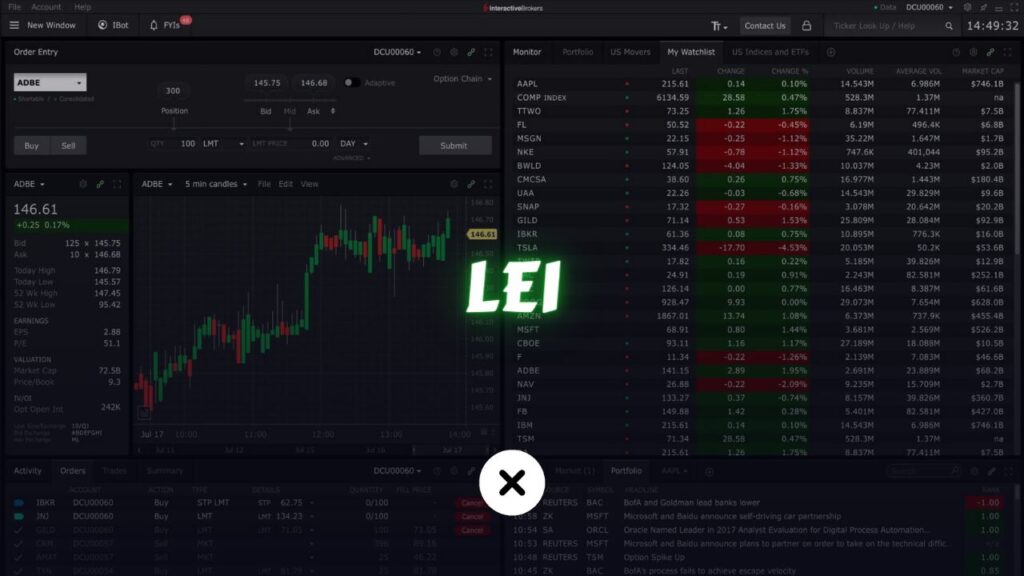

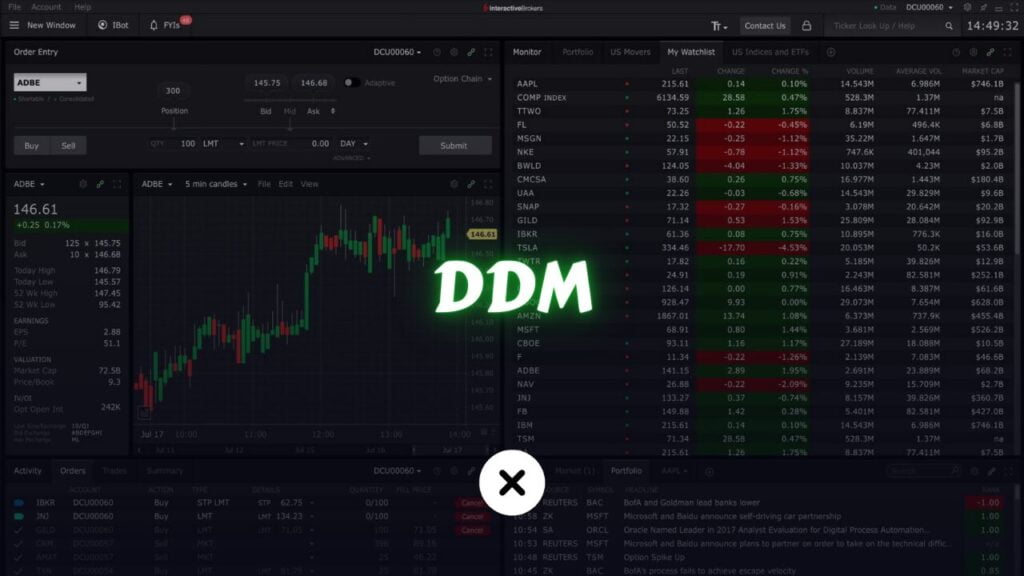

What is a Stock?

What is a stock or shares? Well, a stock basically acts as a security that symbolizes ownership in a corporation. when you possess stocks in a company, you hold a stake in that company’s assets and earnings. A portion of these resources is rightfully yours, as you become a partial owner of the company. So, […]