![US Stock Market Today [2024.07.18]: Technology Sector Crashing? - Key Stocks to Watch Today NFLX, PGR, TSM

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/Stock-Market-Analysis-7.png)

Hi, welcome to our US stock market today article series.

We will use a top-down approach in our analysis. First, we will analyze the overall market, focusing on the S&P 500. Then, we will analyze each sector one by one for their price action performance so we can trade stocks in those sectors with confidence. Finally, we will look at some stocks to watch today.

Economic Events Today

These events include important news that could impact the stock market, macroeconomic reports, and economic indicators. For more details, you can check the bloomberg calendar & yahoo finance.

There are no major events that could affect the market today.

Stocks with Earnings:

| BEFORE MARKET OPEN | AFTER MARKET CLOSE |

|---|---|

| TSM | NFLX |

| NVS | ISRG |

| ABT | PPG |

| BX | WAL |

| MMC | GBCI |

| INFY | AIR |

| CTAS | INDB |

| DHI | MRTN |

| MTB | OCFC |

| NOK | SCHL |

| TXT | KARO |

| DPZ | MCB |

| KEY | SPFI |

| SNA | RGP |

| CBSH | PINE |

| HXL | SBFG |

| ALK | |

| MAN | |

| TCBI | |

| WNS | |

| BKU | |

| VIRT | |

| OFG | |

| FOR | |

| STBA | |

| BHLB | |

| IIIN |

S&P 500

![S&P 500 Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/SPY-D-6.png)

![S&P 500 Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/SPY-H-6.png)

Looking at the S&P 500 ETF, it’s still in an uptrend but has recently pulled back to a support level around 556. If the price drops below this support, it might fall even more. However, since the overall trend is bullish, the price could also start rising from this level. Keep an eye out for both breakout and reversal signals to confirm the trend.

![S&P 500 Heatmap Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/heatmap-5.jpg)

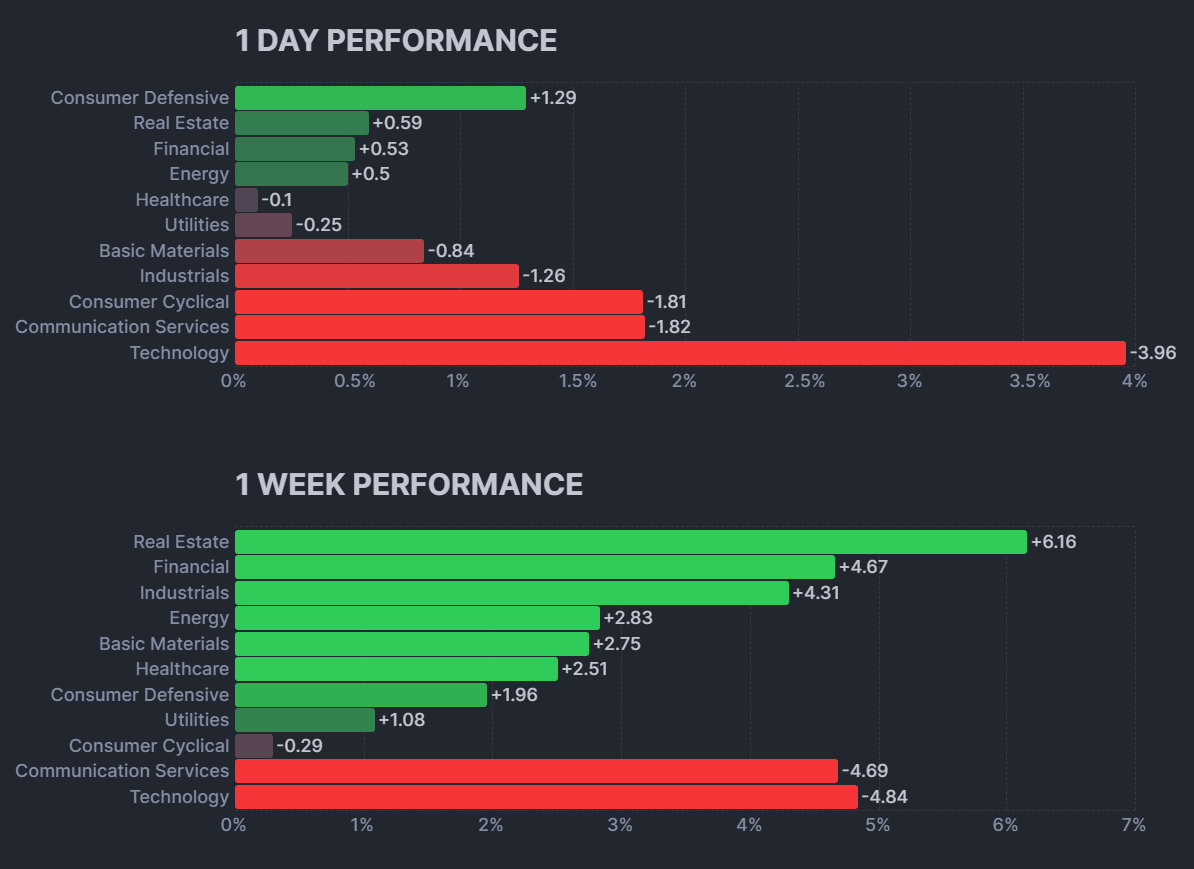

Looking at the heatmap from yesterday, the technology and communication sectors took a big hit, while the financial sector performed well. Major well-known stocks are down. Let’s check the actual sector performance for yesterday before diving into the price action analysis for each sector.

Consumer Staples Sector(XLP):

![XLP Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLP-D-6.png)

![XLP Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLP-H-7.png)

Looking at the Consumer Staples sector, it broke above resistance after being in a consolidation phase for a while, which means it should be in an uptrend now. We might see a pullback to the resistance level before continuing the trend, or it could keep going without pulling back. Watch for the price breaking below this level.

Energy Sector(XLE):

![XLE Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLE-D-6.png)

![XLE Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLE-H-6.png)

Looking at the energy sector, it was trending down but has now broken above resistance and is continuing upward. We might see a pullback around the resistance level shown on the 1-hour chart. If the price breaks above that level, we can expect the upward momentum to continue.

Materials Sector(XLB):

![XLB Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLB-D-6.png)

![XLB Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLB-H-6.png)

The Materials sector seems to be consolidating, but there’s upward momentum in the medium term. Right now, the price is at a resistance level. If it breaks above this level, we can expect it to move to the next resistance. However, there’s also a chance the price could pull back for a correction.

Industrial Sector(XLI):

![XLI Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLI-D-6.png)

![XLI Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLI-H-6.png)

Looking at the Industrials sector, it was consolidating for a while but has now broken above resistance, which means it’s in an uptrend. The resistance now acts as support. The price is currently pulling back to this support level. Once it retests, it could rebound and continue its upward momentum. Watch for the price breaking below this level.

Consumer Discretionary Sector(XLY):

![XLY Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLY-D-6.png)

![XLY Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLY-H-6.png)

Looking at the Consumer Discretionary sector, it’s trending up. Right now, it has pulled back and may start going up from its current level. Watch for the price breaking below the support line shown on the chart.

Healthcare Sector(XLV):

![XLV Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLV-D-6.png)

![XLV Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLV-H-6.png)

Looking at the Healthcare sector, it broke out of its consolidation phase and is now in an uptrend. The price is at an all-time high level. We might see a pullback around this level, or the price could continue to rise.

Financials Sector(XLF):

![XLF Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLF-D-6.png)

![XLF Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLF-H-6.png)

Looking at the Financial sector, it broke above major resistance and is now at an all-time high. We can expect this momentum to continue, but be ready for some corrections along the way.

Technology Sector(XLK):

![XLK Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLK-D-6.png)

![XLK Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLK-H-6.png)

Looking at the Technology sector, it opened with a gap down from the previous high levels and is now nearing a support level. We can expect the price to start going up from here. If the price breaks below this level, it might continue to drop.

Communications Sector(XLC):

![XLC Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLC-D-6.png)

![XLC Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLC-H-6.png)

The same story applies to the Communication sector. It opened with a gap down and is now at a support level. We can expect the price to start going up from here, or it could break below this level and continue dropping. Watch for a breakout.

Utility Sector(XLU):

![XLU Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLU-D-6.png)

![XLU Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLU-H-6.png)

Looking at the Utilities sector, after a correction, the price has started going back up. Right now, it’s around a resistance level. The price could continue rising from here, or it might drop to the previous support and then start going back up.

Real Estate Sector(XLRE):

![XLRE Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLRE-D-7.png)

![XLRE Analysis Today [2024.07.18]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLRE-H-7.png)

Looking at the Real Estate sector, after a long consolidation phase, it finally broke above resistance and is now in an uptrend. We can expect the price to keep rising, but watch for the price breaking below the resistance again.

Stocks to Watch Today

TSM

TSM reported positive earnings today. Despite the technology sector crashing, this stock still looks promising because it’s in the semiconductor industry, which is like petroleum now. After the market opens, if the price trades above this support level, we can expect it to go up. If it breaks below the support, we can expect a correction.

NFLX

Netflix is reporting earnings after the market closes today and is currently trading at a support level, making it a stock to watch.

PGR

After a long consolidation phase, PGR, a financial insurance stock, has broken above the resistance level, signaling an uptrend. If the upward momentum continues after the market opens, we can expect the price to keep rising. Watch for the price breaking below this level again.

Conclusion & Disclaimer

Please provide your feedback on how we can improve this article. Thank you!

We discussed these sectors and markets because when the entire market or sector goes through certain movements, most of the stocks within that market will also experience similar movements. So, by understanding what the market is doing, you can conduct your own analysis on specific stocks.

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!