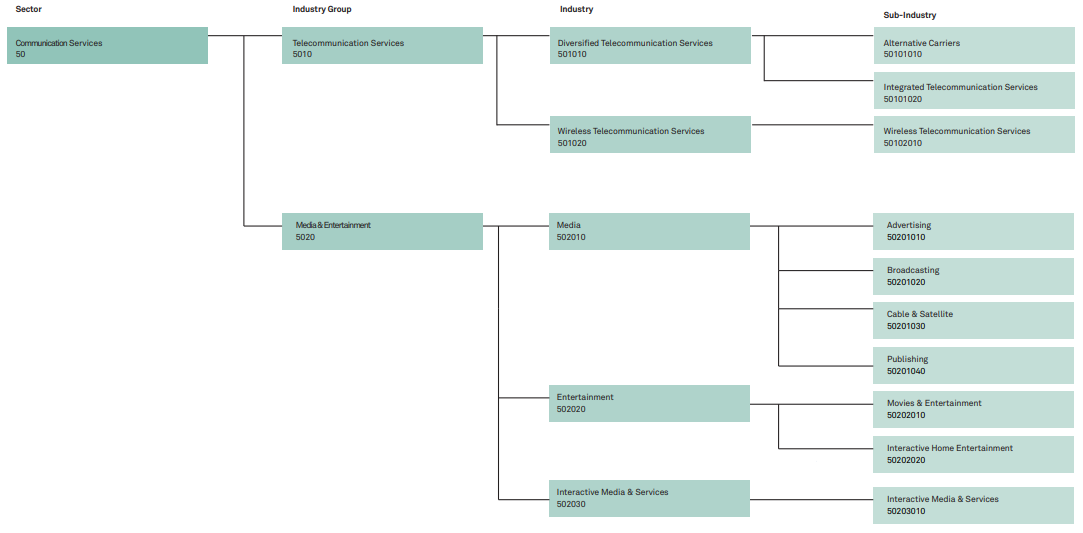

Communication Services:

The communication services sector comprises companies that offer communication services through fixed-line networks, wireless networks, and those providing internet services, including access, browsing, and internet-related software and services.

Interactive Media & Services:

Companies in this industry are involved in internet services, online advertising, online content, social media, e-commerce, and other interactive online activities. Examples include Google (Alphabet Inc.) and Facebook (Meta Platforms, Inc.).

Movies & Entertainment:

This industry includes companies engaged in the production, distribution, and exhibition of movies and entertainment content. It encompasses movie studios, streaming platforms, and entertainment conglomerates. Examples include Netflix and The Walt Disney Company.

Media:

The media industry consists of companies involved in traditional media, such as newspapers, magazines, television broadcasting, and cable television. This category also includes diversified media companies that operate across various media platforms.

Entertainment:

This industry focuses on companies involved in various entertainment activities, including amusement parks, gaming, and diversified entertainment businesses.

Interactive Home Entertainment:

Companies in this industry produce video games, gaming consoles, and related gaming software and hardware.

Cable & Satellite:

This category includes cable and satellite television providers, as well as companies involved in the distribution of television content via cable and satellite networks.

Wireless Telecommunication Services:

This industry encompasses wireless telecommunications companies, including mobile network operators and wireless service providers.

It is responsive to the overall economic conditions and underwent a name change from the telecom sector to the communication services sector in 2018. This sector encompasses companies such as Google and Facebook.

The exchange-traded fund (ETF) representing the communication services sector is identified as XLC

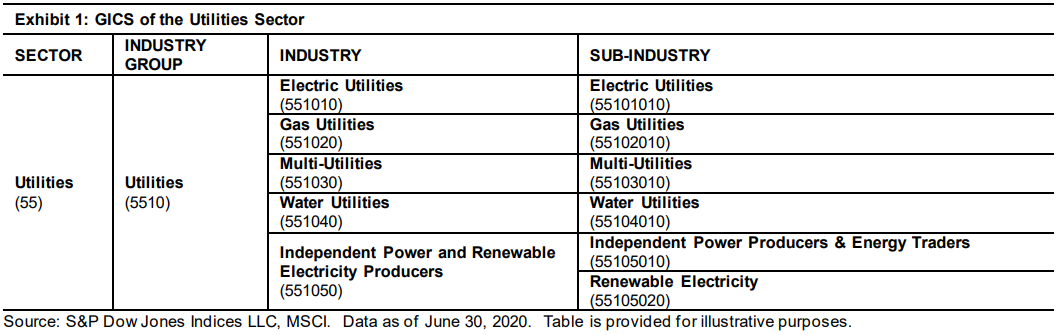

Utilities:

The utilities sector consists of companies that supply or distribute electricity, gas, or water to both businesses and consumers.

Government involvement in these companies is typically significant and can vary depending on the country.

The utilities sector is considered noncyclical because demand remains relatively stable irrespective of economic conditions, making it a defensive sector. Additionally, it is typically subject to extensive government regulation.

The exchange-traded fund (ETF) that represents the utilities sector is identified as XLU

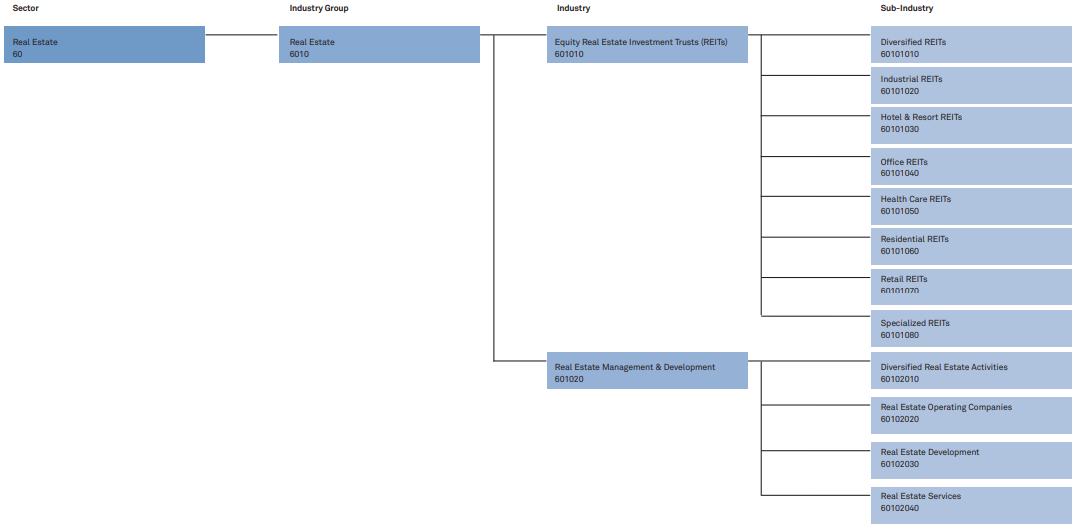

Real Estate:

The real estate sector comprises both equity real estate investment trusts (REITs) and companies involved in real estate development and operations.

Equity Real Estate Investment Trusts (REITs):

This category includes companies that primarily own, operate and manage income-producing real estate properties. These can encompass various types of properties such as office buildings, shopping centers, apartment complexes, hotels, and more.

Real Estate Management & Development:

Companies in this industry are involved in real estate development, property management, and real estate services. They may engage in property development, construction, and management of real estate assets.

Real Estate Operating Companies:

This category includes companies that are primarily engaged in real estate services, but they may not meet all the criteria for classification as Equity REITs. It encompasses companies involved in real estate brokerage, real estate services, and real estate-related activities.

The real estate sector’s performance is influenced by the overall economic conditions and changes in interest rates.

The exchange-traded fund (ETF) representing the real estate sector is known as XLRE

Conclusion

You can read more about GICS and the way they categorize sectors in this file

Now, you have developed a solid grasp of stock market sectors and industries. It’s not about memorization but understanding that stocks are grouped into categories.

Why is this important? Well, when you’re trading or investing, it’s unwise to put all your funds into one investment. Diversifying your investments across different sectors can help mitigate risks.

Additionally, when screening stocks for various strategies, sectors and industries become important parameters. You’ll find these insights invaluable as you delve into strategies.