It’s Monday, 2nd Week of April 2024. Let’s take a look at our market analysis today.

Key Events Today

There is nothing much today to worry about.

And these stocks have earnings today.

Forex

Regarding EURUSD, for the last four days, the trend has been positive, with green candles. Currently, the price seems indecisive, indicated by the presence of doji candles. However, the overall upward trend persists because the price rebounded from a strong support level.

The price reached 1.08000 and then rose back to 1.08400, where it’s currently consolidating. If it breaks above 1.08400, it could move towards 1.08700 or higher. Conversely, if it drops below, it might head towards 1.08000. Breaking 1.08000 could signal the start of a long-term downtrend, though the likelihood leans towards a breakout above.

Stock

Following a big decline in the stock market, there was an upward movement on Friday. On Thursday, the price broke out of the channel, suggesting a new bearish trend, but there were suspicions it could be a false breakout. Currently, the price is trading near the channel again. If it returns within the channel today, it suggests the breakout was indeed false. However, if the price retraces from the channel and continues downward, it confirms the channel’s breach and signals a bearish trend.

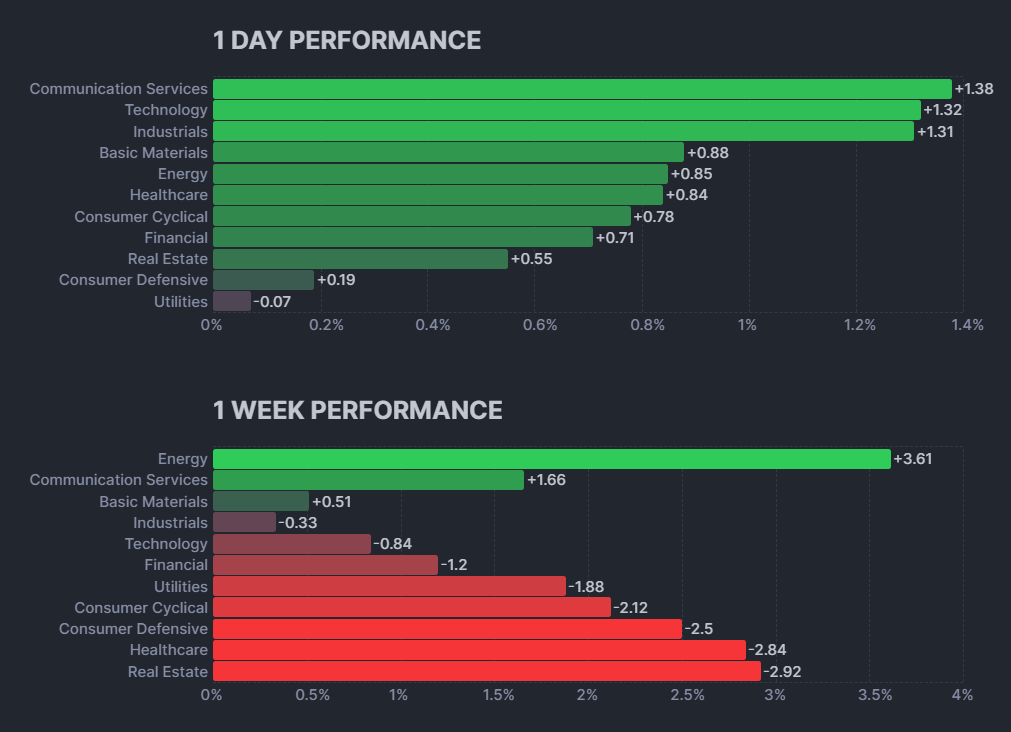

Overall, energy stocks performed the best, with a 3.61% increase over the week. Communication services stocks also performed well, with a 1.66% increase over the week. Conversely, consumer defensive stocks performed the worst, with a 2.5% decrease over the week.

Consumer Staples:

XLP also followed a similar pattern of trading within its channel, and it did break the channel along with the overall market on Thursday. This confirms that the entire market experienced a downturn on that day.

Currently, the price is trading below the lower trend line. If it manages to break back above and re-enter the channel, it suggests that the uptrend is still intact. In this scenario, a breakout upwards could lead the price towards the middle trend line. Conversely, there’s another possibility that the price retraces from the lower trend level and continues downward. Today’s movement will provide confirmation of what might unfold in the following days, so it’s best to wait and observe.

Energy:

The energy sector continues to shine, with its uptrend remaining strong and intact. We can anticipate it to perform similarly today. The overall trend for the energy sector is bullish, and despite Thursday’s minor setback amidst the market downturn, it sustained only minimal damage.

Materials:

Materials are also experiencing an uptrend, with a clear uptrend channel evident. The crucial takeaway is that this channel should not be broken; if it does break down, it signifies a trend reversal towards a downtrend. The lower line functions as support, while the upper line acts as resistance for the price movement. Therefore, the price should ideally trade within these levels. While corrections may occur, the overall trend remains bullish. you only need to worry about when the channel breaks.

Industrial:

Industrials are currently exhibiting more of a sideways trend, which typically indicates an impending breakout in either direction. Since it’s within a channel, the price should ideally remain within this range. It’s crucial to keep a close watch for any breakout, as that will indicate the direction the price is likely to head.

Consumer Discretionary:

XLY is also trading within a sideways channel, with the price currently near its strongest support level. There are two potential outcomes: either the price will bounce up from this level, suggesting an upward movement, or it could break down, indicating the start of a new bearish trend. So It’s crucial to monitor the support level closely for any potential breakout.

Healthcare:

Healthcare broke out of its sideways channel, moved downward, found support, and retraced. However, it remains outside of the channel. We could anticipate the price falling to 138, which is the next strongest support level, or it might bounce back up from the current level. If it breaks the trend line, it would confirm the uptrend.

Financials:

The financial sector is also exhibiting a sideways trend. Similar principles apply here as discussed earlier: the price should ideally remain within the channel, and if the channel breaks, it signifies a potential change in trend.

Technology:

The technology sector is also following a similar pattern, trading within its channel. Currently, mean reversion strategies could be profitable, taking advantage of the price returning to its average. However, it’s prudent to wait for a breakout before considering momentum strategies.

Communications:

Communications are displaying upward momentum, with the price following a clear trend that appears robust. The expectation is for this trend to continue moving higher. However, if the trend line breaks, it would indicate a potential change in trend. As of now, the trend is upward.

Utilities:

Utilities are also experiencing a solid uptrend, indicating a potential for continued upward movement. While there may be occasional corrections, the overall trend appears strong and bullish.

Real Estate:

For XLRE, the price is currently on a downtrend and trading around its support level. There are two potential scenarios: it may bounce up from this level, suggesting a reversal to the upside, or if it breaks down, we can anticipate it to move to lower levels as depicted in the picture.

Crypto

Regarding BTC, it remains on an uptrend, as anticipated. It has bounced back to the 70000 range, with the potential to continue climbing higher. However, there may be corrections along the way. Overall, the price of the cryptocurrency is still bullish, and it could potentially reach new highs in the coming days.

Disclaimer

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.