Trading in financial markets is a high-stakes endeavor where traders seek to maximize profits while minimizing losses. However, human psychology often complicates this pursuit, and one of the most prevalent cognitive biases affecting traders is loss aversion bias.

Loss aversion bias refers to the tendency of individuals to strongly prefer avoiding losses over acquiring equivalent gains. This bias can significantly influence decision-making processes, leading to suboptimal outcomes.

In this article, we delve into loss aversion bias in trading, its effects on behavior, and strategies to mitigate its impact.

What is Loss Aversion?

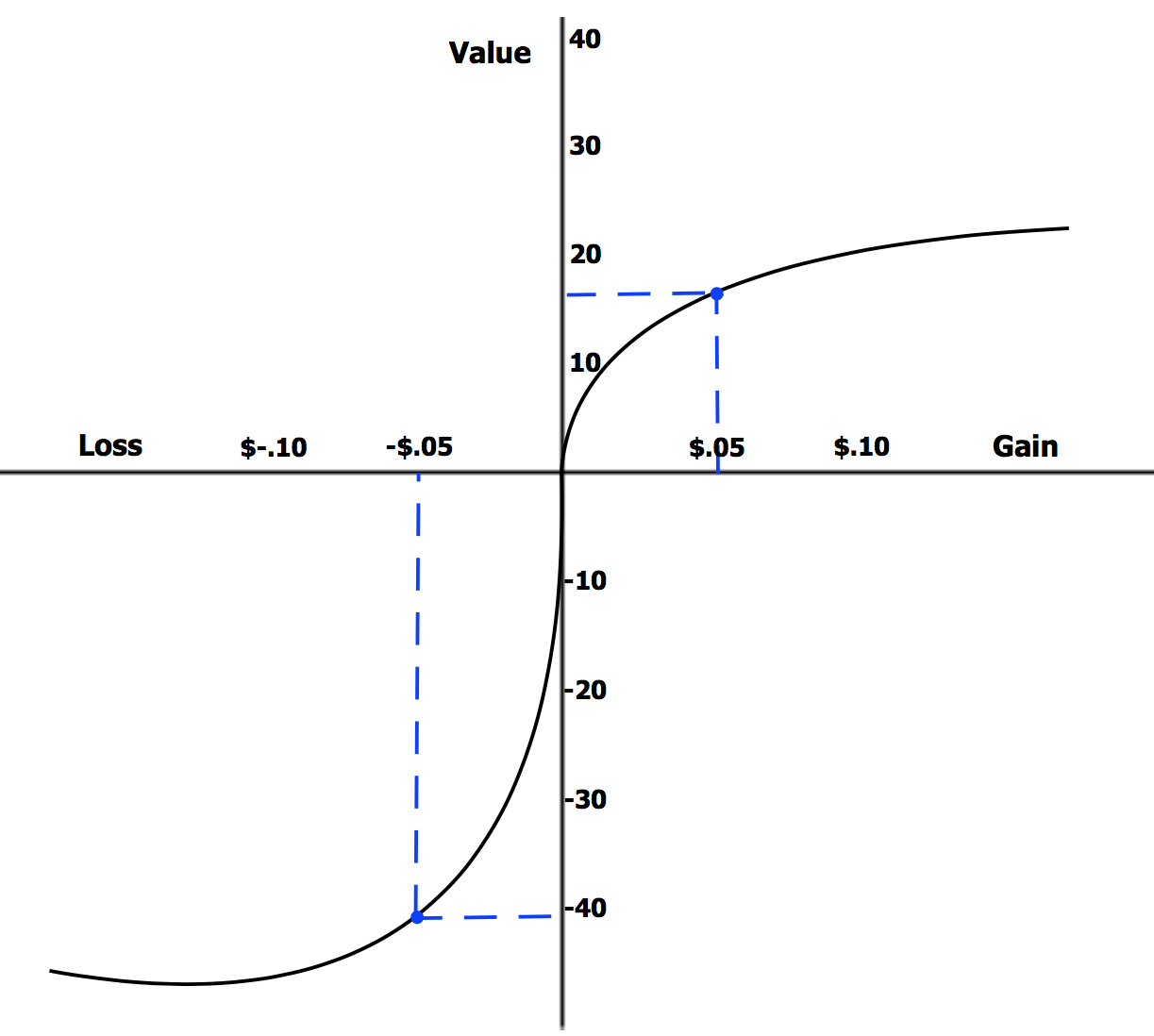

Loss aversion bias is rooted in prospect theory, proposed by psychologists Daniel Kahneman and Amos Tversky. According to this theory, individuals weigh potential losses more heavily than equivalent gains, leading to risk-averse behavior in situations involving potential losses.

The negative impact is approximately twice as big as the positive impact.

In trading, this bias manifests when traders hold onto losing positions for too long, hoping to avoid realizing a loss, even when it’s clear that doing so may lead to further losses.

Example:

Let’s try a game.

Heads or Tails for $10,000. Would you play with me? You might say No.

Because there’s an equal chance of winning or losing, and the amounts are the same, it’s like a zero-sum game.

But you might feel much worse about losing $10,000 than you would about winning the same amount.

So, we don’t see gains and losses the same way; losing $10,000 feels a lot worse than gaining the same amount.

In Decision Theory, this is called Loss Aversion, where people prefer avoiding losses over getting the same amount in gains.

It’s better to not lose $10 than to find $10.

These biases are well known and studied a lot in economics and decision theory, so they’re really important.

We’re moving beyond the simple idea of greed and fear that many trading courses teach because there are specific biases that we can identify and change.

Research about Loss Aversion

A research team endeavored to provide evidence supporting the existence of loss aversion, demonstrating that we indeed perceive losses as significantly more unfavorable than equivalent gains.

Their realization was that loss aversion is consistently dependent on a reference point, always influenced by one’s current circumstances or position.

Their approach involved selecting a group of individuals and informing them that they currently held a job where their level of interaction with others was somewhat isolated, and their commuting time averaged around 10 minutes.

Now, they presented two distinct options for new job choices to the participants.

JOB A entails a degree of limited interaction with others (superior to the current job), yet it necessitates a commute time of 20 minutes.

On the other hand, JOB B offers a moderately social environment (better than the current job and JOB A), but it requires a long commute time of 60 minutes.

It is highly probable that you would prefer JOB A, just like the majority of individuals in the group.

However, this outcome does not provide conclusive evidence. Therefore, to further investigate, they introduced a different reference point, shifting from the current job as the reference point that participants were using to make their choice.

Imagine a scenario where your current job is not isolated, but rather highly social, with an 80-minute commute time.

Now, given this new perspective, which job offer would you choose?

In both scenarios, you would be sacrificing contact with people, but in terms of commute time, you would be gaining (reducing your commute time).

What they discovered was that people preferred JOB B. In other words, they were inclined to transition from an environment with high social interaction and an 80-minute commute time to a setting that offered social interaction with a 60-minute commute time.

They were unwilling to opt for something that involved extremely limited contact with people.

Despite the fact that both jobs involved the same type of work, people still made a distinct choice based on where they started or reference point. The question is, why?

Essentially, their decision was influenced by their focus on what they stood to lose. The determining factor for their job choice was primarily based on the specific aspect they perceived as a loss.

In the initial scenario where the current job was an isolated environment with a 10-minute commute time, their decision-making process for choosing JOB A did not revolve around the potential for improved social interaction. Instead, their primary concern was the loss of commute time. Because in both Jobs they were losing on commute time.

Their intention was to minimize their losses, leading them to opt for the job where they would experience the least amount of loss.

The significance of what is lost outweighs the significance of what is gained.

When the scene shifted to a highly social environment with an 80-minute commute time, their focus was not on the reduction of commute time from 80 minutes to 20 minutes. Surprisingly, they disregarded the commute time altogether and instead prioritized the level of contact with people, as that was the aspect they perceived as a loss in both job options.

Their preference leaned towards transitioning from a highly social environment to a moderately social one, rather than opting for a limited social setting.

Therefore, their decision-making process was primarily influenced by the aspects they perceived as losses.

That is why heartbreaks cause more pain than the joy of finding love.😂

Here is the Research Papers if you like to read them.

How Loss Aversion Affects Trading?

Reluctance to Cut Losses: Traders may hesitate to cut their losses by selling losing positions, clinging to the hope that the market will reverse course and their investments will eventually turn profitable. This reluctance can lead to significant losses as losses accumulate over time.

Overemphasis on Past Performance: Investors may be overly influenced by past losses, allowing them to dictate future decisions. This can result in missed opportunities as traders avoid certain assets or strategies due to past negative experiences.

Ignoring Rational Risk-Reward Ratios: Loss-averse traders may disproportionately focus on avoiding losses rather than maximizing gains, leading them to disregard rational risk-reward ratios. This can result in taking overly conservative positions that limit potential profits.

Emotional Decision-Making: Loss aversion bias often triggers emotional responses such as fear and anxiety, which can cloud judgment and lead to impulsive decision-making. Emotional trading can exacerbate losses and undermine long-term investment strategies.

Example:

You own 1000 shares in a company that you bought when the price was at its highest. Now, the price is dropping. I suggest you sell the shares to lower your risk, but you might hesitate because you hope the price will bounce back or for other reasons. If I then propose buying another 1000 shares, you’re likely to say no.

But why? Didn’t you just say it wasn’t a good position to be in?

The thing is, there’s a constant fear of losing or taking on more risk than you can handle. You dread the worst-case scenario and the regret that comes with it. You’re so uncomfortable just thinking about it that you try to avoid it altogether.

Now, let’s say you bought a stock at $10, it went up to $20, then dropped back down to $15.

If you invested $10,000, you made $10,000 when the price hit $20. But when it drops to $15, your profit is only $5,000. You’re still making money in both cases.

But when you decide to sell at $15 and take that $5,000 profit, you feel kinda bummed. Why? Because you’re thinking about that $20 mark where the stock was. You see it as losing $5,000, even though you still made $5,000.

Sometimes, people hold onto their profits because they can’t bear the thought of not selling at the highest point. It’s like the pain of not selling at the peak is worse than the joy of making gains.

It’s important to know that losses seem bigger and feel worse than gains of the same amount. It’s just how our brains work. If you let these emotions guide your trading, you might not make the best decisions because you’re not thinking logically.

Plus, wins might not feel as good as they should, which can lead to making risky trades to make up for past losses.

And that’s a big problem when it comes to managing risk and deciding when to cut your losses.

Strategies to Mitigate Loss Aversion Bias

Setting Clear Risk Management Guidelines: Establishing predefined risk management rules, such as stop-loss orders, helps traders limit potential losses and prevent emotional decision-making.

Diversification: Diversifying investment portfolios across different asset classes and sectors can help spread risk and reduce the impact of individual losses.

Focus on Long-Term Goals: Emphasizing long-term investment objectives can help traders avoid making impulsive decisions based on short-term fluctuations in the market.

Utilizing Technology and Automation: Leveraging trading algorithms and automation tools can help remove emotional biases from decision-making processes and execute trades based on predefined criteria.

Continuous Education and Self-Awareness: Traders should strive to educate themselves about cognitive biases such as loss aversion and remain vigilant in identifying and correcting biased decision-making.

So, to wrap it up, a straightforward way to steer clear of loss aversion bias when trading is sticking to a clear trading plan. By doing this, you’re just acting like a robot, making trades exactly when your strategy says to. It’s the most reliable and tested way to avoid any biases in trading. Plus, it’s the only way to truly succeed in trading.

Conclusion

Loss aversion bias is a big problem for traders. It messes with how they make decisions and can lead to not-so-great results. But if traders understand why this bias happens and use strategies to deal with it, they can do better in the financial markets. Being aware, disciplined, and making smart decisions are key to doing well in trading despite these tricky biases.