In the previous article, we talked about the trading plan for the gap trading strategy and briefly discussed our stock selection. In this article, we are going to delve a bit deeper and learn how to find stocks for gap trading.

What is Gap Trading?

Gap trading is a trading approach that involves exploiting price gaps between a security’s previous closing price and its opening price, aiming to profit from the rapid price movement that often occurs following such gaps.

In the previous discussion, we concluded that not all stocks fill their gaps; the gaps that do fill are the ones caused by an imbalance in supply and demand at a specific point. So, how do we find stocks that are gapped and have the potential to fill? Let’s delve into that.

How to Find Stocks for Gap Trading?

Sectors and Industries:

Firstly, not all sectors are suitable for this type of trading. This means that any sectors prone to sudden price surges should be avoided. For instance, mining companies might discover new copper or gold deposits at any time, causing prices to soar. Similarly, healthcare companies could unveil new medications or face FDA approval decisions, leading to abrupt price shifts.

Such rapid movements aren’t ideal for gap trading strategies. As we mentioned before, the gap should result from an imbalance between buyers and sellers for it to be filled. Therefore, when searching for stocks, it’s crucial to steer clear of healthcare and mining companies.

However, you can consider other sectors for this strategy. Keep in mind that technology companies can also introduce new products or technologies, potentially causing sudden price fluctuations. The key takeaway here is to avoid stocks with the potential for sudden price movements when selecting for this strategy.

Stock Price:

Next, let’s consider the stock price. You want to choose stocks priced over $1. Let me explain why.

For instance, sometimes a stock valued at $0.10 opens at $0.11, which is a 10% gap. But do you really want to enter such a trade for just a 1 cent movement? Low-value stocks could surge and maintain that direction. In other words, low-value stocks often don’t fill their gaps, and even if they do, it happens too quickly. You won’t have enough time to capitalize on it.

So, always look for stocks priced at more than $1.

Stock Liquidity:

You don’t want to trade a stock that others aren’t trading. Because if you really need to get out due to bad news that just came out, you might not be able to. And even if you can, it could be at a really bad price. Illiquid stocks are really tough to get your order filled at a good price. You might have to wait too long, and by that time, the stock may have moved. So, always make sure that the stock you’re trading has enough volume.

How can you tell if a stock is liquid or illiquid? In US markets, stocks with an average volume over 50k are considered “okay”, and a volume over 100k means it’s a liquid stock. So, always look for stocks with over 50k volume, and if possible, try to find ones with over 100k volume.

Gap Range:

You also want stocks that are gapping within a specific range. What does that mean? For example, if you have a stock that closed at $10 and the next day it opened at $10.02, do you want to enter that position for just 2 cents? No, right? In order for you to take a position, it has to be worthwhile.

In terms of historical performance, a gap between 2% to 8% tends to work better. You don’t want to get into a stock that gapped 20% because if it gapped that much, there’s probably something going on with that stock, and the gap is not due to an imbalance. Even if it does fill, it’s not likely to happen again. You want consistency.

So, what yields consistent results is a gap between 2% to 8% for shorts and -2% to -8% for long trades.

Screening Stocks for Gap Trading

What I mentioned above are some of the criteria you want to look for when finding a stock. So, how do we find stocks using these criteria? Well, we use something called a stock screener.

Best Screeners for Stock Trading

Here are a few stock screeners that you can consider for gap trading:

- Finviz: Finviz offers a simple and user-friendly interface with various filters, including price gaps, volume, and market capitalization.

- TradingView: TradingView provides advanced charting tools along with a screener that allows you to filter stocks based on gap criteria and other technical indicators.

- StockFetcher: StockFetcher is another powerful tool that lets you create custom stock screens based on specific criteria, including price gaps and volume.

- Yahoo Finance: Yahoo Finance offers a basic stock screener that allows you to filter stocks based on price gaps, volume, and other fundamental and technical parameters.

- Thinkorswim: Thinkorswim, offered by TD Ameritrade, provides a comprehensive platform with advanced charting and screening capabilities, ideal for more experienced traders.

These screeners offer various features and customization options, so you can choose the one that best suits your trading style and preferences. but I recommend trying TradingView it’s free and powerful.

How to Customize Screener for Gap Trading?

Here’s a step-by-step guide on how to customize a stock screener for gap trading using the TradingView screener as an example:

Set Sector and Industry Filters:

- Under the “Filters” section on the left-hand side, look for options to filter sectors and industries.

- Exclude sectors prone to sudden price surges, such as healthcare and mining, by unchecking them from the list.

Apply Price Filter:

- Find the “Price” filter option.

- Set the minimum price filter to $1 or higher by entering “1” in the appropriate field.

Volume Filter:

- Locate the “Volume” filter option.

- Set the minimum average volume filter to over 50k by entering “50000” in the appropriate field.

Gap Range Filter:

- TradingView does have a specific filter for gap range in its screener.

- Look for the “Gap Up %” or “Gap Down %” filter option.

- Set the gap percentage range filter to between 2% to 8% to identify stocks with gaps within your desired range.

Review and Analyze Results:

- Once you have applied all the desired filters, click on the “Apply” button to apply them.

- Review the list of stocks that meet your criteria and analyze their potential for gap trading.

Adjust and Refine:

- If necessary, adjust the filters to further refine your search based on specific criteria or preferences.

- Experiment with different combinations of filters to find the most suitable stocks for your gap trading strategy.

Save or Export Results:

- TradingView allows you to save or export your screener results for future reference or analysis.

- Consider saving your customized screener settings for easy access to conduct gap trading scans in the future.

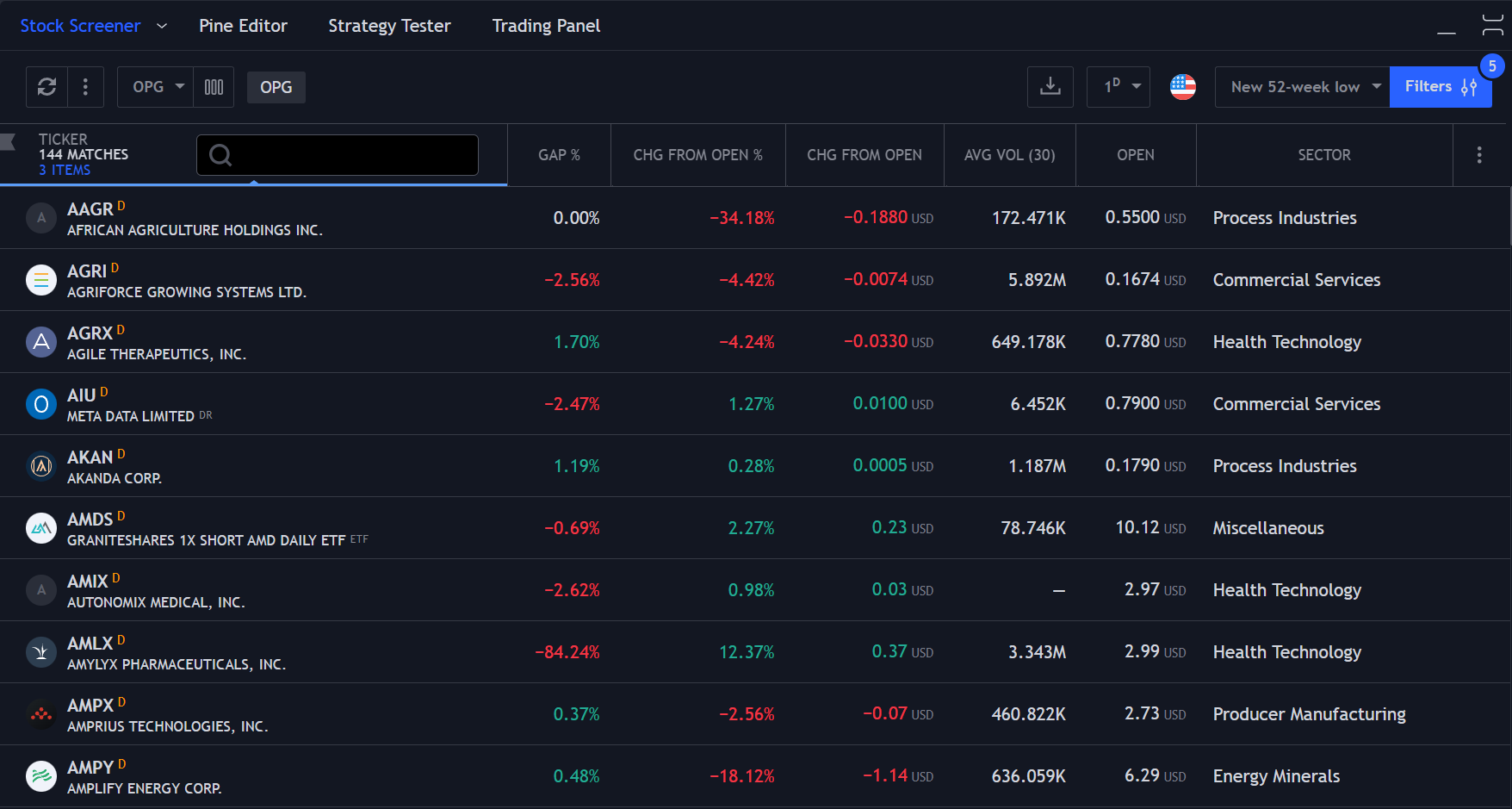

Your screener should look something like this. With this, you can quickly search for stocks that are gapped and make trades as soon as you can to capitalize on the gaps.

Conclusion

In conclusion, gap trading offers an opportunity to capitalize on price disparities between a security’s previous closing and opening prices.

We’ve explored various aspects of gap trading, from understanding its fundamentals to selecting suitable stocks and utilizing stock screeners effectively. By focusing on sectors with stable price movements, considering stock price and liquidity, and narrowing down gap ranges, traders can identify potential opportunities for profitable trades.

Utilizing stock screeners like TradingView can streamline the process, allowing traders to quickly identify gapped stocks that align with their trading strategy. With the right approach and tools at hand, traders can enhance their chances of success in the dynamic world of gap trading.