![US Stock Market Today [2024.07.23]: Price Action Analysis for S&P 500 Sectors and Stocks to Watch for - GM, Tesla, Coca-Cola, and UPS

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/Stock-Market-Analysis-8.png)

Hi, welcome to our US stock market today article series.

We will use a top-down approach in our analysis. First, we will analyze the overall market, focusing on the S&P 500. Then, we will analyze each sector one by one for their price action performance so we can trade stocks in those sectors with confidence. Finally, we will look at some stocks to watch today.

Economic Events Today

These events include important news that could impact the stock market, macroeconomic reports, and economic indicators. For more details, you can check the bloomberg calendar & yahoo finance.

- There aren’t any significant economic events that might impact the stock market today.

Stocks with Earnings:

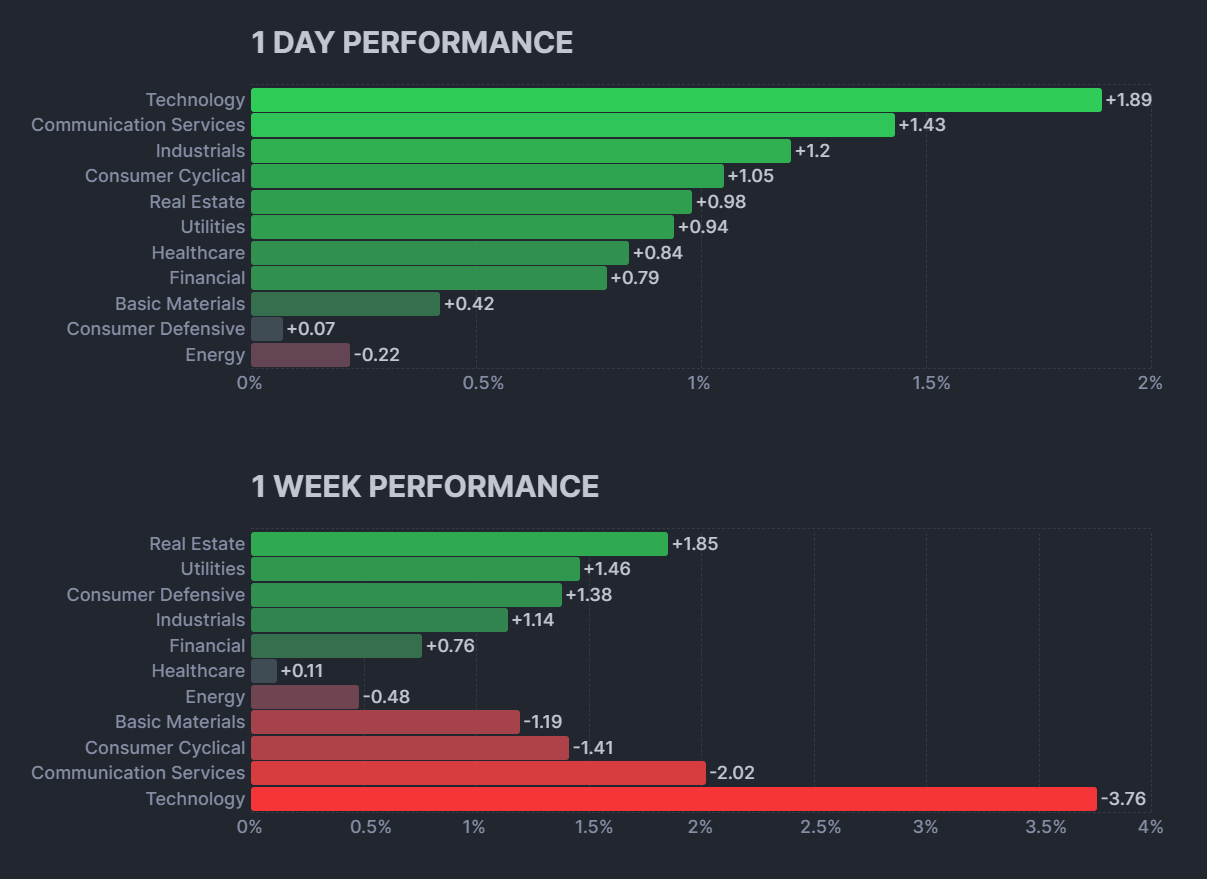

S&P 500

The S&P 500 is generally trending up. After a recent correction, it’s starting to move back up. We anticipate this upward momentum to continue since the overall trend is bullish. Just keep an eye out for prices dropping below the current low, as it could signal more downward movement.

Consumer Staples Sector(XLP):

The consumer staples sector is consolidating. It briefly broke above resistance but quickly retreated, indicating a false breakout. Currently, the price is hovering around a support level and pulling back. If the price rises and breaks above resistance again, we could see a bullish trend with higher prices. Conversely, if the price breaks below this support level, it’s likely to drop further toward the next support level.

Energy Sector(XLE):

The energy sector, after a downtrend, has begun to recover. Now, it’s pulling back from a resistance level and near a support level. If the price starts rising from this support, we may see it reach the resistance and potentially break above it. However, if the price starts to decline and breaks below the support, we could expect it to drop further toward the next support level.

Materials Sector(XLB):

The materials sector is in a consolidation phase. It’s retracing from the resistance level and currently resting on a support level. If the price breaks below this support, we could see further decline. However, there’s also a possibility that the price could rebound from this support and continue upwards, possibly even breaking above the resistance. Keep an eye out for signals of both reversal and breakout.

Industrial Sector(XLI):

The industrials sector recently broke above resistance during a consolidation phase but quickly retraced back below it. Currently, it’s trading near the resistance level again. If the price climbs above this resistance, we might see an uptrend begin. Conversely, if the price starts to fall from this resistance, we could expect it to move towards support levels.

Consumer Discretionary Sector(XLY):

The consumer discretionary sector is trending upwards. It’s currently retracting from a support level. We anticipate the price will continue to rise in the same upward trend, but be cautious of any potential break below this support.

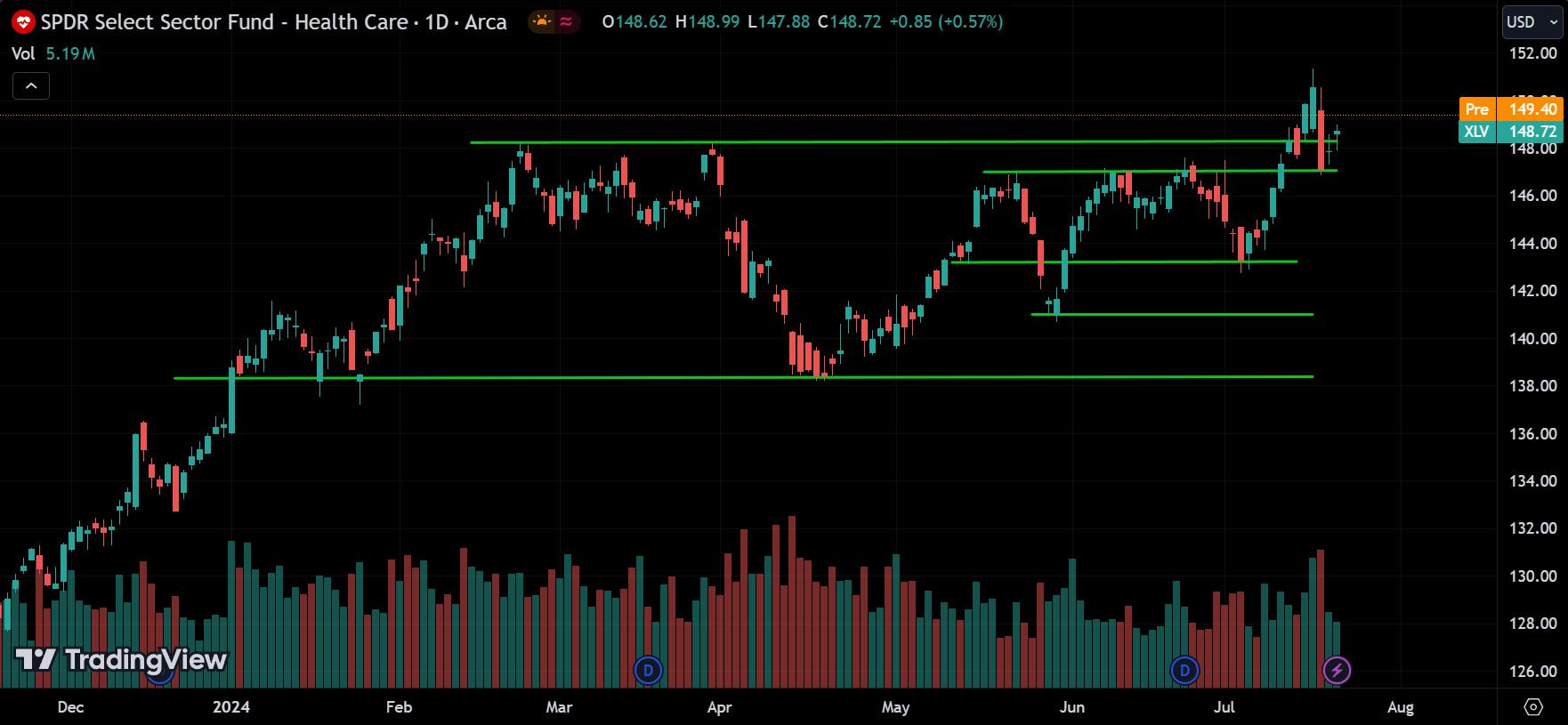

Healthcare Sector(XLV):

It appears the healthcare sector is entering an uptrend, having broken above resistance and now trading above that level. We anticipate the price will continue to rise in this direction, though corrections may occur. Keep an eye out for any potential breaks below the support level.

Financials Sector(XLF):

The financial sector is on an uptrend. It recently retraced from resistance and is currently attempting to re-enter. We anticipate the price will move back toward the resistance and potentially break through it. Keep an eye on any potential breaks below the major support level.

Technology Sector(XLK):

The technology sector is generally trending upward. After a correction, the price is beginning to move back up. If the price breaks above the resistance noted on the 1-hour chart, we can expect the upward momentum to continue.

Communications Sector(XLC):

The communication sector is on an uptrend overall. It recently retraced from a resistance level and is currently at a support level. We expect the price to start moving up from this support. However, if the price breaks below this support, it could potentially drop further, so be cautious.

Utility Sector(XLU):

The utilities sector is also trending upward. It’s currently above a resistance level, and we anticipate this momentum will continue toward the main resistance level. Keep an eye out for any potential breaks below this resistance, which now acts as support.

Real Estate Sector(XLRE):

The real estate sector is leading with strong performance, on an uptrend. It recently broke above resistance, pulled back for a retest, and is now resuming its upward movement. We anticipate this momentum will continue. Keep an eye on any potential breaks below this support level.

Stocks to Watch Today

TESLA(TSLA):

Tesla will release its earnings report after today’s market close, so the price could react during trading hours. It’s a stock to watch today, especially given the widespread belief in this EV leader. If they meet the estimates, the stock price could soar.

THE COCA-COLA COMPANY(KO):

Coca-Cola reported positive earnings, and the price is approaching a high level last seen in April 2022. We anticipate the price will reach this resistance range and either bounce back or potentially break above and continue upward.

GOOGLE(GOOG):

The search engine giant is reporting earnings after the market closes, similar to Tesla. This will also affect trading hours, so it’s something to keep an eye on.

THE UNITED PARCEL SERVICE(UPS):

UPS missed earnings estimates, and in premarket trading, its price was at a major support level. People’s reactions will be revealed only after today’s market opens and closes. This is something to watch closely.

GRAND MOTORS(GM):

GM continues to surpass its earnings estimates, driving its price trend higher. Today, we may witness GM’s stock price reaching new highs.

Conclusion & Disclaimer

Please provide your feedback on how we can improve this article. Thank you!

We discussed these sectors and markets because when the entire market or sector goes through certain movements, most of the stocks within that market will also experience similar movements. So, by understanding what the market is doing, you can conduct your own analysis on specific stocks.

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!