![Market Analysis Today[2024.04.05]: The Uptrend is Over?

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/04/Market-Analysis-Today-05.jpg)

It’s the last trading day of the first week of April. Let’s work on our financial market analysis today.

Key Events Today

We have the Unemployment Rate coming out this morning which is a market-moving event.

And these Stocks have earnings today.

Forex

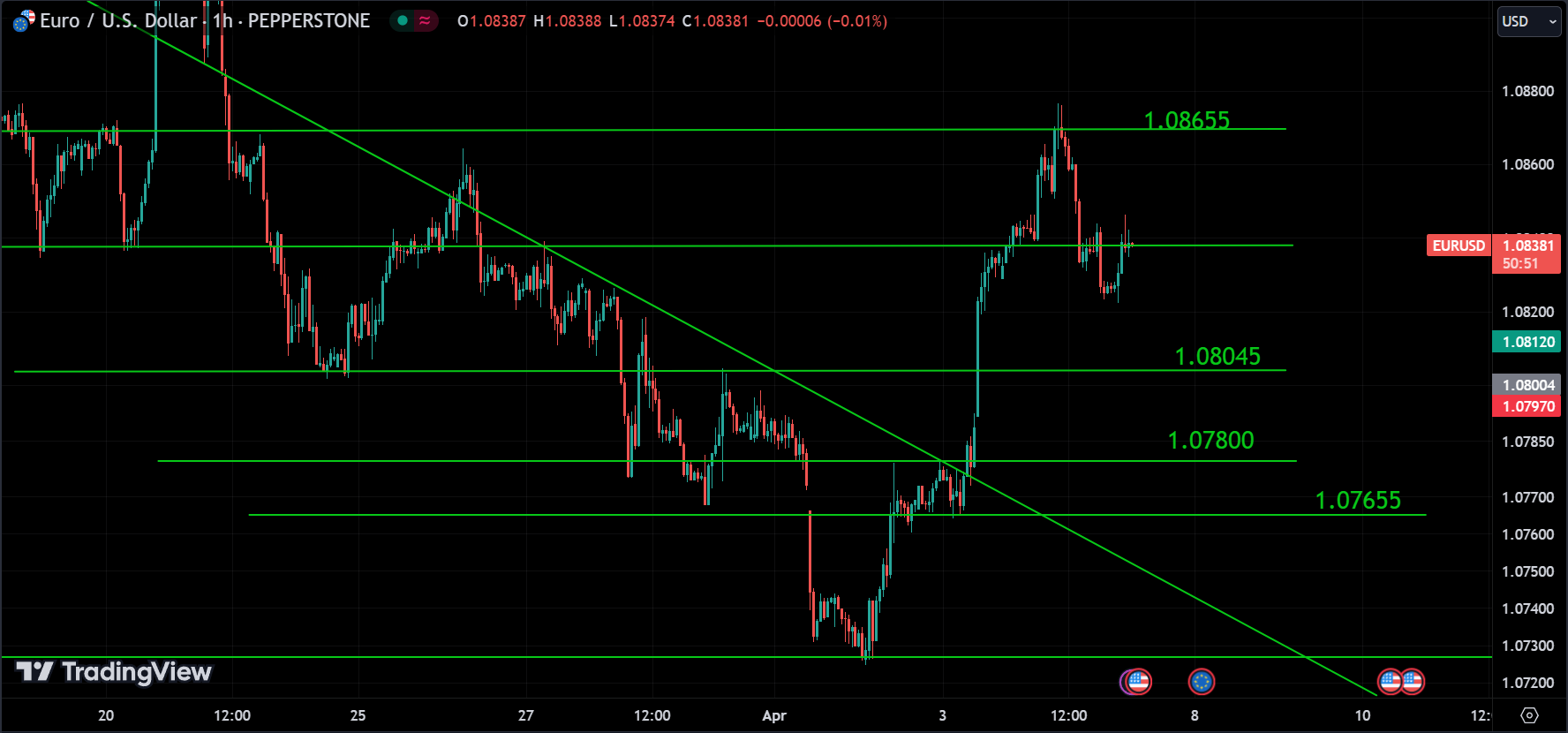

Regarding EURUSD, the price went down from the resistance level, and currently, it’s trading around 1.08378, but it dropped even further than that.

What we might see is either the correction has finished and the price continues to rise, or it could drop below 1.08045 to reach even lower support levels.

On the daily chart, the day closed with gains, but it seemed like sellers were pushing the price down, yet buyers ultimately prevailed. As mentioned earlier, there’s a greater likelihood that the correction has ended. However, since we can’t predict the future, we’ll have to wait and see what unfolds.

Stock

Oh boy the SPY, it seems like the channel broke down. This indicates that the trend is over, and the market is entering a bearish phase. However, this breakout could potentially be a fake breakout; only the market knows for sure. Therefore, the best course of action is to wait for today’s results to confirm the new trend. If today ends with gains and the price returns back into the channel, then it was likely a fake breakout. However, if the price continues to fall below, we are indeed in a bearish market.

524 is currently acting as a strong resistance level for the price, with 508 serving as the next support level. If the price breaks below 508, it would signal a strong bearish trend. Let’s wait and see what unfolds today.

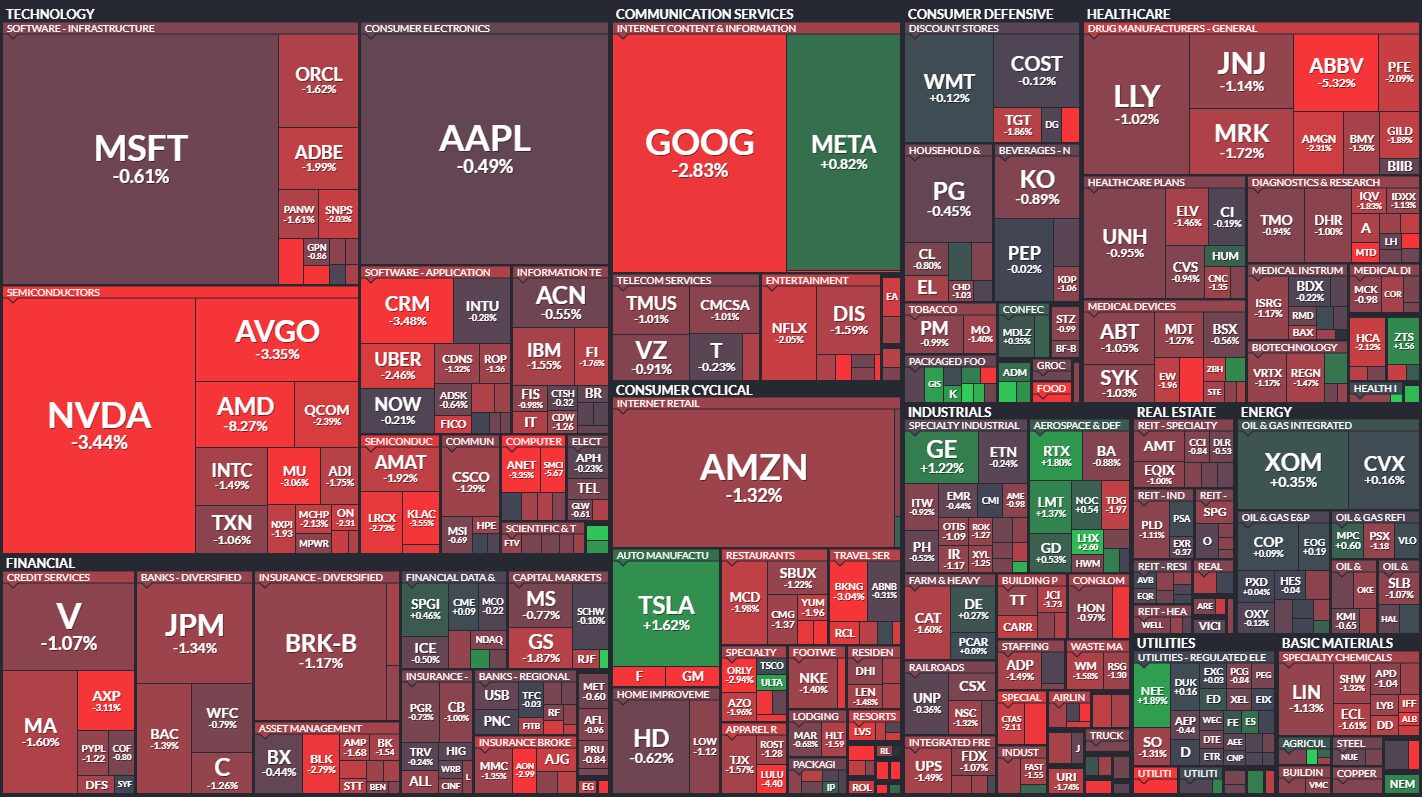

Everything is down, except for Meta and Tesla, which are in the green. Even Nvidia took a hit, dropping by 3.44%. The energy sector also did poorly.

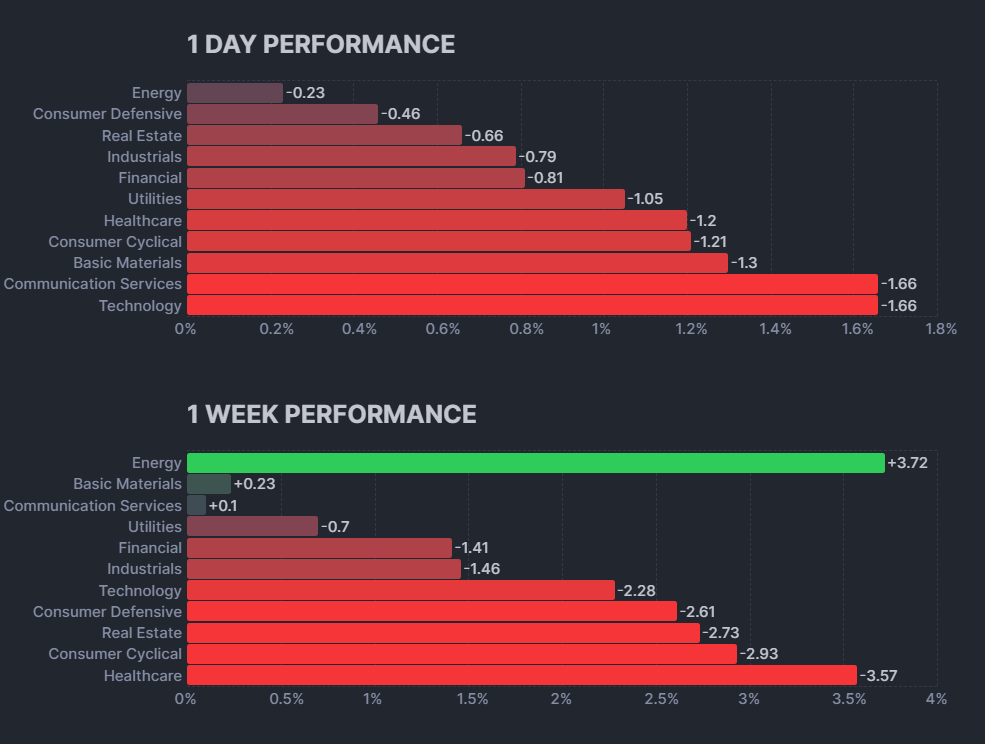

Over the course of the day, all sectors of the stock market performed poorly. The Communication Services sector performed the worst, with a return of -1.66%.

Over the course of the week, all sectors of the stock market also performed poorly, with the exception of the Energy sector, which had a return of +3.72%. The Healthcare sector performed the worst, with a return of -3.57%.

Overall, the stock market performed poorly over the day and the week.

Crypto

As we discussed yesterday, following the consolidation period, the price broke upwards, reaching a peak before retracing. Interestingly, the previous resistance level is now acting as support, making it less likely for the price to drop below that point. Given this scenario, we can anticipate BTC to continue its upward trajectory in price.

The price cannot fall below the 66300 price range. If it does, then the trend is changed. What we can expect is if the price goes up, it can go all the way up to 70000 or more.

Disclaimer

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carries inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.