Hello, and welcome to xlearn’s price action forex forecast for day traders. If this is your first time here, I recommend reading our guide on how to use our market analysis article before diving into this one.

By reading these articles, you can learn how to interpret prices and engage in price action trading.

We are entering an important week in September, as this week kicks off the interest rate cuts for the US. Additionally, key GDP and unemployment data from various countries will be released, making it a crucial time for the markets. Since the rate cut is already priced in, we might see unexpected market volatility when the data comes out. However, because this is the first rate cut, it will still have a significant impact on the markets, so be prepared.

Now, before we get into the analysis, let’s quickly review the major economic events that could impact the market.

Key Economic Events This Week

These events encompass important global news, macroeconomic reports, and economic indicators. For more details, you can check the forex factory.

2024.09.16

- There are no major events that could affect the forex market on this day.

2024.09.17

- 8:30 ET: Canada will release its CPI m/m report, showing the change in prices of goods and services bought by consumers. The previous figure was 0.4%, with a forecast of 0.0%. If the actual figure is higher than the forecast, it’s positive for the currency. This report is the most important inflation indicator because of its early release and wide coverage. Unlike many others, this data is not seasonally adjusted, as it reflects the most commonly reported calculation. Consumer prices are a key driver of overall inflation, which can influence central bank decisions on interest rates. This will have an impact on CAD pairs.

- 8:30 ET: The US Retail Sales m/m report will be released, showing the change in the total value of sales at the retail level. The previous figure was 1.0%, with a forecast of -0.2%. If the actual figure is higher than the forecast, it’s positive for the currency. This is the earliest and broadest measure of crucial consumer spending data, serving as the primary indicator of consumer spending, which makes up the majority of overall economic activity. This report will impact USD pairs.

2024.09.18

- 2:00 ET: The UK will release its CPI y/y report, showing the change in the price of goods and services bought by consumers. Both the previous and forecast figures are 2.2%. If the actual figure is higher than the forecast, it’s positive for the currency. This is the UK’s most important inflation data because it’s used as the central bank’s inflation target. Consumer prices make up the majority of overall inflation, and inflation affects currency value since rising prices may lead the central bank to raise interest rates to control inflation. This will impact GBP pairs.

- 14:00 ET: The Federal Funds Rate will be released alongside the FOMC Statement. This is the interest rate at which banks lend balances held at the Federal Reserve to other banks overnight. The previous rate is 5.50%, with a forecast of 5.25%. If the actual rate is higher than the forecast, it’s good for the currency. While the rate decision is usually expected by the market, the FOMC Statement is more important as it focuses on future guidance. Short-term interest rates are the most important factor in currency valuation, as traders use other indicators to predict future rate changes. This will have a significant impact on USD pairs and the overall forex market.

- 14:30 ET: The FOMC Press Conference will be held by the Federal Reserve Chairman. A more hawkish tone than expected is good for the currency. The press conference lasts about an hour and has two parts: first, a prepared statement is read, then the floor is open to press questions. The unscripted answers during the Q&A often lead to high market volatility. The conference is streamed live on the Fed’s YouTube channel. This is one of the main ways the Fed communicates with investors about monetary policy, explaining the reasons behind recent interest rate and policy decisions. It also discusses economic conditions like growth and inflation, giving hints about future policies. This will impact USD pairs.

- 18:45 ET: New Zealand will release its GDP q/q report, showing the change in the inflation-adjusted value of all goods and services produced by the economy. The previous figure was 0.2%, and the forecast is -0.4%. If the actual figure is higher than the forecast, it’s good for the currency. This report is the broadest measure of economic activity and the key indicator of the economy’s health. It will have an impact on NZD pairs.

- 21:30 ET: Australia will release its Unemployment Rate, which measures the percentage of the total workforce that is unemployed and actively looking for work in the previous month. Both the previous and forecast figures are 4.2%. If the actual rate is lower than the forecast, it’s positive for the currency. Although this is considered a lagging indicator, the number of unemployed people is an important sign of the economy’s health, as consumer spending is closely linked to job conditions. This will have a slight impact on AUD pairs.

2024.09.19

- 7:00 ET: The UK will release the Official Bank Rate along with the Monetary Policy Statement. This is the interest rate at which the Bank of England (BOE) lends to financial institutions overnight. Both the previous and forecast rates are 5%. If the actual rate is higher than the forecast, it’s good for the currency. While the rate decision is usually expected by the market, the Monetary Policy Summary gets more attention as it focuses on future guidance. Short-term interest rates are the most important factor in currency valuation, as traders use other indicators mainly to predict future rate changes. This will have a significant impact on GBP pairs.

- The Bank of Japan will release its policy rate, which is the interest rate applied to excess current account balances held at the BOJ. Both the previous and forecast rates are <0.25%. If the actual rate is higher than the forecast, it’s good for the currency. The exact release time is not provided, so the event is marked as ‘Tentative’ until the rate is announced. This rate is the BOJ’s main operating target. Short-term interest rates are the key factor in currency valuation, as traders focus on them to predict future rate changes. This will have a major impact on JPY pairs.

2024.09.20

- 2:00 ET: The UK will release its Retail Sales m/m report, showing the change in the total value of inflation-adjusted retail sales. The previous figure was 0.5%, and the forecast is 0.3%. If the actual number is higher than the forecast, it’s good for the currency. This report is a key measure of consumer spending, which makes up a large part of overall economic activity. It will have some impact on GBP pairs.

- 8:15 ET: BOC Governor Macklem Speaks at the National Bureau of Economic Research Economics of Artificial Intelligence Conference in Toronto. A more hawkish tone than expected is good for the currency. As the head of the central bank, which controls short-term interest rates, he has the most influence over the nation’s currency value. Traders closely watch his speeches for any subtle hints about future monetary policy. This could have some impact on CAD pairs.

- 8:30 ET: Canada will release its Retail Sales m/m report, showing the change in the total value of sales at the retail level. The previous figure was -0.3%, and the forecast is 0.5%. If the actual number is higher than the forecast, it’s good for the currency. This report is a key measure of consumer spending, which makes up a large part of overall economic activity. It will have some impact on CAD pairs.

Price Action Forex Forecast

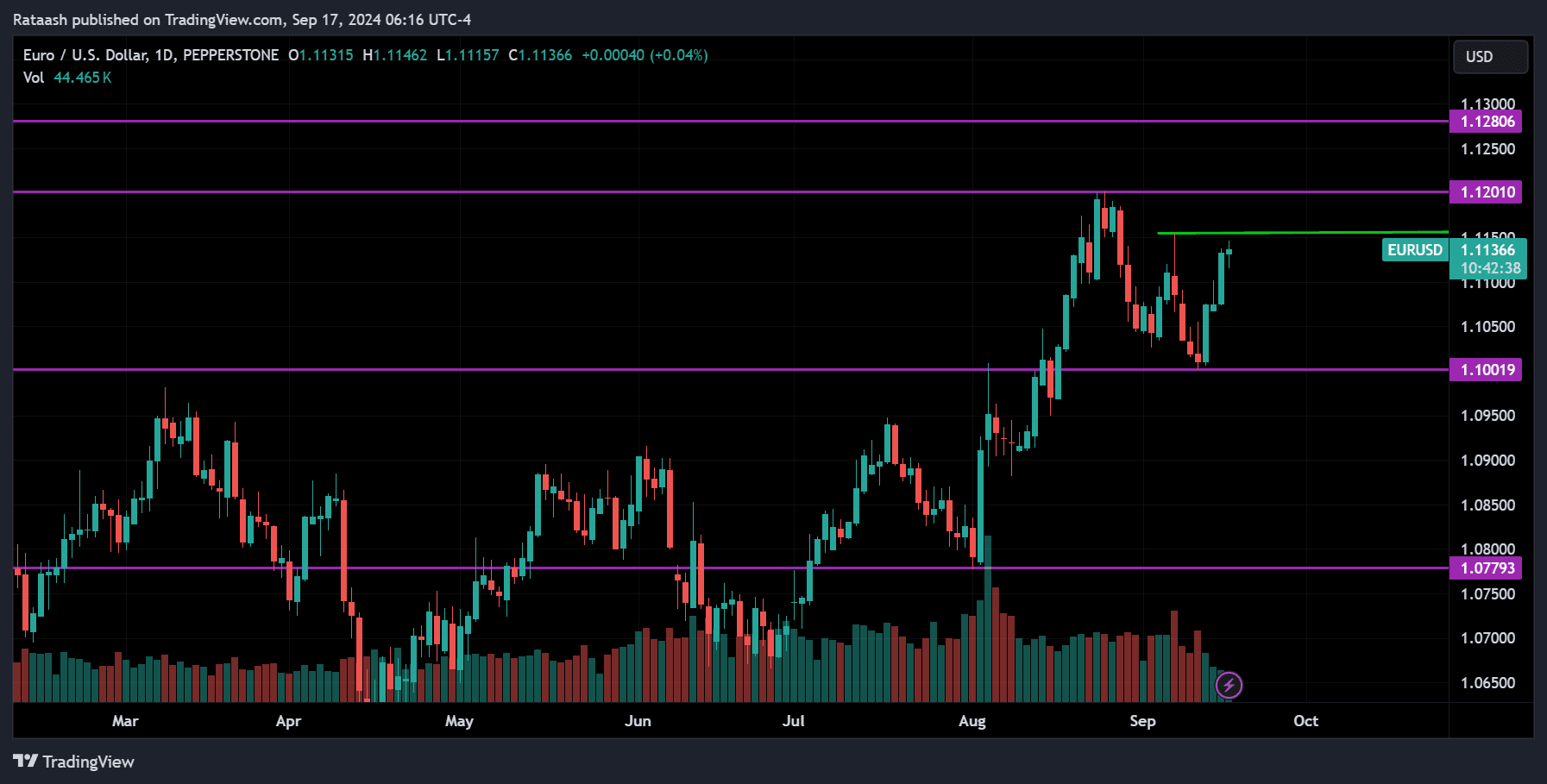

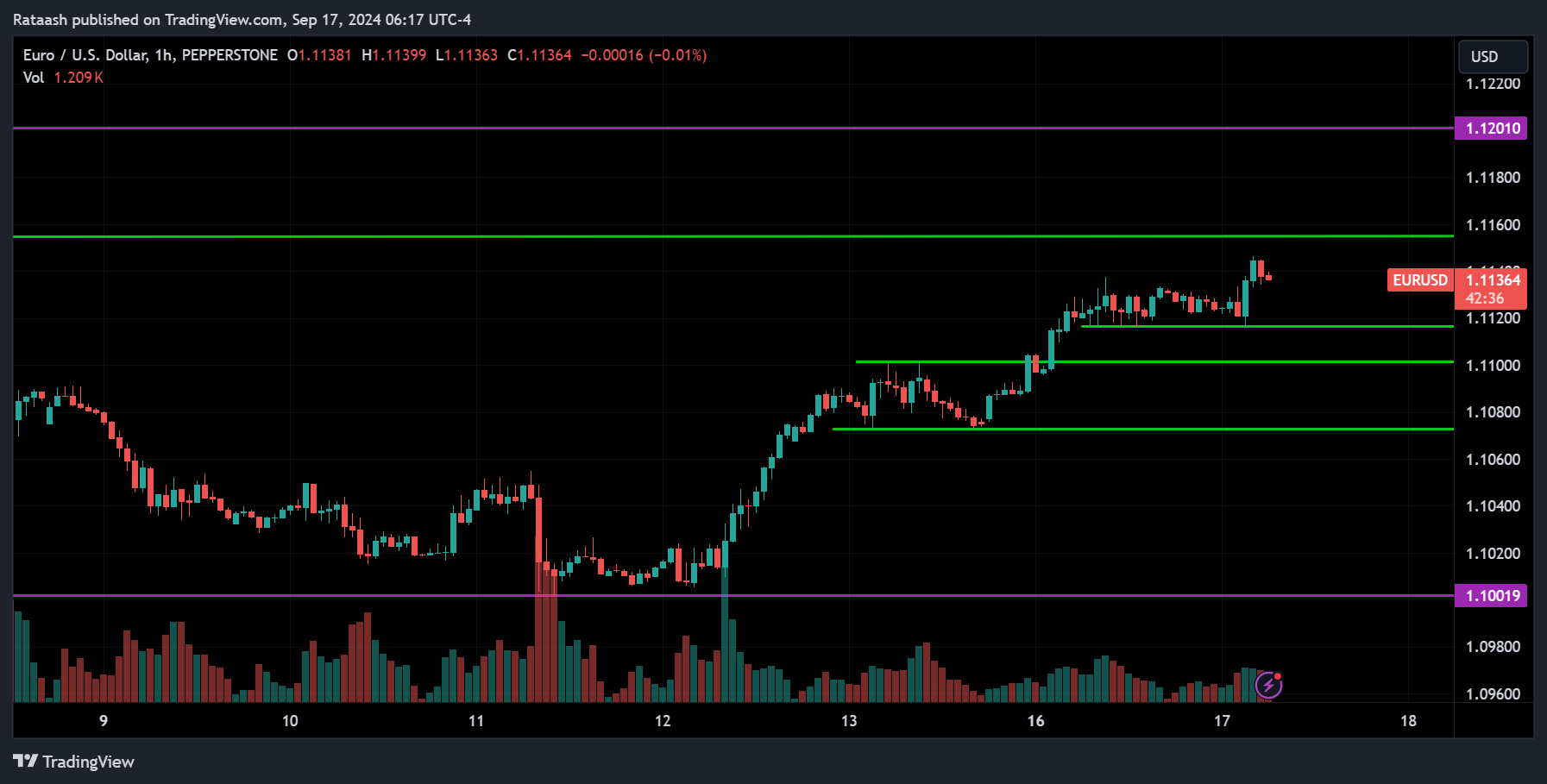

EURUSD:

EURUSD is overall trending up. The price recently experienced a correction from the 1.12000 resistance down to the 1.10000 support, and now it’s starting to move back up. There is a resistance around 1.11600, and if the price breaks above this level, we can expect it to reach 1.12000 again and either pull back or break through and continue upward. On the other hand, if the price pulls back and breaks below the 1.10800 support, we could see it drop further toward 1.10000.

USDCAD:

USDCAD is overall trending down. It pulled back from the 1.34500 support and is now at the 1.36000 resistance. Looking at the 1-hour chart, the price is consolidating. If the downtrend has ended, we might see the price break above the 1.36250 resistance and start a new uptrend. However, if this is just a correction and the downtrend continues, we can expect the price to break below the 1.35700 support and drop toward 1.35500. If that level is also broken, the price could keep falling.

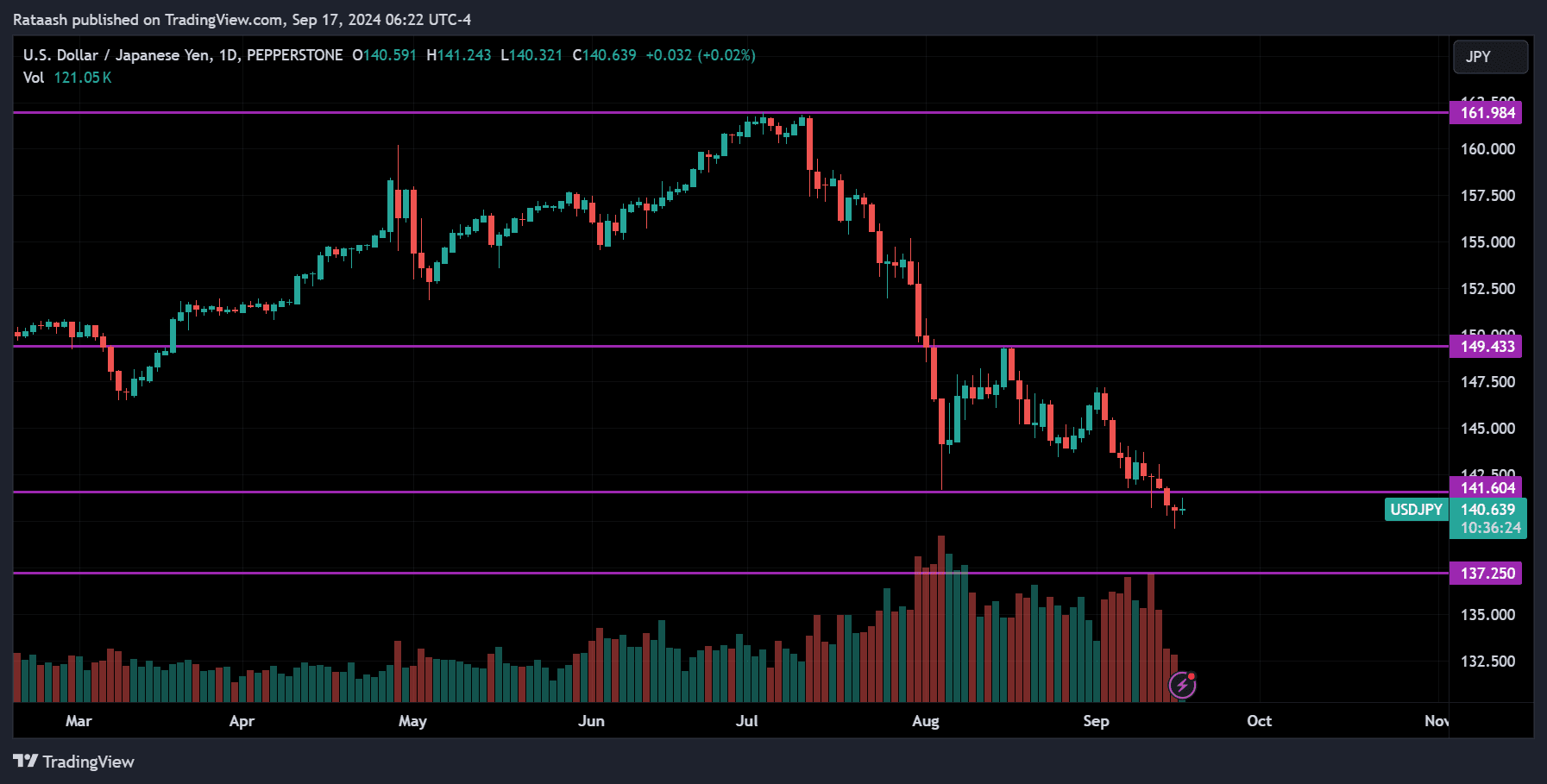

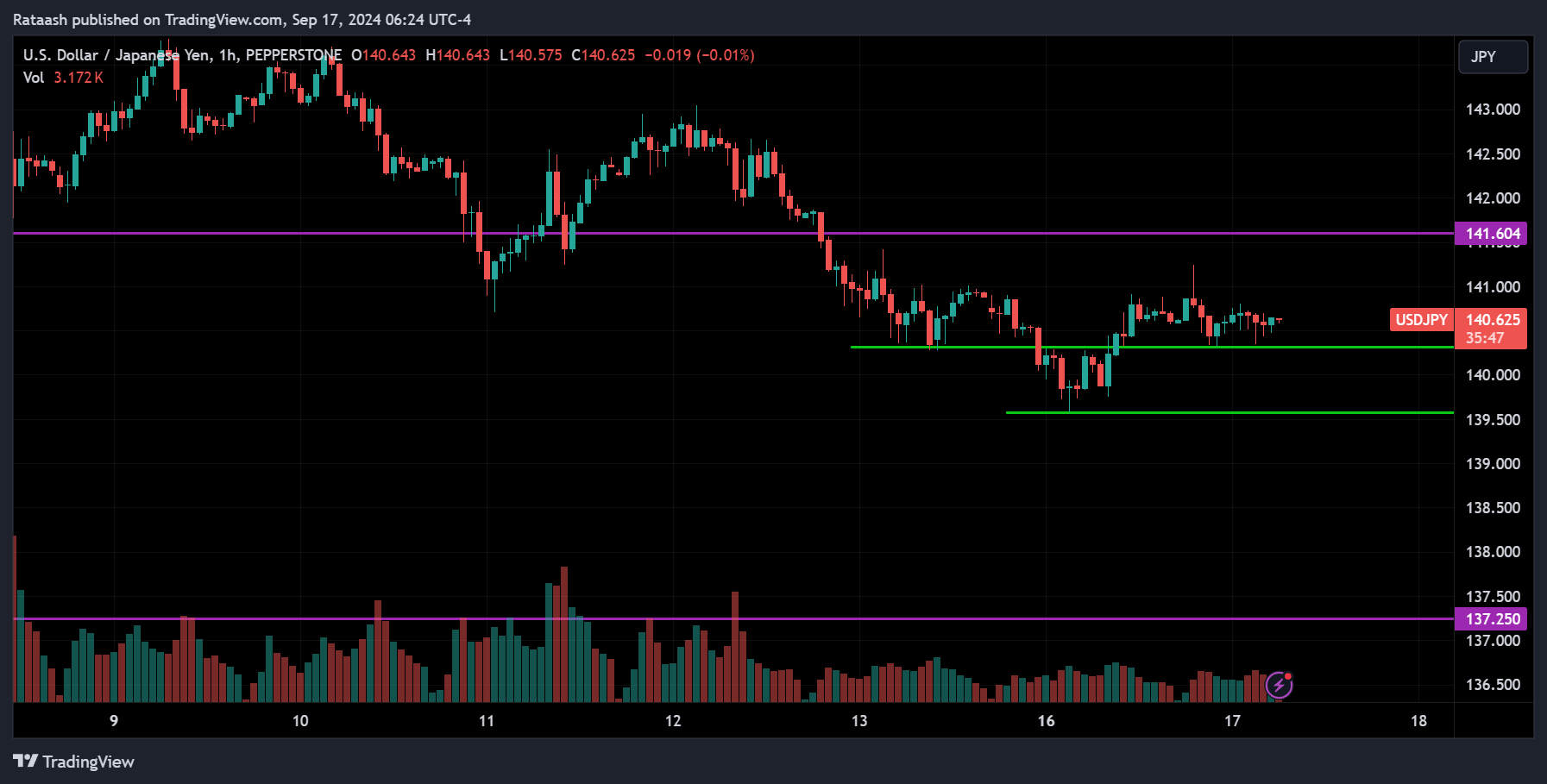

USDJPY:

USDJPY is overall trending down, with the next major support around 137.250. Currently, the price is moving sideways near the 139.500 support, with resistance around 141.600. If the downtrend continues, we can expect the price to break below 139.500 and keep dropping toward the 137.250 range. On the other hand, if the price breaks above the 141.600 resistance, we could see a new uptrend or correction start, with the price moving toward 145, 147.500, and possibly the 150 range.

USDCHF:

USDCHF is overall trending down, with the price consolidating around the major 0.84000 support. Looking at the 1-hour chart, you can see the price trending down and getting close to this support. If the price breaks below 0.84000, we can expect it to continue dropping toward the 0.83300 range. On the other hand, if the price starts to rise and breaks above 0.84500, we can expect it to move toward the 0.85400 range.

GBPUSD:

GBPUSD is overall trending up, and the price is approaching the major 1.32700 resistance. If the price breaks above this level, we can expect it to continue rising. However, if the price pulls back from this resistance, it could drop back toward 1.30450. Looking at the 1-hour chart, there’s a small green support line. If the price breaks below this support, it could head down to 1.30450.

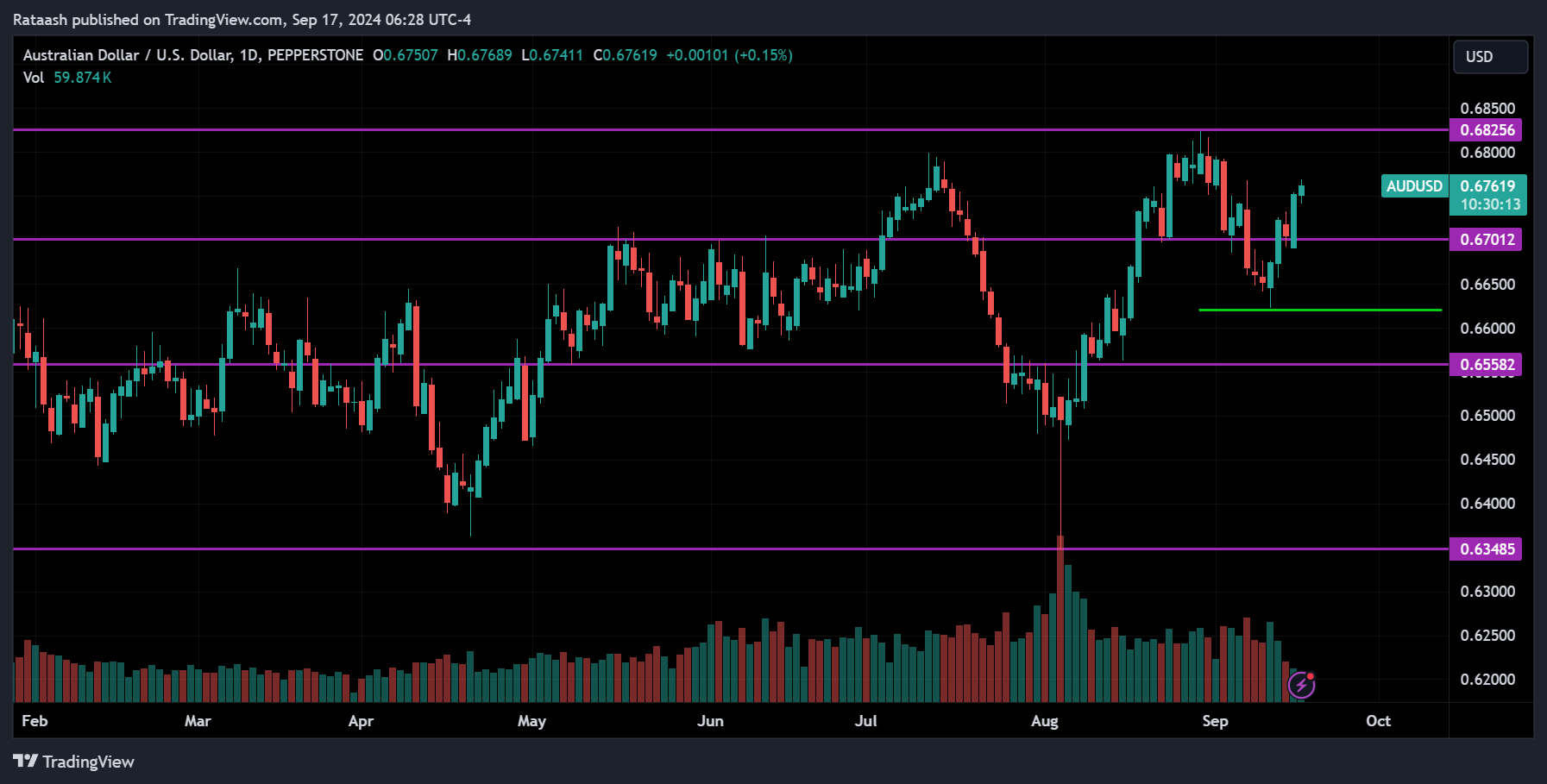

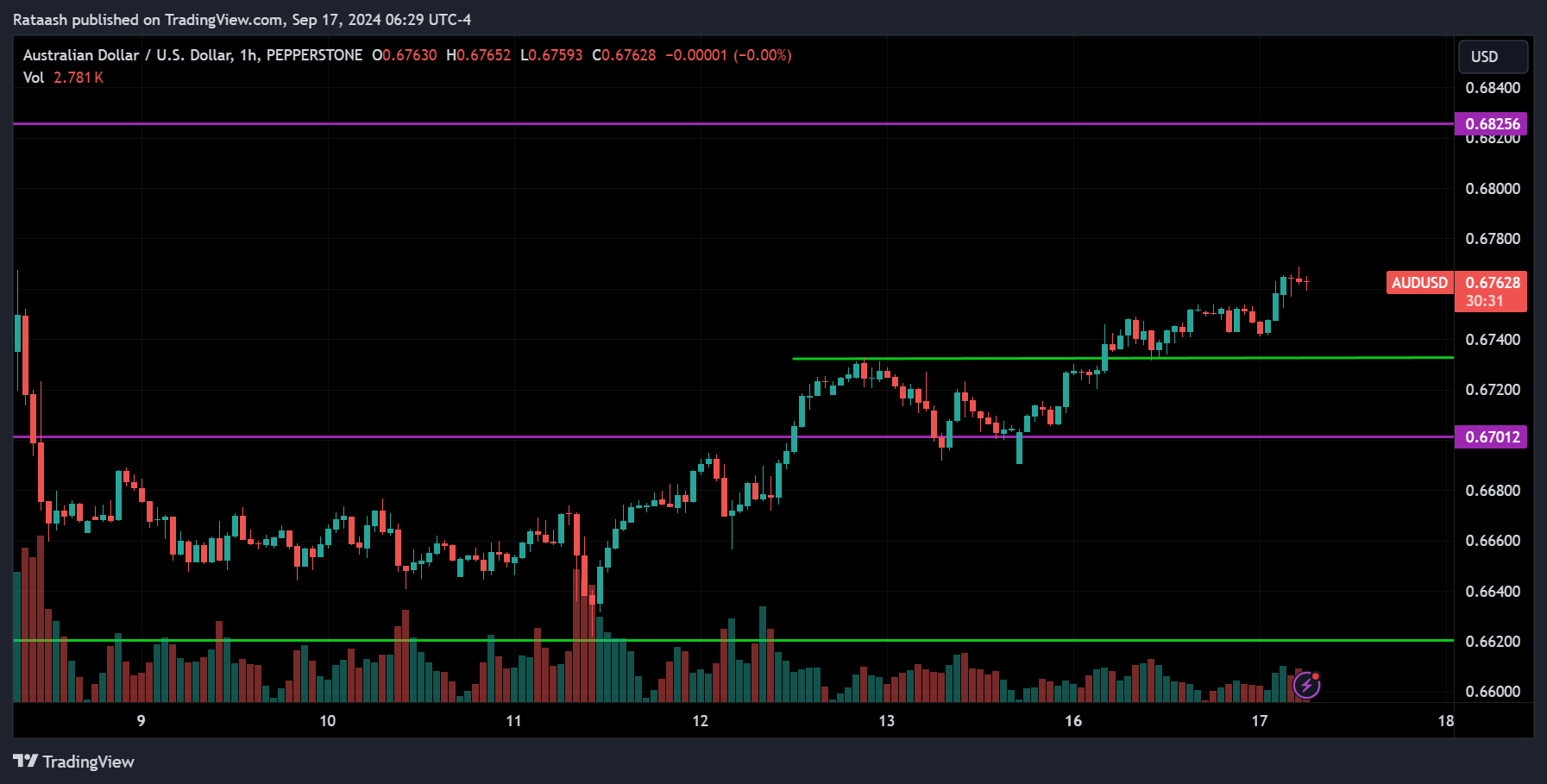

AUDUSD:

AUDUSD is also trending up, and the price is nearing the 0.68250 resistance. We might see the price reach this level and then pull back for a correction. However, if the price breaks above this resistance, it could continue to rise. On the 1-hour chart, there is a small support around 0.67400. If the price breaks below this level, it could drop to 0.67000, and if that level is also broken, the price could fall further toward 0.66200.

NZDUSD:

NZDUSD is trending up but recently pulled back from the 0.63000 resistance. Now it’s starting to rise again from the 0.61000 support. We can expect the price to continue moving up toward the 0.63000 range, but if it breaks below the 0.61800 support, the price may drop to 0.61600. If that level is broken, it could fall back toward 0.61000, and if this level breaks too, we could see the price start a downtrend toward 0.58500.

Conclusion & Disclaimer

Subscribe to our Telegram channel to get instant updates on new articles.

Please provide your feedback on how we can improve this article. Thank you!

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!