There are two types of trading strategies: momentum strategies and mean-reverting strategies. Any trading strategy you decide to use will fit into one of these categories. In this article, we’ll explore these different types of trading strategies and what makes them different.

What are Momentum Strategies?

Momentum strategies are trading approaches that focus on the idea that assets or markets that are already exhibiting strong price movements are likely to continue in the same direction.

These strategies assume that assets that have shown upward or downward momentum will continue to gain or lose value, respectively, for a certain period.

In simple terms, when a stock is following a trend, it is likely to remain in that trend for a certain period. Momentum strategies take advantage of these trend movements.

It doesn’t matter the reason for momentum, whether it’s news, technical analysis, fundamentals, or any other factor. If your aim is to capture a big move, then it’s a momentum strategy.

Momentum trading can yield significant profits during strong trends, offering the potential for high returns over relatively short periods. It aligns with the “trend is your friend” adage and exploits market momentum for profit.

What are Mean Reversion Strategies?

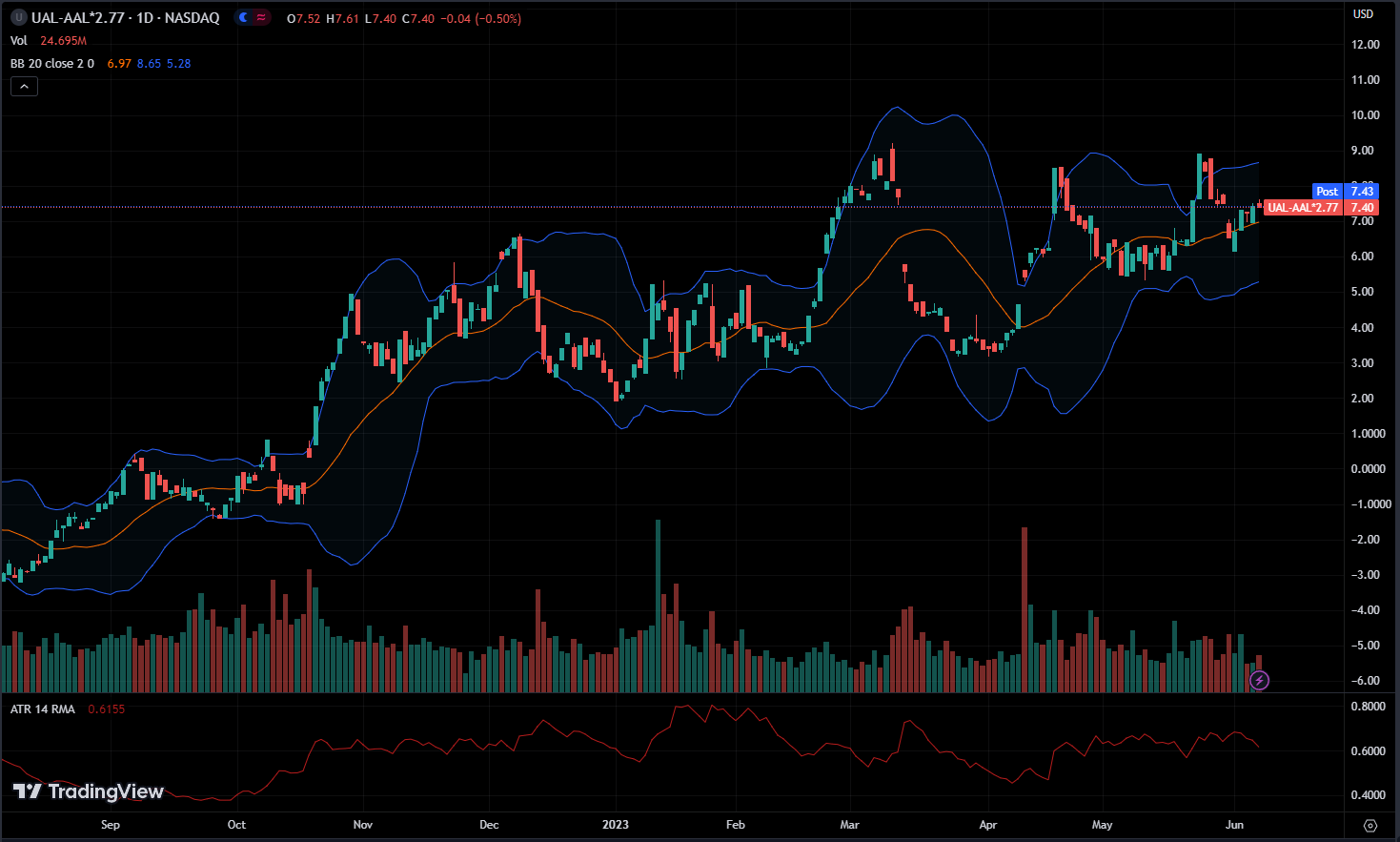

Mean reversion strategies in trading are approaches that operate on the principle that asset prices tend to move back toward their average or mean value after deviating from it.

This strategy assumes that extreme price movements will be followed by a correction, returning the price to its average level.

In simple terms, when something experiences an upward movement, it becomes less likely to continue rising and more likely to reverse and decline. and then when it comes down, it becomes less likely to continue falling and more likely to reverse and rise.

This behavior implies that the asset tends to revert back to its average price every time it deviates from it.

This type of behavior is commonly referred to as mean reversion.

Momentum vs Mean Reversion Which One is the Best?

The market exhibits both momentum behavior, where it tends to move in a particular direction and mean reversion behavior, where it goes up and down.

Whenever the overall market demonstrates momentum, many individual stocks are likely to exhibit momentum as well. Conversely, when the market is in a mean-reverting phase, a significant number of stocks are expected to follow a mean-reversion pattern.

Contrary to popular belief that the market predominantly exhibits momentum behavior, it is, in fact, mean reverting about 80% of the time, while staying in a momentum state for only around 20% of the time.

The reason for this false belief is our human tendency to overemphasize momentum due to the memorable instances of certain well-known stocks like Apple, Amazon, and Google that experienced significant and continuous upward movement. We tend to recall the exceptional cases of stocks that consistently rise or fall.

However, we often overlook the numerous stocks that exhibit a pattern of going up and coming back down, or simply remaining relatively stable. In reality, such instances where nothing extraordinary occurs represent the majority of cases in the market.

So most of the time we are actually in mean reversion.

Now which type of strategy, momentum or mean reversion, do you believe is the most effective?

Both momentum and mean reversion strategies can be effective, but it is important to understand that they operate in different ways. Therefore, your approach needs to be tailored accordingly for each strategy.

Example:

When using a mean-reverting strategy, it’s important to know that if a stock shows mean-reverting behavior, you’d sell it when it rises and buy it when it falls, repeating this process.

But, it’s worth noting that sometimes the stock might change direction suddenly, causing potential losses in the mean reversion strategy.

With mean-reverting strategies, the goal is usually to make small profits consistently. However, there may be times when you face losses.

In momentum strategies, the aim is to find stocks expected to make big moves in a direction and capitalize on those moves.

However, it’s essential to realize that often, the stock may not move much. But then, there might be a time when it moves significantly as expected.

In momentum trading, you expect a stock to rise, so you buy it. But sometimes it falls, causing a loss. This can happen several times, but eventually, it moves in the right direction, bringing significant profits.

So, in momentum trading, you try for big gains by predicting market moves, even though you may face losses sometimes.

It’s like swinging for a home run many times, accepting smaller losses until you hit a successful trade that gives big returns.

Both strategies work differently. In momentum trading, you focus on aiming for big profits, even if it means facing some small losses. But with mean-reverting strategies, the aim is to gather small profits consistently, although you might face losses sometimes.

So, the trade-off is between trying for big gains with frequent small losses in momentum trading versus aiming for steady small profits with occasional losses in mean-reverting trading.

Now, which is better?

Both momentum and mean-reversion strategies have their advantages. It’s often good to use both at the same time.

Starting with a mean-reverting strategy can be helpful because it can give you small wins regularly, which feels good emotionally. You’ll mostly have winning days with small profits and only a few days with losses.

But using a momentum strategy can be tougher emotionally. You might have losses most days, with big gains only sometimes. Missing out on those big gain days can be tough emotionally.

So, it’s best to use both strategies together. When the market shows mean-reverting behavior, your mean-reverting strategy will make profits while your momentum strategy might lose. And when the market is in a momentum phase, your mean-reverting strategy might lose, but your momentum strategy can bring big gains. By using both, you ensure consistent profit potential in different market conditions.

We shouldn’t rely only on market behavior because it’s unpredictable and hard to predict accurately.

Conclusion

Trading strategies can be broadly categorized into two main types: momentum and mean-reverting. While momentum strategies seek to exploit existing trends, mean-reverting strategies aim to profit from price corrections back to the mean.

Although the market is often perceived as predominantly exhibiting momentum behavior, statistics show that it actually leans more towards mean reversion. Both strategies have their strengths, and employing a balanced approach that combines elements of both can offer resilience and profitability across various market conditions.

However, traders need to remain adaptable and not rely solely on market behavior, as it can be unpredictable. Instead, a diversified strategy tailored to the nuances of each approach is crucial for long-term success in trading.

If you want to learn more about mean reversion and momentum check out this research article by Alina F. Serban

I strongly recommend immersing yourself in research articles within your areas of interest as they provide valuable insights and inspire you to conduct your own research. Reading such articles can spark new ideas and deepen your understanding of the subject.

In the upcoming article, we will delve into the process of selecting stocks tailored to specific types of strategies.