Before we dive into bond ETFs, let’s start by understanding how regular bonds and bond ETFs compare in terms of their advantages and disadvantages.

Bonds vs Bond ETFs for investing

Bonds are like IOUs issued by companies, governments, or other organizations. When you buy a bond, you’re essentially lending money to the issuer in exchange for regular interest payments and the return of the bond’s face value when it matures.

They have a fixed interest rate, known as the coupon rate, and a set maturity date when you get your initial investment back.

They are relatively stable but less liquid because you can’t easily buy or sell them like stocks.

Remember Exchange Traded Funds? Bond ETFs are like baskets of bonds bundled together into a single investment product. When you buy shares of a bond ETF, you’re investing in a diversified portfolio of bonds.

They trade on stock exchanges, so they are more liquid than individual bonds. You can buy and sell them throughout the trading day.

Bond ETFs don’t have a fixed maturity date, and their value can fluctuate with changes in interest rates and bond prices.

So should you invest in individual bonds, or should you opt for bond ETFs?

If you buy a bond, it’s straightforward. Let’s say you get a $10,000 bond with a 5-year term and a 5% interest rate. In 5 years, you get your $10,000 back, and each year, you receive $500 in interest. Even if interest rates change, it doesn’t really matter. Yes, the bond’s price might go up or down if rates change, but if you hang onto it until it matures, you’re certain about what you’ll get. Selling it earlier could mean a gain or a loss, but if you stick with it until maturity, you know exactly what you’ll receive.

When you invest in a bond ETF, it works a bit differently. You see, a bunch of people pool their money, and the fund invests in lots of different bonds. So, there are various bonds in that fund, some taking longer to mature, while others mature sooner. But when you look at the whole bunch, it kind of evens out. It’s like if you have a long-term bond fund with an average duration of, say, 15 years. Some bonds in it might be shorter-term, and some might be longer-term, but on the whole, they average out to be about 15 years.

This means that in a bond ETF, you won’t get your initial money back. When a bond in the ETF matures, they just buy a new, longer-term bond with that money. So, there’s always some bonds in there maturing, and they use that money to buy new ones. In bond ETFs, you don’t get your initial money back because it’s a fund, not a single bond. You have to sell the ETF at a particular time. This makes it riskier compared to owning an individual bond.

With bond ETFs, your income isn’t set in stone. It’s more mixed up, in a sense. You see, bond ETFs often give you dividends, and they usually come in every month. This happens because different bonds in the ETF pay their interest at different times. So, one month, you might get a small dividend, and another month, it could be bigger. It’s not as regular or exact as just holding one single bond.

So, because of this, when you have a bond ETF or fund, there’s more risk because you’re not holding just one bond. It’s more like a group of different bonds, and as they mature, the fund buys new ones. and you only hold the value of the ETF.

So, you might think there are several good things about owning a bond instead of a bond ETF. With bonds, you know precisely what you’re getting, so it’s less risky. However, there’s another side to this – it’s a bit riskier in another way. Why? Well, when you buy a bond directly, it needs more money. Many bonds cost between $5,000 to $20,000. If you don’t have that much money to start with, how can you manage to invest such an amount?

On the other hand, a bond ETF is something you can get for as little as $100. So, it needs more money to buy a bond directly, and because of that, you’re also less spread out, less diversified. Let’s say you have $40,000, and you can only invest in two bonds. That means you’re not very diversified. In a Bond ETF, you’re holding a bunch more bonds, so you’re much more diversified.

This is particularly important if you want to buy corporate bonds. You wouldn’t want to limit yourself to just one or two companies. To spread your risk across different companies, you’d need more money.

So, there are upsides and downsides to having bonds and bond ETFs. In my view, bond ETFs work well for folks who are just starting, don’t have much money to invest, and want to spread their risk with an ETF. They’re fine with taking a bit more risk because a bond ETF can go up and down more, especially since it doesn’t reach a specific end date – they keep changing those bonds. That’s why it might suit younger people better.

Now, for older folks who’ve saved up more money, it might make sense to buy bonds directly. That way, you know exactly how much you’ll get back, and there’s less risk if you’ve spread your money across different bonds the right way. But if you don’t have enough money to spread out properly, one option is to be careful not to put too much into corporate bonds. Maybe stick with government bonds, which are safer but offer less profit.

It really depends on your age, how much risk you can handle, and what you prefer. So, the choice between bonds and bond ETFs is something you have to decide based on your specific situation and what you’re comfortable with.

Best bond ETFs for investing

Now, let’s check out a few ETFs that can help you get some exposure to bonds.

You can find useful information about ETFs on the website ETFdb.com

1. BND – Vanguard Total Bond Market ETF

The Vanguard Total Bond Market Index Fund ETF is a comprehensive investment product offered by Vanguard, one of the leading financial institutions known for its low-cost and diversified investment options. This ETF is designed to provide investors with exposure to a broad spectrum of the U.S. bond market.

The ETF offers diversification by investing in a wide range of bonds within the U.S. bond market. It encompasses various types of bonds, including U.S. government bonds, corporate bonds, municipal bonds, and mortgage-backed securities. This diversification helps spread risk across different sectors of the bond market, enhancing portfolio stability.

The fund employs a passive investment strategy. It aims to replicate the performance of a specific bond index, typically the Bloomberg Barclays U.S. Aggregate Bond Index. To achieve this, the fund holds a representative sample of the bonds included in the index. Passive management typically results in lower costs, and Vanguard is recognized for its cost-effective approach.

While it hold securities of all maturity lengths, it is heavily weighted towards the short end of the curve.

It usually features a low expense ratio(0.03%), meaning that the fees for managing the fund are minimal. This cost-efficiency is advantageous for investors as it allows a significant portion of their investment to work for them.

As an ETF, the Vanguard Total Bond Market Index Fund ETF is traded on stock exchanges, making it highly liquid. This means investors can easily buy and sell shares throughout the trading day at prevailing market prices. Liquidity provides flexibility and the ability to make real-time adjustments to bond holdings.

The ETF generates income for investors through the interest payments, also known as coupon payments, from the bonds it holds. This income is typically distributed to shareholders on a regular basis, providing a steady source of cash flow. It is an attractive feature for income-focused investors. mostly all bond ETFs offers dividends of the interest payments.

The value of the Vanguard Total Bond Market Index Fund ETF can fluctuate based on changes in interest rates and bond prices. It offers a balance between generating income and preserving capital.

2. LQD – iShares iBoxx $ Investment Grade Corporate Bond ETF

The iShares iBoxx $ Investment Grade Corporate Bond ETF is designed to provide investors with exposure to a diversified portfolio of U.S. investment-grade corporate bonds.

The ETF primarily holds investment-grade corporate bonds, which are issued by well-established companies with relatively low credit risk. These bonds are considered safer investments compared to high-yield or junk bonds.

It tracks the performance of the iBoxx $ Investment Grade Corporate Bond Index, which includes bonds from various sectors and industries.

Just like BND, the ETF generates income for investors through the interest payments from the corporate bonds it holds.

While investment-grade corporate bonds are generally considered less risky than equities or high-yield bonds, they are not without risk.

A lower expense ratio(0.14%) means that a greater portion of the investment returns remains with the investor.

3. JNK – SPDR Bloomberg Barclays High Yield Bond ETF

The SPDR Bloomberg Barclays High Yield Bond ETF, often referred to by its ticker symbol JNK, it’s designed to provide investors with exposure to the high-yield, or “junk,” corporate bond market. This ETF is offered by State Street Global Advisors and is one of the largest and most widely traded high-yield bond ETFs.

The ETF primarily holds high-yield corporate bonds. These bonds are issued by companies with lower credit ratings, which means they carry higher credit risk compared to investment-grade bonds. As a result, they offer higher yields to compensate for the increased risk.

It tracks the performance of the Bloomberg Barclays High Yield Very Liquid Index, which includes bonds from various sectors and industries.

Given its focus on high-yield bonds, the ETF offers the potential for attractive income generation. High-yield bonds typically provide higher coupon payments compared to investment-grade bonds, making them appealing to income-oriented investors.

High-yield bonds are considered riskier than investment-grade bonds due to the higher likelihood of default. Consequently, the ETF’s value can be more sensitive to changes in credit conditions and economic factors. Investors can expect a trade-off between the potential for higher income and increased credit risk.

The ETF generally has an high expense ratio compared to other bond ETFs. (0.4%)

4. BSV – Vanguard Short-Term Bond ETF

The Vanguard Short-Term Bond ETF is offered by Vanguard, This ETF is designed to provide investors with exposure to the short-term segment of the U.S. bond market.

The ETF primarily holds short-term bonds, which are bonds with relatively shorter maturities. These bonds typically have maturities of three years or less. Short-term bonds are considered less sensitive to interest rate fluctuations than long-term bonds, making them less volatile.

It tracks the performance of the Bloomberg Barclays U.S. 1-5 Year Government/Credit Float Adjusted Index. This index includes short-term government bonds and high-quality corporate bonds.

While short-term bonds typically offer lower yields compared to long-term bonds, the Vanguard Short-Term Bond ETF still generates income for investors through the interest payments from the bonds it holds.

Short-term bonds are generally considered less risky than long-term bonds due to their shorter maturities.

The ETF typically has a low expense ratio (0.04%)

5. BLV – Vanguard Long-Term Bond ETF

Again, The Vanguard Long-Term Bond ETF is offered by Vanguard, It’s designed to provide investors with exposure to the long-term segment of the U.S. bond market.

The ETF primarily holds long-term bonds, which are bonds with relatively longer maturities. These bonds typically have maturities of ten years or more. Long-term bonds are generally more sensitive to interest rate fluctuations than short-term bonds, which can make them more volatile.

It tracks the performance of the Bloomberg Barclays U.S. Long Government/Credit Float Adjusted Index. This index includes long-term government bonds and corporate bonds.

Long-term bonds typically offer higher yields compared to short-term bonds.

Long-term bonds are generally considered riskier than short-term bonds due to their longer maturities and greater sensitivity to interest rate changes.

The ETF typically has a expense ratio of 0.04%.

6. SHV – iShares Short Treasury Bond ETF

The iShares Short Treasury Bond ETF is designed to provide investors with exposure to short-term U.S. Treasury bonds.

The ETF primarily holds short-term U.S. Treasury bonds, which are issued and backed by the U.S. government. These bonds are considered among the safest investments due to the U.S. government’s creditworthiness.

It tracks the ICE U.S. Treasury Short Bond Index, which includes various Treasury bonds with maturities of one year or less.

Short-term Treasury bonds typically offer lower yields compared to long-term bonds. these government bonds even low.

The ETF typically has a expense ratio of 0.15%

7. IEF – iShares 7-10 Year Treasury Bond ETF

The iShares 7-10 Year Treasury Bond ETF is designed to provide investors with exposure to intermediate-term U.S. Treasury bonds with maturities ranging from seven to ten years.

The ETF primarily holds U.S. Treasury bonds with maturities that fall within the seven to ten-year range. These bonds are issued and backed by the U.S. government.

It tracks the ICE U.S. Treasury 7-10 Year Bond Index, which includes various Treasury bonds with maturities between seven and ten years.

Intermediate-term Treasury bonds typically offer moderate yields.

The ETF typically has a expense ratio of 0.15%

8. TLT – iShares 20+ Year Treasury Bond ETF

The iShares 20+ Year Treasury Bond ETF is designed to provide investors with exposure to long-term U.S. Treasury bonds with maturities of 20 years or more.

The ETF primarily holds long-term U.S. Treasury bonds, These bonds have maturities of 20 years or more, making them particularly sensitive to interest rate changes.

It tracks the ICE U.S. Treasury 20+ Year Bond Index, which includes various Treasury bonds with maturities of 20 years or more.

Again, Long-term Treasury bonds typically offer higher yields compared to shorter-term bonds.

The ETF typically has a expense ratio of 0.15%

How to choose best bond ETFs for investing?

We discussed the differences between bonds and bond ETFs and looked at a few examples of bond ETFs. Now, let’s explore how to select the appropriate bond for our investment portfolio.

If your goal is to invest in bonds and receive regular monthly payments while maintaining a stable balance, you can simply invest in long-term bond ETFs because it gives good return compared to short and mind term bond ETFs. You’ll mainly need to keep an eye on interest rate changes.

If you’re a young investor, you may not need to be concerned about interest rate fluctuations, especially if you don’t plan to sell your investments right away. if you are holding long term bonds It’s more important to monitor interest rates when you anticipate needing your invested capital in the near future. and if that’s the case its best to hold short term bond ETFs than long term. and never worry about interest rate fluctuations.

The main goal of investing is to make our money grow, and the best approach is to have a diversified portfolio that can do well in different market situations.

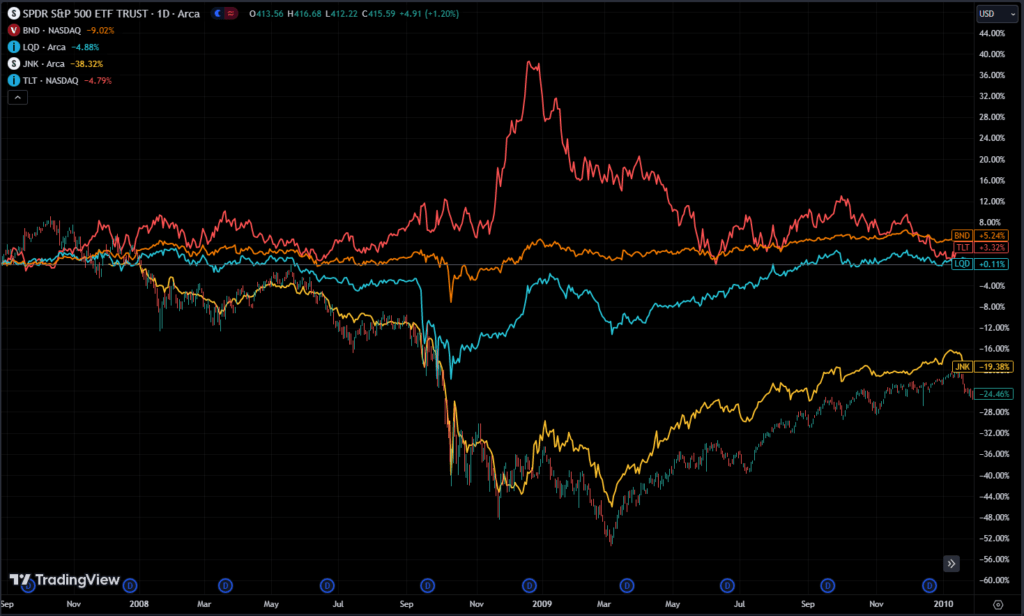

As investors, we need to be mindful of market crashes, and the primary reason we include bonds in our portfolio is for diversification. When the stock market experiences a downturn, the value of long-term bonds tends to increase. To illustrate this point, let’s consider an example.

The stock market tends to do well over a long time compared to other markets. Now, let’s compare these bond ETFs with SPY, which is an ETF representing the U.S. stock market.

During a market crash, the government typically reduces interest rates to help boost the economy. This action tends to cause the prices of long-term bonds to rise due to their durations. This is why, when we anticipate a market crash, it’s a good idea to include long-term bonds in our investment portfolio because bonds tend to perform better than stocks during a crash.

You’ll notice that the JNK bond ETF, when the market had a crash, saw its value drop even though interest rates went down. The reason is that these companies in the ETF are not the strongest; in fact, they’re among the weaker ones. So, there’s a risk that they might not be able to repay their loans. If people start thinking that these companies might go bankrupt and won’t be able to repay their debt, the bond’s price will decrease.

During a market crash, many companies may face financial difficulties or go bankrupt. This is why you need to be cautious with JNK bonds. In my opinion, JNK bonds are quite risky and not a wise choice to hold because there are better investment options available.

The LQD ETF did decline in value, but it didn’t drop as significantly as the JNK ETF. This suggests that investment-grade corporate bonds are a safer choice for investment.

Investing in these is your decision if you’re seeking a higher yield.

Now, let’s consider government treasury bonds. Short-term government bonds are the safest and most stable bonds. This is because the U.S. government is unlikely to face financial issues, and interest rate fluctuations don’t affect them much. So, if there’s economic uncertainty, and you want to prioritize safety, short-term government bond ETFs are an excellent choice, such as SHV.

If you take a look at a long-term ETF like TLT, you’ll see that it performed better than the market during a crash. If you had this in your investment portfolio during a market downturn, it could have helped reduce your risk. That’s why, in my opinion, government long-term bond ETFs are among the best bond ETFs to invest in.

However, it doesn’t mean you should buy this ETF all the time. What I mean is, if interest rates are very low, and you keep buying these bonds, you might face losses when the government raises interest rates. So, you need to know when to hold these bonds.

For example, if you expect the stock market to crash soon, that’s when you should have a larger portion of this ETF in your portfolio to safeguard your investments from the market downturn. also its best to buy these when the interest rates are high. you can sell and buy back stocks when you think the market done crashing.

its called asset allocation and rebalancing. we will talk about these in the future.

Conclusion

Stocks are considered one of the best long-term investments. However, there’s a risk that the stock market could crash, causing a significant drop in your portfolio’s value, and it might take a long time to recover from such a crash. That’s where bonds come into play. The main reason I personally invest in bonds is to manage this risk. When there’s a market crash, having long-term bonds in my portfolio can help me avoid some of the market’s downsides.

In other words, while the stock portion of my investments might be going down, I can still make money from my bond investments. This allows me to adjust and rebalance my portfolio when things return to normal. Bonds act like safety exits, and for this purpose, government long-term bonds are among the safest options.

it’s not usually a good idea to invest solely in bonds because, in the long run, stocks have the potential to outperform bonds.