In the big and ever-changing world of finance, investors employ a many methods to evaluate the intrinsic value of stocks. One such approach, deeply rooted in fundamental analysis, is the Dividend Discount Model (DDM). This model serves as a cornerstone for investors seeking to estimate the fair value of a stock based on its future dividends.

Let’s delve into the intricate workings of the Dividend Discount Model and explore how it aids investors in their decision-making process.

What is Dividend Discount Model?

The Dividend Discount Model (DDM) is a valuation approach employed by analysts to estimate the value of a stock. It is applicable primarily to companies that have a track record of consistently paying dividends over an extended period.

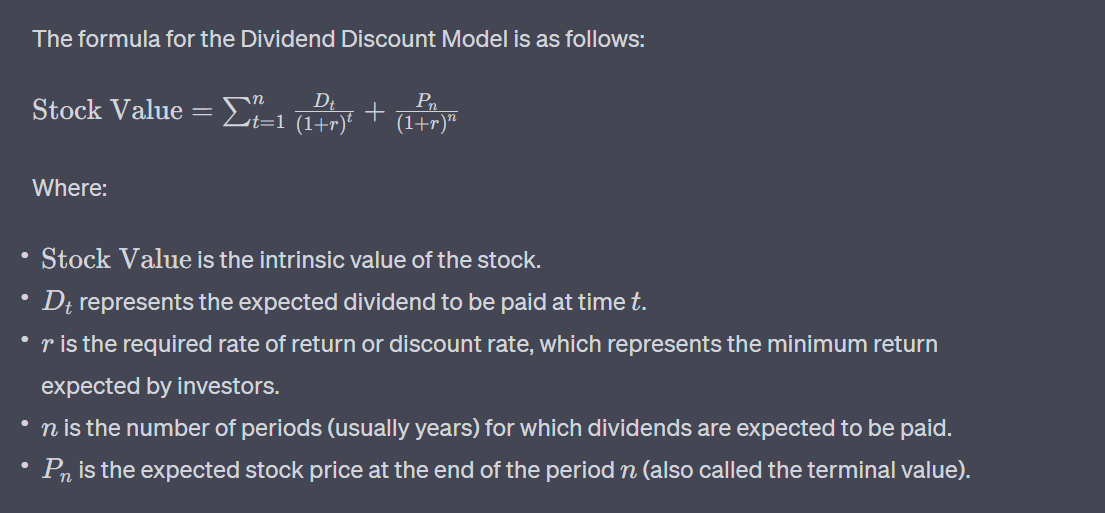

The DDM is a method used to estimate the intrinsic value of a stock by considering the present value of its future dividends. It assumes that the value of a stock is equal to the present value of all the dividends it is expected to pay to shareholders in the future.

The basic idea behind the DDM is that investors purchase stocks in order to receive a return on their investment, primarily in the form of dividends. By discounting the expected future dividends back to their present value, the DDM attempts to determine what a stock is worth today.

The DDM assumes that dividends will grow at a stable rate over time. There are different variations of the model to account for different growth scenarios, such as the Gordon Growth Model, which assumes a constant growth rate, and the Two-Stage DDM, which considers different growth rates for a specific period and a stable growth rate afterward.

Advantages and Limitations of the DDM

Advantages:

Simple and Intuitive: The DDM provides a straightforward framework for estimating the intrinsic value of a stock, making it accessible to both novice and seasoned investors.

Focus on Dividends: For income-oriented investors, the DDM offers a direct way to assess the attractiveness of a stock based on its dividend-paying ability.

Long-Term Perspective: By considering future dividend streams, the DDM encourages investors to take a long-term view of their investments.

Limitations:

Dependency on Assumptions: The accuracy of DDM projections heavily relies on the validity of assumptions, such as the dividend growth rate and the discount rate.

Not Applicable to Non-Dividend Paying Stocks: Since the DDM revolves around dividends, it’s unsuitable for valuing companies that do not distribute dividends.

Sensitivity to Input Variables: Small changes in inputs, such as the growth rate or the discount rate, can result in significant fluctuations in the calculated intrinsic value.

Example:

Imagine I offer you a retirement plan. It promises you $100 every year for the next 10 years, plus an extra $1000 at the end of those 10 years. Now, how much would you be willing to pay for this plan?

Even though all the payments add up to $2000 ($100 each year for 10 years plus $1000 at the end), you know that $2000 in the future isn’t the same as $2000 today. This is where the time value of money comes in. For example, if I borrow $100 from you and give it back in a few hours, you might think that’s fair. But if I ask for $100 today and promise to pay you back next year, you’d expect more than $100 in return. That’s because if you kept that $100 in a bank, you could earn some interest and end up with more money.

Basically, money’s value today is more than the same amount in the future because you could use it to earn interest or make investments. This is super important for understanding present value and the time value of money.

Assuming the current interest rate is 5%, how much would you be willing to offer to get $100 in the future? You would offer less than $100.

Let’s consider a scenario where you have $100 and you want to determine its value after one year. To calculate the future value, you would multiply $100 by (1 + the interest rate of 0.05), resulting in $105. However, if you wish to determine the value of $100 from one year ago, you would divide it by (1 + 0.05), which is approximately $95.

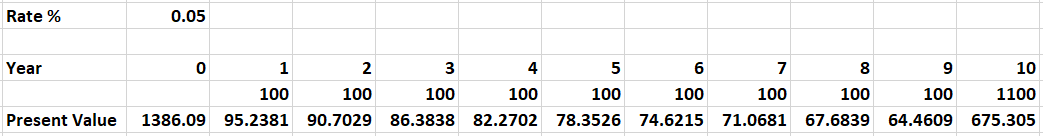

The same principle applies to our retirement plan. Let’s proceed with the calculations.

If we want to determine the value of $100 from one year ago, we can calculate it by dividing $100 by (1 + 0.05), which equals approximately $95.23. Therefore, the present value of $100 today is considered to be $95.

Now, let’s consider the other $100 that is expected in two years. To calculate its present value, we need to discount it by the interest rate for two years. Using the same interest rate of 5%, we can divide $100 by (1 + 0.05). This gives us approximately $90.70 as the present value of $100 expected in two years.

By performing the calculations for each individual amount and determining their present values, we can then add up these present values to obtain the total.

Every year, to find out how much future values are worth today, you divide them by 1.05. This shows that the farther into the future an amount is, the less valuable it is in today’s terms.

So, the total worth of all these future payments together is the sum of their individual values today.

Therefore, the value of this plan is $1386. Paying more than this would be a bad deal, while paying less would be a good deal.

The same idea applies to stocks. If you own a stock that pays dividends each year, and you have an idea of the expected dividend amounts and future resale value, you can find their present value by discounting those future cash flows. This present value represents the stock’s worth to you today and can be seen as its price.

This is how analysts use dividend discount models to figure out a stock’s value.

Imagine you have the chance to get $100 every year forever, and your discount rate is 5%. How much would this stream of payments be worth to you today? By dividing $100 by 0.05, you get $2000. So, you’d pay $2000 for an investment that gives you $100 each year with a 5% interest rate.

But keep in mind, dividends aren’t fixed and usually grow over time. So, we need to include a growth rate in the calculation. For example, if the next year’s dividend is $100, the discount rate is 5%, and the growth rate is 1%, dividing $100 by the difference between the discount rate (0.05) and the growth rate (0.01), which is 0.04, gives us $2500. This means the investment becomes more valuable because of the expected increase in dividends.

How we use DDM as Traders?

Determining a stock’s value based solely on dividends isn’t straightforward, as it involves two tricky aspects: calculating dividends and estimating growth. Growth rates can change, making precise calculations tough. But analysts usually have insights and predictions about future growth rates and the discount rates they use in their calculations. These factors help them figure out a stock’s worth.

Traders know that analysts use the dividend discount model (DDM) to calculate the value of stocks with consistent dividends. Many stocks fit this category and keep up a pattern of reliable dividend payments. So, traders usually assume that stocks with steady dividends, plus high institutional ownership, are valued using the DDM approach.

Stocks trade at their current price because it’s what all traders in the market agree on, considering lots of factors including the value from the dividend discount model (DDM). So, trying to figure out the stock price solely using the DDM might not be the most accurate, since the market price already reflects this agreement. Instead, traders watch and analyze changes in dividend payments to gauge potential changes in stock value.

Let’s say a company starts with a $1 dividend in the first year, and it goes up by 2% each year. But at some point, the company decides to cut the dividend to 92 cents. From this scenario, we can learn some key things.

First, it’s clear that institutional investors and stakeholders who own the stock probably used the dividend discount model (DDM) to figure out the stock’s value, looking at the historical dividend data of $1, $1.02, and $1.04.

But with the dividend cut to 92 cents, it’s a big change from the usual growth trend. This drop in dividend and the lack of an obvious growth path could mean the stock’s value goes down. So, we’d expect the stock’s value to drop because of this dividend change.

Conclusion

As traders, our focus isn’t on using the dividend discount model (DDM) to value stocks. Instead, we’re interested in understanding how analysts use the DDM. This helps us predict how a stock will react to changes in dividends, especially when there’s high institutional ownership. By considering the insights from the DDM, we can understand better how the stock might behave and make smarter trading decisions.

That’s why many companies that always pay dividends are careful about cutting or slowing down their dividend growth. They know that any reduction in dividends or growth can really hurt their stock price. Investors pay close attention to dividend-related actions, and any bad changes can cause the stock’s value to drop fast. So, companies work hard to keep their dividends steady and growing to keep investors happy and support their stock price.

By utilizing the screening feature on finviz, you can identify many stocks that possess both high institutional ownership and a dividend yield.

If you visit dividend.com and enter the ticker symbol of a company, you can access detailed information about that company’s dividends.