If you’re diving into stock trading, there’s a term you’ll want to get familiar with: stock splits. In this article, we’ll break down what stock splits are all about in simple terms, giving you the lowdown you need to trade stocks with ease and confidence.

What is Stock Split?

A stock split is a corporate action undertaken by a publicly traded company to increase the number of its outstanding shares while simultaneously reducing the share price.

This process does not alter the overall market capitalization of the company. Instead, it divides each existing share into multiple shares, thereby increasing liquidity and accessibility for investors.

Types of Stock Splits

Stock splits come in different forms, primarily distinguished by the ratio at which existing shares are divided. The two most common types are:

Forward Stock Split:

In a forward stock split, a company increases its outstanding shares by dividing each existing share into multiple shares.

For example, in a 2-for-1 stock split, each shareholder receives two shares for every share they previously owned. The total value of the shares remains the same, but the number of shares outstanding doubles, effectively halving the share price.

Reverse Stock Split:

Conversely, a reverse stock split consolidates existing shares, reducing their number while increasing the share price.

For example, in a 1-for-5 reverse split, every five shares are merged into one, resulting in fewer outstanding shares with a proportionally higher price.

Reverse splits are often implemented by companies trading at low prices to maintain compliance with exchange listing requirements or to enhance their perceived value.

Motivations Behind Stock Splits

Price Adjustment: Stock splits are often initiated to adjust the share price to a more desirable range, making the stock more affordable for retail investors. By reducing the nominal price per share, companies aim to enhance liquidity and broaden investor participation.

Psychological Impact: Lowering the share price through a stock split can have a psychological effect on investors, potentially attracting new buyers who perceive the lower price as an opportunity for investment. Additionally, a lower share price may enhance the stock’s liquidity, as smaller investors can purchase more shares with the same amount of capital.

Market Perception: Stock splits are sometimes viewed as a positive signal by investors, signaling confidence and growth prospects from the company’s management. Although a stock split does not inherently change the fundamental value of the company, it can create a perception of optimism and momentum in the market.

Example:

Companies think that if their shares cost too much, people might not want to buy them, even though this idea might not make sense when you just look at the numbers. But this idea is still important because it affects how people feel about the stock, and lots of studies have shown this.

For example, let’s say you own a stock that starts at $10, but over time, its price goes way up to $200 per share. At this point, the company might think the stock is too pricey, which could scare off potential buyers.

To fix this, the company might decide to make the stock cheaper by doing a stock split. Imagine they have one million shares worth $200 each. After the split, each share becomes two shares, so now there are two million shares, each worth $100. Even though the number of shares and their price change, the total value of your investment stays the same. So, if you had one share worth $200 before, after the split, you’d have two shares, each worth $100, which adds up to the same total value.

Companies believe there’s an ideal price range, usually around $35, where investors like the stock. This range makes the company seem neither too cheap, which might suggest it’s not doing well, nor too expensive, which could push buyers away.

But it’s important to know there’s no one perfect price for a stock. Many studies have looked at what happens to companies after they do stock splits and how many people want to buy their shares afterward. They’ve found that stock splits don’t really change how well a company does.

So, companies don’t really have to do stock splits. But even so, lots of them still think it’s important to keep their stock prices in certain ranges and do stock splits when the prices get too high.

The most common way for companies to do stock splits is by splitting them into two shares. But sometimes, companies choose different split ratios, like 1 to 3, 1 to 4, or whatever works best for them.

What is Reverse Stock Split?

A reverse stock split, also called a stock consolidation or reverse split, works the opposite way of a regular split (forward split). In a reverse stock split, a company reduces the number of its shares by combining multiple shares into one. This makes the price of each share go up without changing the total value of the company.

Imagine a company’s stock price has dropped a lot and is now very low, like 10 cents. The company might not like this and decide to do a reverse split.

For example, if a company has 1 million shares at 10 cents each, they might want to increase the price to $1 by doing a reverse split of 10 to 1. This means that for every 10 shares you have, they’ll become 1 share. So, the total number of shares goes down to one hundred thousand, but the company’s value stays the same.

After the reverse split, if you had 100 shares at 10 cents each, you’d now have 10 shares at $1 each. Even though you have fewer shares, your investment is still worth the same.

In short, a reverse stock split is used to raise the stock price and lower the number of shares when a company’s stock price has dropped a lot. This is usually to avoid trading at really low prices and to follow the rules of stock exchanges.

Many stock exchanges need companies to keep their stock price above a certain level to stay listed. If a company’s stock stays below that level for too long, it might get removed from the exchange. To avoid this, companies might do a reverse split to raise the stock price and meet the exchange’s rules.

Also, lots of mutual funds have their own rules about the lowest price they’ll invest in, often not buying stocks below a certain price, like $5.

Usually, a company announces a stock split before it happens. If you have any orders open, it’s a good idea to take care of them yourself instead of just trusting your broker to do it all.

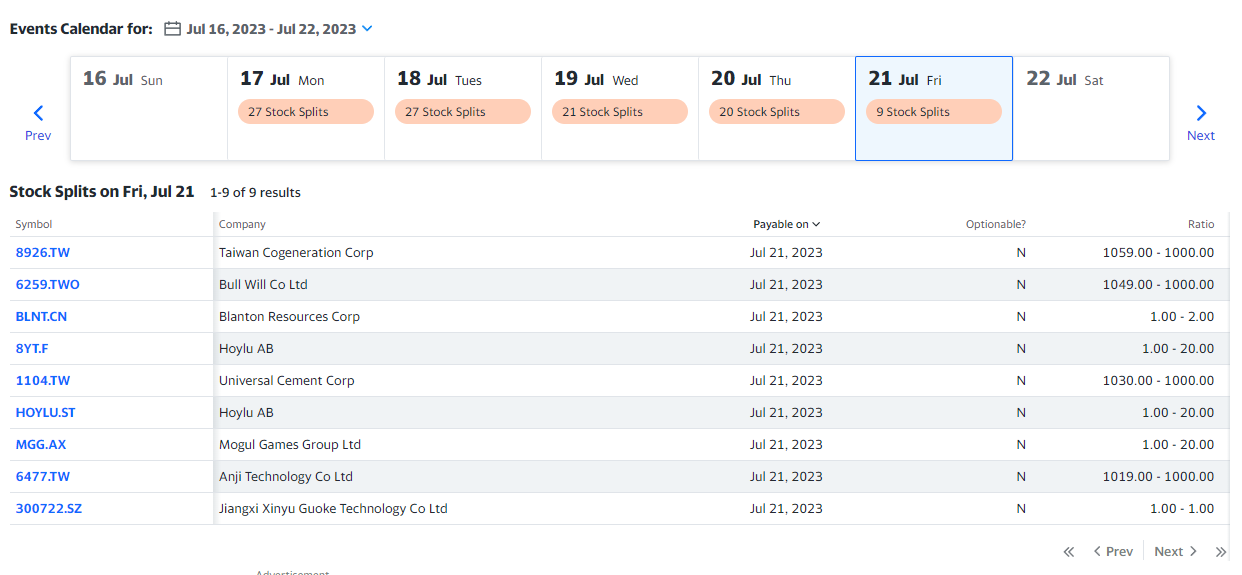

Yahoo Finance provides a calendar specifically for tracking stock splits.

Conclusion

In conclusion, stock splits represent a fundamental corporate action undertaken by publicly traded companies to adjust their share structure and price. Whether aimed at increasing accessibility for investors or signaling confidence in future growth, stock splits can influence market dynamics and investor sentiment. By understanding the motivations behind stock splits and their implications for investors, individuals can make informed decisions in navigating the ever-evolving landscape of the financial markets.