![Market Analysis Today[2024.04.11]: S&P 500 Going Bearish?

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/04/Market-Analysis-Today-04.11.jpg)

It’s Thursday, 11th of April 2024. Let’s dive into our market analysis today.

Key Events Today

We have 3 events that needs attention PPI, EUR Monetary Policy and Unemployment Claims.

And these stocks have earnings today.

FOREX

Yesterday, the CPI data for came hot 3.5%. This suggests that rate cuts probably won’t happen soon. Currently, the price is hovering around the strongest support level at 1.07200 for EURUSD. There are two possibilities: either the price breaks this support level and continues to drop, or it rebounds upward from this support level.

On the one-hour chart, the price is currently at its strongest support level. It has to either break below this level or rebound. If it breaks, we can anticipate the price dropping further to around 1.06600 or lower. However, if it rebounds, we could see it rise to around 1.07675. Breaking above this level could push it even higher to around 1.08000. The trendline, which previously indicated an uptrend, is now acting as a resistance for the price. So, it’s unlikely for the price to break that level soon.

CRYPTO

BTC rose following the CPI data, but a correction phase may still be underway as the uptrend has been disrupted and the price remains below that level. To confirm the uptrend, the price must surpass the trend line. Therefore, it’s advisable to wait for a breakout before considering a long position. If the price declines, you could potentially buy it at a lower price.

STOCK

Regarding SPY, it appears that the price is moving into a sideways trend, indicating that the previous uptrend has been broken. The probabilities suggest that the price is more likely to decline. To be more certain, wait for the lower trend line to be breached. If this occurs, we would officially enter a bearish trend.

Alternatively, if the price rises and breaks out of the sideways channel, reentering the uptrend channel, it suggests that bullish sentiment persists. Currently, the market is experiencing indecision, with yesterday’s CPI data heavily influencing it. Therefore, today, we may witness corrections in both supply and demand. It’s prudent to wait for breakouts to confirm the trend.

Yesterday, the majority of stocks saw declines. following significant drops over the past couple of days Nvidia saw a rebound, gaining 1.97%, while Tesla experienced a decline of 2.90%. Interestingly, the energy sector appears to be performing relatively well amidst the overall market downturn.

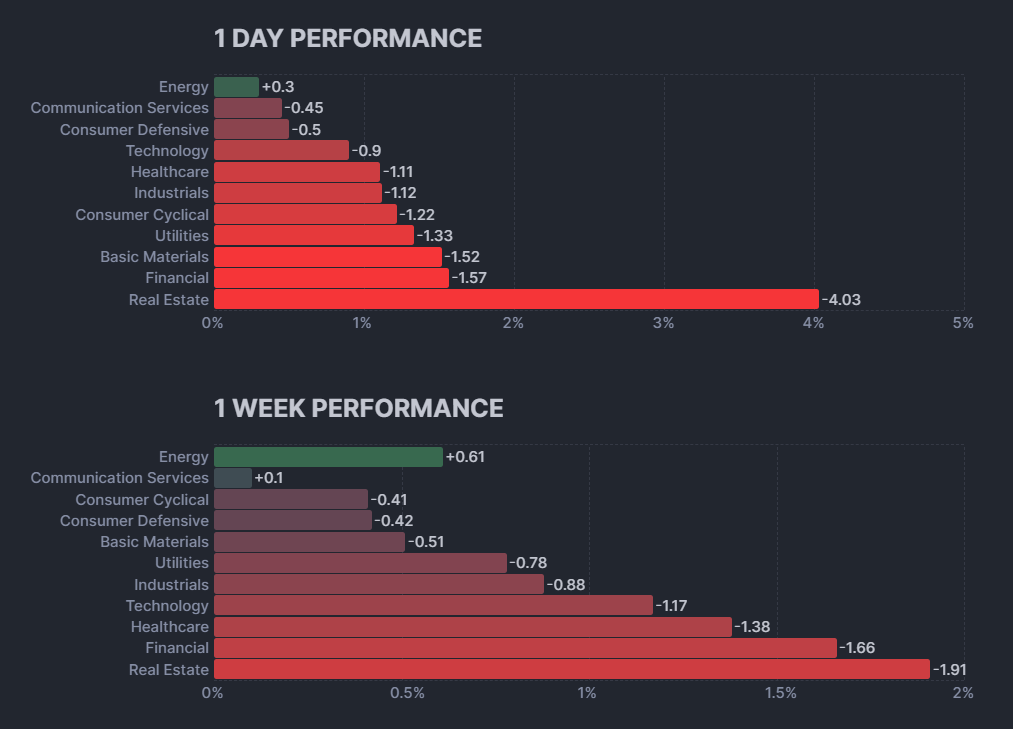

Overall, the stock market has been in a downtrend for the past week. The real estate sector has been the worst performer, declining by over 4% in the past week. Financials and healthcare have also declined significantly, by over 1.5% and 1.38% respectively. The only sector to show positive performance over the past week is energy, which has grown by 0.61%.

Looking at the one-day performance, the trend is similar with most sectors experiencing negative performance. Real estate continues to be the worst performer, declining by over 4%. Financials and basic materials have also declined by over 1.5% each. The only sectors to show positive performance over the past day are energy and communication services, which have grown by 0.3% and a very small amount, respectively.

Overall, the stock market appears to be in a downtrend. This is supported by both the week-long and day-by-day performance across a majority of sectors.

Sorry for not going through each sector individually today. I’m short on time. We’ll tackle them tomorrow.

Disclaimer

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.