VWAP indicator is likely the most underestimated one available, and it holds tremendous value.

What is VWAP?

VWAP, which stands for Volume Weighted Average Price, is a trading indicator used in financial markets. It calculates the average price at which a particular stock or asset has been traded throughout the day, taking into consideration the trading volume at each price level.

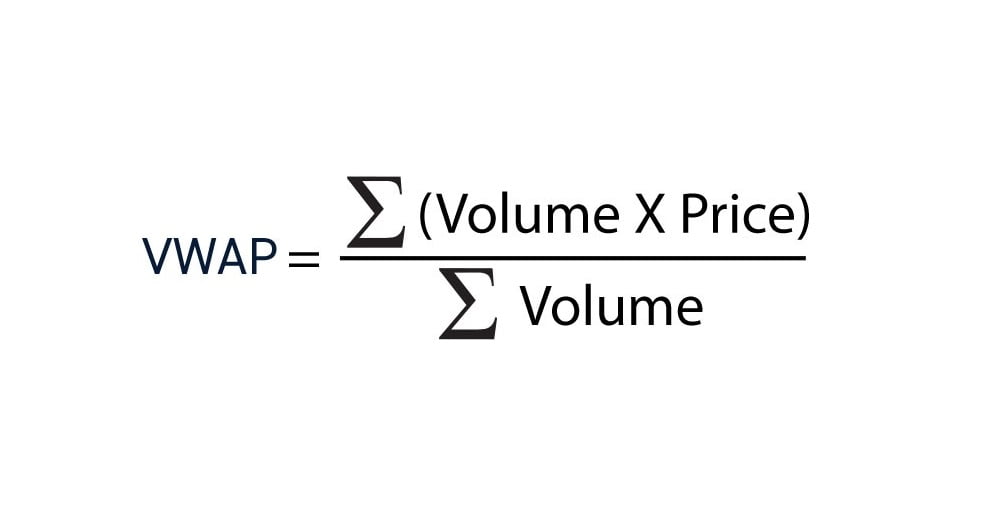

The VWAP is calculated by taking the sum of the price multiplied by the volume for each trade and dividing it by the total volume traded over a specific time period.

VWAP is mostly used in Intraday data.

The VWAP calculation takes into account both the price and volume of each trade, giving more weight to trades with higher volumes. This weighting factor helps to provide a more accurate average price based on the market activity.

The VWAP indicator is primarily used by traders and investors to assess the fair value of an asset over a given period. It provides insights into the average price paid by market participants, considering the influence of both price and volume. VWAP is often used as a benchmark for institutional traders to evaluate their trading performance and execution quality.

By comparing the current price of an asset to its VWAP, traders can gain an understanding of whether the asset is trading above or below its average value for the day. If the price is above VWAP, it may indicate strength or bullishness, while a price below VWAP could suggest weakness or bearishness.

Example:

Consider a scenario where a stock has undergone four trades. It was traded for 100 shares at a price of $10, followed by another 100 shares at $11, then 100 shares at $12, and finally, a thousand shares at $13. Now, let’s determine the average price at which the stock has been traded, accounting for the respective volumes.

100*10 + 100*11 + 100*12 + 1000*13 / 1300 = 12.53

Therefore, the Volume Weighted Average Price (VWAP) for these trades amounts to $12.5.

Volume plays a significant role in trading and holds relevance in the market.

Consider a scenario in your neighborhood where houses typically sell for $500,000. Now, imagine that one day, a single house sold for $2 million. Does this imply that all houses in the neighborhood are now valued at $2 million? Absolutely not. The high sale price of one house does not automatically dictate the value of all other houses.

However, if many houses in the neighborhood were recently sold for around $2 million each, then this information carries more validity. The larger the quantity of houses sold at similar prices, the more meaningful and relevant the data becomes. In this case, a higher quantity of sales at the $2 million mark would indicate a potential shift in the market or an upward trend in housing prices.

In trading, a similar principle applies. When a stock is traded in small quantities, such as just 100 or 200 shares, the resulting price may not hold as much significance. In contrast, a price that is determined through a high volume of shares being traded carries more meaning and relevance.

The greater the quantity of shares traded, the more meaningful the resulting price becomes in assessing market trends and determining the value of the stock.

By analyzing the Volume Weighted Average Price, you are essentially calculating an average of the prices at which a stock has been traded, considering the corresponding volumes of each trade.

Why VWAP is so Important?

As an example, let’s consider the compensation structure of institutional traders.

In this scenario, there is a portfolio manager who oversees a fund with a value of $100 million. The primary responsibility of the portfolio manager is to allocate this fund among various stocks. To assist in the decision-making process, the portfolio manager relies on a team of analysts who conduct research and select the stocks on their behalf. Additionally, there are traders whose main objective is to execute the purchase of stocks as instructed by the portfolio manager.

Suppose the portfolio manager instructs the traders to purchase 10 million shares of company XYZ. The trader’s primary responsibility is to execute the purchase of these shares. How will the trader be compensated? Will they receive payment based on the stock’s appreciation? No, because their role is solely to carry out the purchase.

While the trader does receive a base salary, they also have the opportunity to earn a bonus or performance reward based on their performance. So, how is their performance evaluated? The assessment is made by comparing the price at which the trader was able to purchase the shares with the Volume Weighted Average Price. This determines whether the trader performed well or poorly.

If the Volume Weighted Average Price of the stock is $12.50, but the trader’s average purchase price is $13, it indicates a poor price selection. The trader did not acquire the shares at a favorable price. Conversely, if the trader managed to buy the shares at $12, it signifies that they obtained a price better than the average.

In each institutional firm, it is common practice for the individual responsible for trading to closely monitor the VWAP.

Institutional traders closely monitor the VWAP because it influences their buying and selling decisions. When an institutional trader needs to purchase a stock, they may choose to buy it at a price lower than the VWAP in order to obtain a more favorable price and benefit financially. Conversely, if the stock price exceeds the VWAP, the trader might opt to wait until it returns to the VWAP level before executing the purchase.

On the other hand, when the trader intends to sell a stock and observes that it is trading below the VWAP, they are likely to avoid selling at that point as it would result in a suboptimal price, lower than the VWAP. Instead, they would prefer to sell the stock above the VWAP to secure a better price for their trade.

When someone intends to sell, their goal is to sell at the highest achievable price, while when someone intends to buy, their aim is to buy at the lowest possible price.

When the price touches the VWAP, traders tend to take advantage of the opportunity to sell at or near the VWAP, avoiding potential missed opportunities. Additionally, other institutional traders also strive to execute their trades around the VWAP. This is why the VWAP often acts as a point of resistance or support, depending on the situation. In this case, it acts as resistance.

Each time the price reaches the VWAP, it tends to bounce back due to the presence of numerous orders at that level. However, once the VWAP is broken, its role shifts, and it becomes a level of support instead of resistance.

If the price is above the VWAP, it will function as a support level, while if the price is below the VWAP, it will serve as a resistance level.

Institutional traders consistently monitor the VWAP in order to secure favorable prices, which causes the VWAP to function as both a support and resistance level. and that’s why VWAP is so important.

How to use the VWAP Indicator?

Relying blindly on the indicator across different symbols is not advisable since not all stocks have significant institutional ownership.

Therefore, it is crucial to focus on companies that possess a high level of institutional ownership when using this indicator.

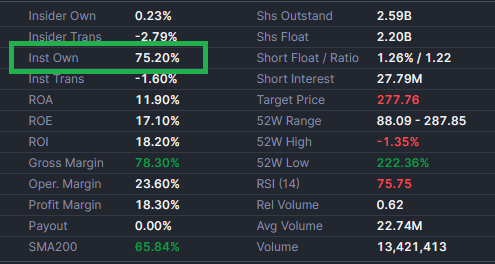

Let’s take Apple as an example and examine its institutional ownership using the finviz platform.

With an institutional ownership of 75%, Meta indicates that a significant portion, 75% to be precise, of the company’s ownership is held by institutional investors. This implies that a large number of individuals trading this stock are institutional traders who likely consider the VWAP as a crucial indicator.

Therefore, it becomes important for you to also monitor the VWAP as it can provide insights into the potential actions of these institutional traders. By observing the VWAP, you can attempt to predict and anticipate the trading behaviors of these market participants.

Conclusion

In trading, it is essential to consider what others are focusing on. so If your stock is actively traded by institutional investors, you must pay attention to the VWAP. if not VWAP is less accurate on that stock.