Tactical asset allocation (TAA) is an investment strategy that involves actively adjusting a portfolio’s asset allocation in response to short-term market conditions or economic outlook. this is an active portfolio management strategy.

This might mean adjusting how much you have in things like stocks, bonds, cash, and other types of investments from time to time. And you can get even more deep by picking different amounts for different stocks, bonds, or any assets you have.

It just basically adjusting your holdings allocation in your portfolio based on the market performance.

Let’s have an example.

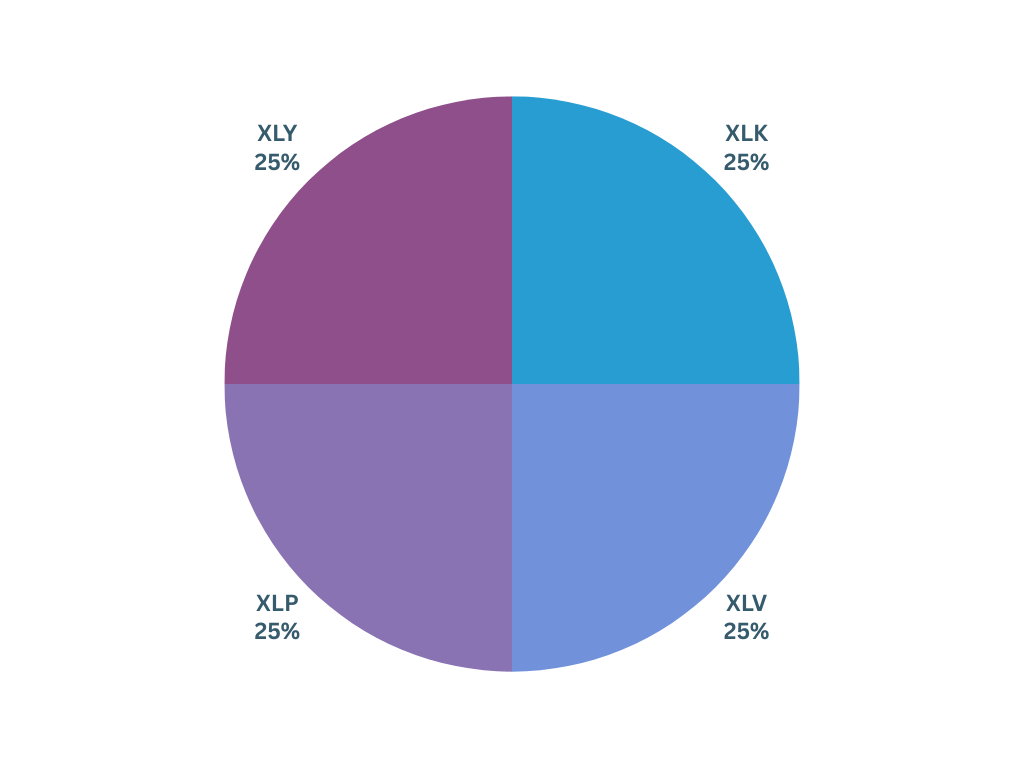

You have a portfolio and in it you’ve got some ETFs, let’s say XLK (Technology sector), XLP (Consumer Staples), XLV (Health Care sector), XLY (Consumer Discretionary) and you’ve evenly spread 25% across each of them.

Imagine there’s a big problem in the market—a crash. When the market crashes, XLY tends to go down too because things people can live without (like buying extra stuff) are more likely to have ups and downs than the overall market (SPY). Everything might take a hit, but XLY and XLK, especially in the tech area, tend to go down faster because they depend on how well the economy is doing. This is called being cyclical, and it means they’re more affected by economic changes. On the other hand, XLP and XLV don’t follow the economic cycle as much, so they don’t crash as quickly.

Because of that, the 25% you set for each ETF might shift. They won’t all stay the same. For instance, the part with technology might become 20%, and the XLP part might increase to 30% in how you divide up your investments. That’s why you want to rebalance—to make sure those parts stay at 25%, like you planned.

Now, some folks might take a more drastic step than just rebalancing. What they’ll do is create a new plan for how they divide up their investments. For instance, instead of keeping 25% in each of these sectors, they might think, “You know, the technology and consumer discretionary areas are doing really poorly right now, while consumer staples and healthcare are not falling as much. So, I’m going to switch things up. I want to have less, maybe 20%, in consumer staples and healthcare, and I want to increase it to 30% in the technology and consumer discretionary sectors.”

So, they totally switch up how they divide their investments because these sectors are trading low, and they can buy them at a better price. That’s why, when the market is crashing, it’s the right time to buy more.

Now, let’s check out a real example from the market. let’s compare S&P 500 with financial sector (XLF).

Usually, the financial sector and the overall market usually go in the same direction, but back in 2008, when the financial market crash happened, the financial sector went down a lot more than the whole market. So, if you had 25% of your investment in the financial sector because you liked it, once it dropped that much and your other parts didn’t drop as much, you could rebalance. But maybe you also think, “You know, that sector went down a lot. I don’t want to be only 25% in it anymore. I want to be 30%, and I want to decrease how much I have in the other sectors.”

That’s tactical asset allocation—adjusting how you spread out your investments based on what’s going on in the market.

let’s see another example,

When the COVID pandemic started, many areas like airlines and hotels went down because people weren’t traveling. However, sectors like technology went in the opposite direction. Initially, they went down with the overall market, but then everyone realized we’re staying at home and using more of these technology companies and apps, so they really took off.

So, depending on someone’s thoughts, a person might say, “You know, currently, the technology sector is doing really well. I usually have 25% in the technology sector, but I believe this whole pandemic is going to end. People will leave their houses and start traveling, and airlines will pick up. So, what I want to do is lower my holdings in the technology sector from 25% and increase my investment in the airline industry or hotel companies, or something like that.”

Now, someone else might say, “Hey, you know what? We’re never going back to normal. This is the new normal. Everybody will be working from home, and there’ll be less travel. People won’t need to travel for work because we’re used to this now. So, I actually think the technology sector is going to be even stronger, and other sectors won’t be as robust.” Another person might have a different tactical allocation. It’s not something easy to do—you can’t predict the future. You can guess, but you can’t be 100% sure. You need to make sure the probability is on your side when making these asset allocation decisions.

We only discussed stocks in tactical asset allocation. This is as deep as you can get in tactical asset allocation—deciding how much to keep invested in stocks.

You can also do tactical allocation with other things like bonds or crypto. For instance, if you have a mix of bonds and stocks, and when the market crashes, your bonds do well while your stocks drop, you can do tactical asset allocation by cutting down on bonds and getting more stocks.

Benefits of tactical asset allocation

Let’s imagine you have a mix of 40% in bonds and 60% in stocks in your investment portfolio. Now, when the market takes a hit, we know that during a stock market crash, bonds tend to hold up better, so they stay relatively stable. However, stocks take a significant hit. So, your allocation changes from your original plan. Now, we mentioned that you can rebalance, which means selling some bonds and buying stocks—that’s good.

But what if you decide to make a bigger change to your investment plan? You might say, “You know what, the market is down by more than 50%, and I don’t want to stick with 40% in bonds. I want to cut that to 20%. Instead of having 60% in stocks, I want 80% in stocks.” So, you sell a bunch of your bonds to get more stocks at that huge discount. That’s what tactical allocation is all about—adjusting based on what’s happening in the market.

Because you can’t predict the future, but you can make decisions based on what’s currently happening. If you do this, your portfolio will be much more focused on stocks. As the stock market recovers, you stand to benefit. Perhaps as the stock market goes up and interest rates start going up, you might think, “I don’t want to be 20% in bonds anymore. I want to go back to 40% in bonds and 60% in stocks.” Since stocks have gone up, you can sell some of them and get bonds at a better price. Now, you’re back to a 40%, 60% allocation.

As you keep doing this, maybe the market keeps going up, and it becomes overvalued. Interest rates are high, and you decide, “I want 60% in bonds and 40% in stocks.” And you do that. Then, if there’s another market crash, you have more bonds, so you don’t take as much of a hit. You can adjust your tactical allocation again—reduce your bond holdings, increase your stock holdings when stock prices are down.

Doing this can be extremely beneficial, but it’s obviously hard for most people. Many find it tough to buy stocks when the market is crashing, even though that’s often the best time to do it. If you want to be someone who is actively managing their investments, there are benefits to tactical asset allocation. But again, most people shouldn’t do it because most people can’t beat the market. However, if you’re willing to take that risk, tactical asset allocation is something to consider, keeping in mind your risk tolerance.

1. Risk management

TAA allows investors to respond to changing market conditions, reducing the risk of significant losses during downturns. By adjusting asset allocations based on short-term indicators, investors can potentially mitigate downside risk.

2. Capitalizing on opportunities

TAA enables investors to capitalize on short-term market opportunities. For instance, during market downturns, certain assets may become undervalued, presenting buying opportunities. TAA allows investors to shift funds into these undervalued assets to potentially benefit from their future recovery.

3. Enhanced returns

By actively adjusting asset allocations in response to market conditions, TAA seeks to enhance overall portfolio returns. This strategy aims to allocate more funds to asset classes or sectors expected to perform well in the short term, potentially boosting returns.

4. Flexibility and adaptability

TAA provides flexibility in responding to changing economic and market environments. Investors can adjust their asset allocations based on their views of market trends, economic indicators, or global events, allowing for a more adaptable investment strategy.

5. Profit from market inefficiencies

TAA allows investors to exploit market inefficiencies or mispricings. For example, if certain sectors are temporarily undervalued or overvalued due to market sentiment or short-term factors, TAA provides an opportunity to take advantage of these inefficiencies.

6. Active management opportunities

TAA is for investors who prefer an active management approach. It allows for ongoing monitoring of economic indicators, market trends, and other factors, giving investors the chance to make informed decisions and adjust their portfolios accordingly. trying to beat the market.

7. Customization for economic views

Investors with specific views on the economic outlook can use TAA to tailor their portfolios accordingly. For instance, if an investor believes that certain sectors will outperform in the short term due to economic trends, TAA provides the means to allocate more funds to those sectors.

Conclusion

That being said, tactical asset allocation is something you can do if you have a view on a specific industry in the future. It isn’t something that’s easy to do and isn’t recommended for beginners. It’s much easier to do when the portfolio has bonds, gold, or assets that don’t move in the same way as stocks.

Once more, this is an active way of managing a portfolio where investors aim to outperform the market and achieve better returns. If you’re thinking about doing tactical allocation, it’s important to have good knowledge about the assets you’re investing in. because for normal people it is extremely hard to beat the market.