Hello, and welcome to xlearn’s daily price action forex forecast for day traders. If this is your first time here, I recommend reading our guide on how to use our market analysis article before diving into this one.

By following these articles, you can learn how to read prices and perform price action trading.

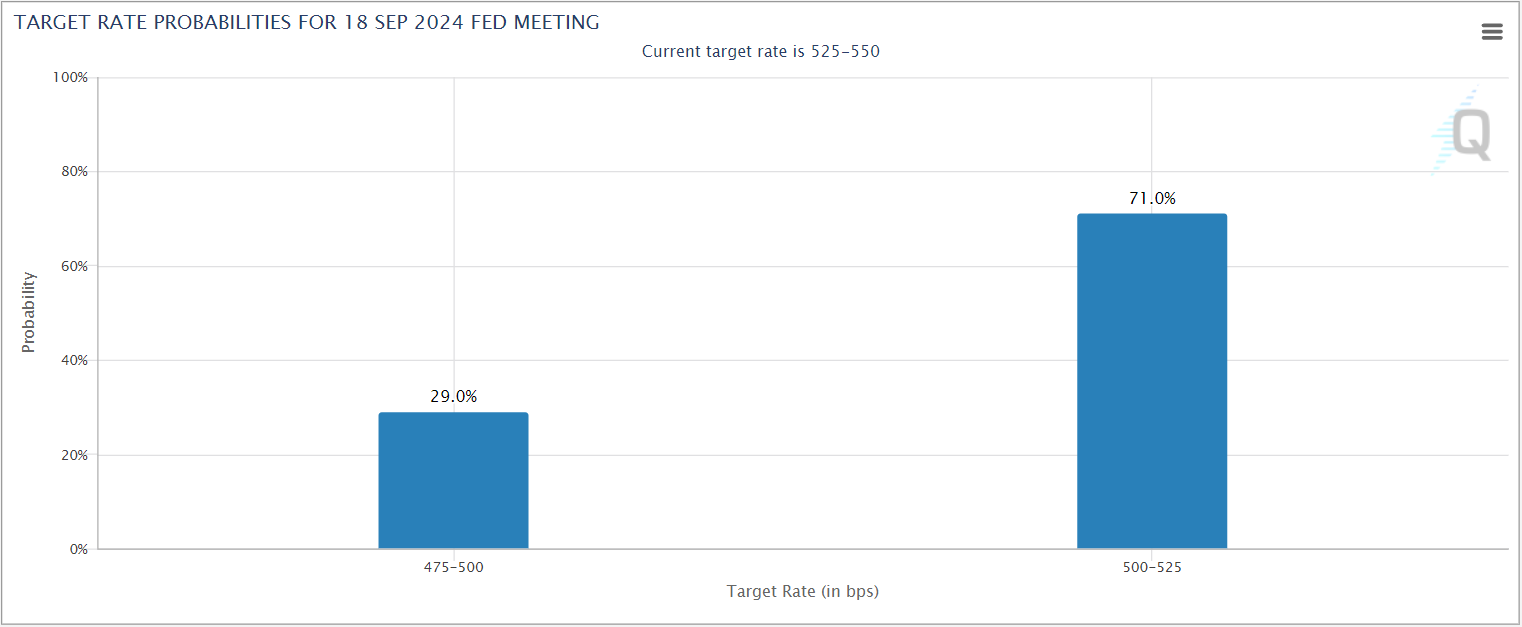

As we begin the second week of September, this week’s focus is on inflation. The US CPI data is coming out, and it could give us clues about potential rate cuts. The markets are already pricing in expectations for these cuts based on the CPI data. This week will be heavily influenced by fundamental factors, so stay alert. Right now, there’s a 71% probability of a 0.25% rate cut and a 29% chance of a 0.50% cut. These probabilities could shift depending on the upcoming CPI report, and the market will react accordingly. Keep in mind that both this week and next will be driven by fundamentals, with the CPI and FOMC meetings approaching.

Before we get into the analysis, let’s quickly review the major economic events that could impact the market.

Key Economic Events for This Week

These events encompass important global news, macroeconomic reports, and economic indicators. For more details, you can check the forex factory.

2024.09.09

- There are no major events that could affect the forex market on this day.

2024.09.10

- 2:00 ET: The UK will release the Claimant Count Change, which shows how many people claimed unemployment-related benefits in the previous month. The previous figure was 135.0K, and the forecast is 95.5K. If the actual number is lower than the forecast, it is positive for the currency. While this is considered a lagging indicator, it gives important insights into the overall economic health, as consumer spending is closely tied to labor market conditions. Unemployment is also a key factor in setting the country’s monetary policy. This can be a volatile event for GBP currency pairs.

- 8:10 ET: BOC Gov Macklem is set to speak at the Canada-United Kingdom Chamber of Commerce in London. If his tone is more hawkish than expected, it’s good for the currency. As the head of the central bank, which manages short-term interest rates, he has more influence over the value of Canada’s currency than anyone else. Traders pay close attention to his speeches because he may give hints about future monetary policy. His speeches can sometimes cause volatility as traders try to interpret possible interest rate changes. so this will affect CAD pairs.

2024.09.11

- 2:00 ET: The UK will release the GDP m/m, which shows the change in the total value of all goods and services produced by the economy. The previous figure was 0.0%, and the forecast is 0.2%. If the actual figure is higher than the forecast, it’s good for the currency. GDP is the broadest measure of economic activity and the main indicator of the economy’s health.

- 8:30 ET: The US will release the CPI y/y, which shows the change in the prices of goods and services bought by consumers, also known as inflation. The previous figure was 2.9%, and the forecast is 2.6%. If the actual number is higher than the forecast, it’s good for the currency. Consumer prices make up most of overall inflation. Inflation is key to currency value because rising prices often push the central bank to raise interest rates to control it. This is a highly volatile event for USD pairs.

2024.09.12

- 8:15 ET: The EURO will release its Main Refinancing Rate, which is the interest rate on the main operations that provide most of the liquidity to the banking system. The previous rate was 4.25%, and the forecast is 3.65%. If the actual rate is higher than the forecast, it’s good for the currency. This rate decision is usually priced into the market, so the ECB Press Conference, held 45 minutes later, often gets more attention. Short-term interest rates are the most important factor in currency value, as traders use other indicators to predict future rate changes. The rate is decided by 6 members of the ECB Executive Board and 15 rotating governors from Euro area central banks. The vote split is not publicly shared. This is a highly volatile event for EUR pairs.

- 8:30 ET: The US will release the PPI m/m, which shows the change in the price of finished goods and services sold by producers. Both the previous and forecast figures are 0.1%. If the actual figure is higher than the forecast, it’s good for the currency. PPI is a leading indicator of consumer inflation because when producers charge more, those costs are typically passed on to consumers. This can have some impact on USD pairs.

- 8:45 ET: The EUR ECB Press Conference will take place, led by the ECB President and Vice President. It’s scheduled 8 times a year, about 45 minutes after the Minimum Bid Rate is announced. If the tone is more hawkish than expected, it’s good for the currency. The conference lasts about an hour and has two parts: a prepared statement followed by press questions. These unscripted answers can cause significant market volatility. The press conference is webcasted on the ECB website, slightly delayed from real-time. It’s the main way the ECB communicates with investors about monetary policy, explaining the factors behind recent interest rate decisions, the economic outlook, and inflation. It also gives important clues about future policy. This will impact EUR pairs.

2024.09.13

- There are no major events that could affect the forex market on this day.

Price Action Forex Forecast

EURUSD:

![EURUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/EURUSD_2024-09-10_00-01-05_5b445.png)

![EURUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/EURUSD_2024-09-10_00-02-11_116a7.png)

EURUSD is in an overall uptrend but is currently pulling back from the resistance level of 1.12000 and is near the support at 1.10270. If the price breaks below the support line, a downtrend could start, and the price may drop toward 1.07800. On the other hand, if the price bounces up from the 1.10270 support level and breaks above 1.10600, we can expect it to head back towards 1.12000.

USDCAD:

![USDCAD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/USDCAD_2024-09-10_00-12-37_4aad1.png)

![USDCAD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/USDCAD_2024-09-10_00-13-46_3cb1f.png)

USDCAD is in an overall downtrend, but the price is currently pulling back up from the support level at 1.34400. Right now, the price is consolidating around the resistance level of 1.35650, with a smaller resistance at 1.35800. If the price breaks above this resistance, it may head towards 1.36000, and if that level is also broken, we could see the start of an uptrend with the price continuing to rise. On the other hand, if the price drops from the 1.35800 resistance and breaks below the support around 1.35250, we can expect the price to keep falling towards 1.34600, and if that level is also broken, then down to 1.34400.

USDJPY:

![USDJPY Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/USDJPY_2024-09-10_00-15-11_c9b62.png)

![USDJPY Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/USDJPY_2024-09-10_00-15-47_e3ac1.png)

USDJPY is trending down, with the price currently consolidating above the support level at 141.600. There’s a small resistance around 144.000. If the price breaks above this resistance, it could rise to the 147.000 level, and if that level is also broken, it may start an uptrend, continuing towards the 149.450 range. On the other hand, if the price breaks below the 141.600 support level, it could drop to the 140.250 support level, and if that level is also broken, the price may continue to fall further.

USDCHF:

![USDCHF Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/USDCHF_2024-09-10_00-16-57_f9c88.png)

![USDCHF Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/USDCHF_2024-09-10_00-17-54_b1a46.png)

USDCHF is also trending down, with the price currently pulling back up from the support at 0.84000. The price is now at a resistance level of 0.85000. If the price breaks above this resistance, we can expect it to rise to 0.85400, and if that level is also broken, it could start an uptrend, continuing toward 0.87500. On the other hand, the price could reverse from the 0.85000 resistance and start dropping back toward 0.84000.

GBPUSD:

![GBPUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/GBPUSD_2024-09-10_00-18-35_23ed8.png)

![GBPUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/GBPUSD_2024-09-10_00-19-48_208aa.png)

GBPUSD is trending up, with the price pulling back from the resistance level at 1.32700 and now nearing the support around 1.30400. We can expect the price to drop to this support and possibly reverse, starting to move back up. Alternatively, the price could break below the support and continue dropping. So, watch for both a potential reversal or a breakout around the 1.30400 range.

AUDUSD:

![AUDUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/AUDUSD_2024-09-10_00-20-28_4bc62.png)

![AUDUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/AUDUSD_2024-09-10_00-21-04_a1fd5.png)

AUDUSD is trending down, with the price having broken below the support level at 0.67000 and now consolidating. We can expect the price to drop further towards the 0.65500 range, where it may either pull back or break through. However, if the price starts to move back up and breaks above the 0.67000 resistance again, we can expect a correction, with the price likely heading towards 0.68250.

NZDUSD:

![NZDUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/NZDUSD_2024-09-10_00-22-00_49438.png)

![NZDUSD Price Action Forex Forecast [2024.09.09]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/09/NZDUSD_2024-09-10_00-22-41_5f7b9.png)

NZDUSD is pulling back from the resistance at 0.63000 and may be entering a downtrend. We can expect the price to continue dropping toward 0.58500, but corrections are likely along the way, especially near key round numbers. Pullbacks are a normal part of maintaining a healthy trend.

Conclusion & Disclaimer

Subscribe to our Telegram channel to get instant updates on new articles.

Please provide your feedback on how we can improve this article. Thank you!

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!