![Market Analysis Today[2024.03.26]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/03/market-analysis-today.jpg)

It’s Tuesday morning, Let’s see what the market has to say to us today.

Market Analysis Today

Key Events to Watch

We have the CB Consumer Confidence Report coming out this morning.

These stocks have earnings today so be watchful.

Forex

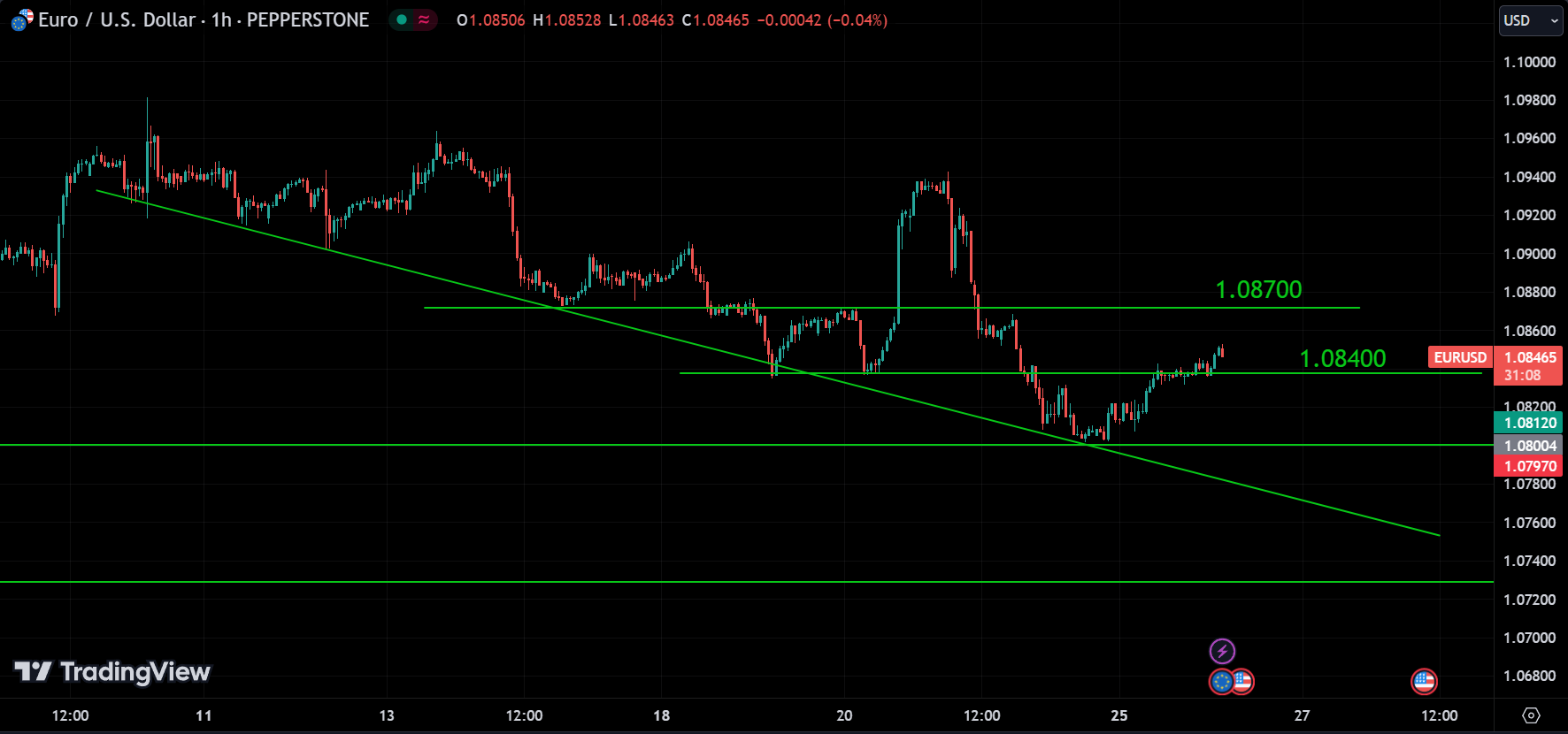

It seems like the EURUSD did indeed find support at the 1.08000 level, just as we mentioned yesterday. As we said before, the price has been moving sideways since 2023 and needs to remain within that range. This sideways movement was influenced by the FED’s rate hikes, but now that they’ve paused, the market might start to break this pattern. However, it’s uncertain which direction it will break — whether it will go above 1.10000 or below 1.05000. We can only wait and see what happens, but the chances are higher for a break above. Still, we can’t be certain.

Now, looking ahead, the price in the long term is still on a downward trend. You can easily see this trend by the line connecting those low points — it fits perfectly. However, there’s a medium-term bullish trend that began at 1.08000 and broke through the resistance at 1.08400. This means that the old resistance level now acts as a support for the price. Therefore, the medium-term bullish trend shouldn’t drop below the 1.08400 level. If it does, it confirms that the downtrend is still in place.

The next resistance level is around 1.08700, so we can anticipate the price reaching there. Perhaps it might even break through it, indicating a strong bullish signal. It could even climb higher to the 1.09000 level. However, it’s important to note that in the long term, the downtrend persists. So, going against it is quite risky. We should only consider doing so if we’re certain that the trend has ended.

As mentioned earlier, the CB Consumer Confidence report is scheduled to be released today. It’s a significant event that can cause price movements to become volatile. Keep a close eye on it.

Stocks

Yesterday, the market opened with a downward gap, then rose to fill the gap, and ultimately closed at the same level where it opened. This situation indicates one clear message: sellers were in control.

However, the market remains within the channel, indicating a correction in price. Yet, yesterday’s event displayed a strong bearish pattern. Today, we might anticipate the price descending towards the lower trend line before rebounding. However, this process could span across multiple days. The crucial concept to grasp is that the market is still in a long-term bullish trend, despite currently experiencing a short-term bearish phase. Presently, we might foresee the price declining to approximately 515.

If you zoom in, you’ll notice a bullish trend, which might lead to the conclusion that the short-term downtrend is possibly ending. Today, the price could potentially rebound upwards, reaching new high levels. However, we can’t be certain. It’s important to acknowledge that we don’t know what the market will do — nobody does.

Boeing’s stock price is taking a bumpy ride in 2024. Recent news of CEO Dave Calhoun’s departure adds another layer of turbulence. This comes on the heels of a tough year for the company, marked by the lingering effects of the 737 MAX grounding, production hiccups, and increased regulatory scrutiny. These challenges have shaken investor confidence, pushing the stock price downwards. While a recent earnings beat offered a temporary bump, the overall sentiment remains cautious.

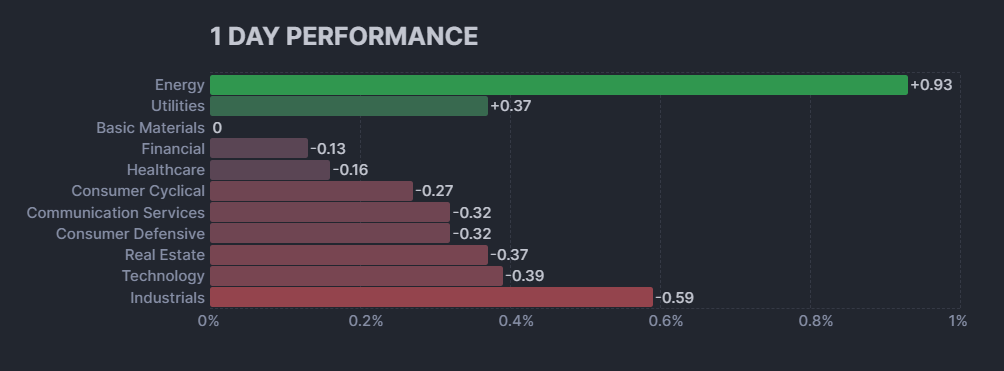

Nvidia continues to push forward, while Micron Technology is skyrocketing, having surged by 6.28%. Tesla also saw an increase of 1%. We can anticipate similar movements today because when something is in a trend, it tends to persist for a while. Again it’s just the probability, anything could happen. additionally, it appears that the energy sectors performed well yesterday, despite the overall market downturn.

As mentioned earlier, the energy sector is currently performing well. Therefore, any investments related to the energy sector could be advantageous for your portfolio.

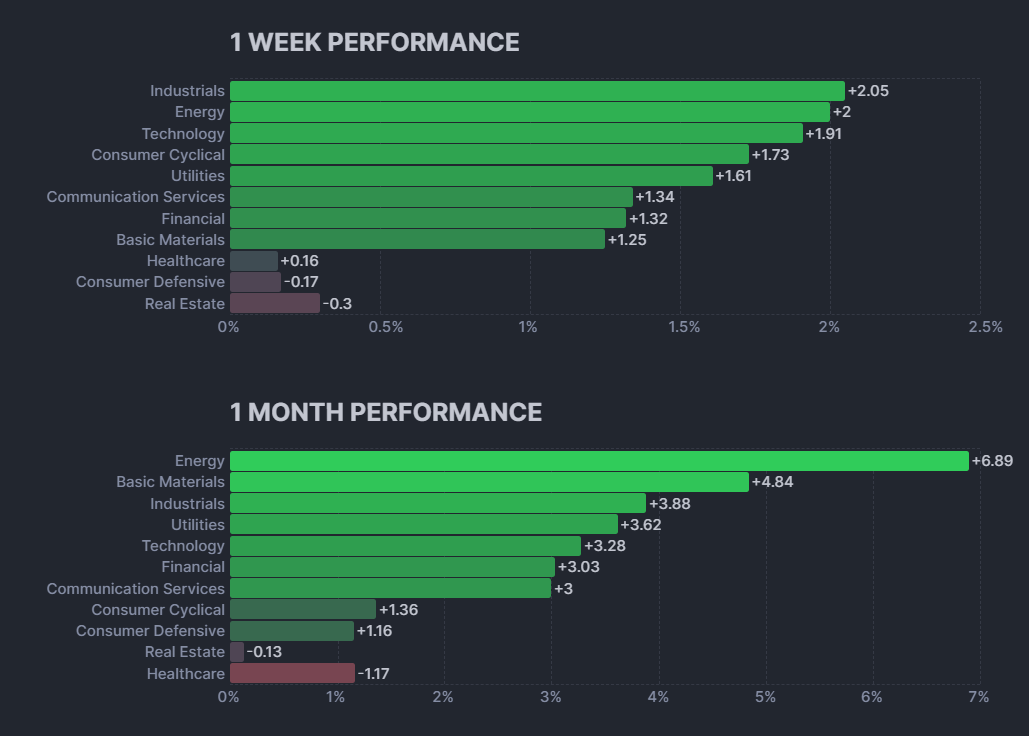

While Energy and Industrials remain strong, climbing over 2% in the past week, the story for Consumer Defensive is a different one. They’ve defied the usual trend and actually gained over the past month, suggesting a continued preference for stability among some investors. Healthcare, on the other hand, is lagging behind, dropping over 1% monthly.

This mixed performance reflects the complexity of the market. While cyclical sectors like Energy and Industrials might signal investor optimism about economic growth, Consumer Defensive’s rise indicates a continued need for stability in some portfolios.

So what we can expect from the market is, if it’s falling, we can anticipate the energy sector to perform well, as it has been doing since the war in Ukraine. If it’s going up, everything will likely rise; technology and AI companies will perform well, of course. We live in a technology-driven world now.

These stocks have earnings today so be watchful.

Crypto

Yesterday, we discussed a trend reversal pattern that could lead to a bullish trend, and indeed it happened. BTC is currently hovering around 70500 at the time of writing this. I believe it’s poised to break its all-time high level again soon. This belief stems from the understanding that something with significant volatility should exhibit similar volatility in the upward direction, not just when it’s declining.

What we can expect from the crypto market now is a general uptrend. It sounds straightforward, but it can also be quite risky at times.

Now, I don’t talk much about other cryptos here because I’m more interested in the technology rather than their financial value. So, the only two cryptos I care about right now are BTC and ETH, and both are bullish.

Disclaimer

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carries inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.