![Market Analysis Today[2024.04.10]: Will it Break or Not?

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/04/Market-Analysis-Today-04.10.jpg)

It’s Wednesday, 10th of April 2024. Let’s take a look at our market analysis today.

Key Events Today

We have two major events today: CPI and the FOMC Meeting Minutes. Both are market-moving events, so we need to be careful.

And these stocks have earnings today.

FOREX

The EURUSD seems to be moving sideways for now, but there’s a medium-term upward trend happening. Currently, the strongest support for the price is around the 1.07250 range, with the next resistance levels at approximately 1.09800 and 1.11400. If the upward trend continues, it could reach 1.09800, and if it surpasses that level, it may rise further to 1.11400. Conversely, the price shouldn’t drop below the 1.07250 support range; if it does, it suggests a bearish trend. However, overall, there’s a high likelihood of the price going up, so it’s important to monitor these support and resistance levels.

On the one-hour chart, the medium-term uptrend is evident, with the price currently approaching a resistance level around 1.08800. If the price surpasses this level, it signals a continuation of the uptrend. Conversely, if the lower trend line is breached, indicating a bearish trend, we might anticipate the price declining to 1.08000. Should that level also be broken, further downward movement to 1.07200 could be expected.

However, it’s crucial to note that today we have significant market-moving events in the form of CPI data and the FOMC meeting. These events have the potential to significantly impact the market, regardless of what technical analysis indicates. Therefore, it’s important to stay vigilant and cautious in light of these events. Trade safely.

CRYPTO

In the daily chart, BTC appears to be exhibiting more of a sideways trend, suggesting that it’s gearing up for a potential move. Currently, the strongest support for the price is around 60000, while the strongest resistance sits at 73800, which marks its all-time high.

The medium-term uptrend appears to have been broken, with the price currently trading below the trend line, which now serves as a resistance level. This suggests that the price is undergoing a correction phase. We might anticipate the price falling to levels around 64500. However, if the price retraces and breaks above the trend line, signaling a return to the uptrend, it could indicate a continuation of the BTC bull run.

STOCK

Regarding the SPY, it’s notable that the channel has been broken, and currently, the lower trend line is acting as a resistance level, as expected. It’s clear to see the price encountering resistance at this level. What we might anticipate next is either a correction in the market, or the price breaking above the trend line to rejoin the uptrend. There’s a high probability of the price experiencing a fall and undergoing a correction. However, predicting the future is uncertain, so it’s essential to wait and confirm the trend. If the price fails to break above the level today, it would increase the likelihood of a bearish trend. Let’s observe how the market unfolds today.

It appears that most things are back on track, except for Nvidia, which is down 2%. It’s crucial to remember that not everything can always maintain momentum. This serves as an important reminder in trading and investing.

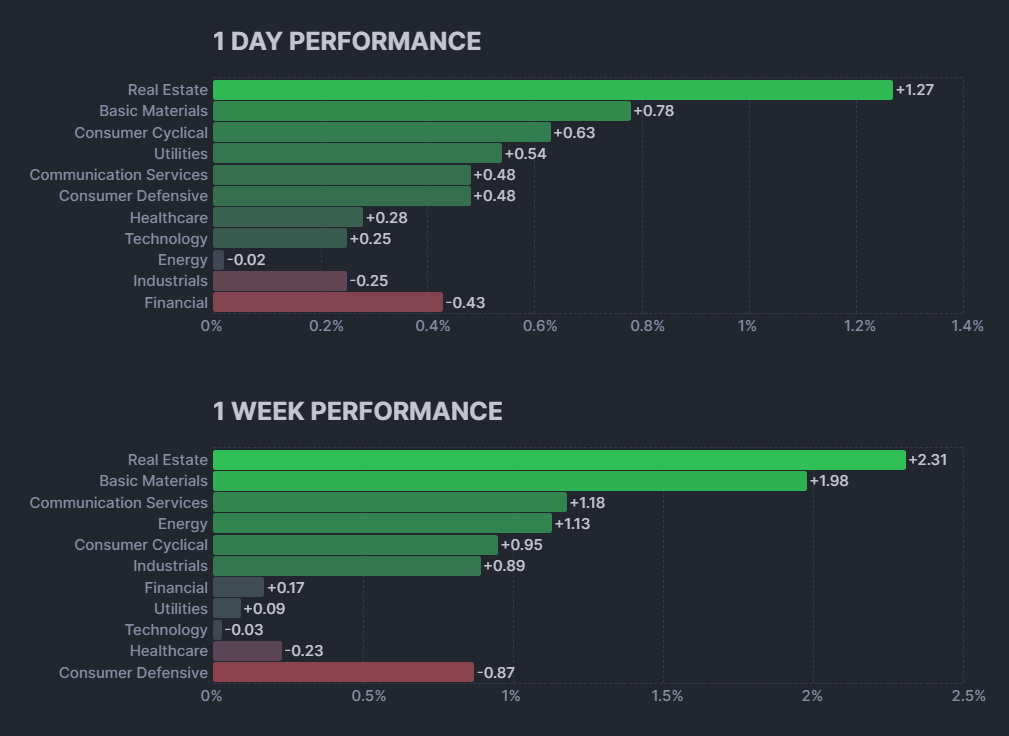

The stock market showed positive performance over the week, with most sectors experiencing growth. Real estate and basic materials led the surge, both exceeding 2% growth. Communication services and energy followed closely behind, each gaining over 1%. Financials and consumer defensive were the only sectors that declined, with financials experiencing the sharpest drop at nearly half a percent.

Looking at the one-day performance, the trend is similar with all sectors except financials and industrials in positive territory. Real estate again came out on top, followed by consumer cyclical and basic materials. Interestingly, energy which performed well over the week, dipped slightly in the one-day view.

Overall, the stock market appears to be on an upward trend. This positive outlook is supported by both the week-long and day-by-day performance across a majority of sectors.

Consumer Staples:

Regarding XLP, the channel remains broken, indicating a higher likelihood of the price declining. However, the situation is similar to SPY. If the price breaks above and reenters the channel, it will likely continue its upward trend. Conversely, if the price remains below the lower trend line, it will likely fall, as this line acts as resistance.

Energy:

XLE, the energy sector, continues to perform well recently. Although the trend remains strong, we might anticipate a correction in the near future. However, at present, the trend remains bullish, with no significant fluctuations. It’s worth noting that we have a crude oil report scheduled for today, which could impact the price of the energy sector. Therefore, it’s important to remain watchful of this report’s effects.

Materials:

Regarding XLB, it’s still trading within the channel, and the trend remains bullish. We can anticipate the price to continue its upward trajectory within the channel.

Industrial:

XLI is currently in a sideways trend, indicating it might be preparing for a breakout. The two lines serve as strong support and resistance levels for the price. If the price breaks either of these lines, it suggests the direction the price is likely to take. Let’s wait and see what unfolds.

Consumer Discretionary:

For XLY, the long-term uptrend channel remains intact. Within this channel, there exists a support line and a resistance line for the price. The price mustn’t drop below the 177 price range; if it does, it could descend all the way to the lower trend line of the long-term channel. However, at present, if the price breaks above the resistance level around 182, we can anticipate it rising to the 186 level. Therefore, the breakout will confirm the direction of its movement. Let’s wait for it.

Healthcare:

Regarding XLV, the price is currently trading near a support line, having bounced back from it. Consequently, we might anticipate the price rising towards the nearest resistance level, approximately around 144. However, if the price breaks below the support level, we could expect it to decline to around the 138 level. The 144 level serves as a robust resistance level, and if the price manages to break above it, it would strongly indicate an uptrend. Nevertheless, the probability leans towards a break below, but we cannot be certain. Therefore, it’s advisable to wait for confirmation before making any decisions to enter or exit positions.

Financials:

Regarding XLF, it’s experiencing a similar situation to XLI, with the price currently in a sideways trend and potentially preparing for a breakout. The 41.20 level serves as a strong support, while 41.60 acts as resistance. If the price breaks above this resistance, we may anticipate further upward movement. Additionally, if it surpasses the next strongest resistance around 42, and particularly if it exceeds the 42.25 range, this would confirm a bullish trend. Therefore, it’s advisable to wait for the breakout before making any decisions.

Technology:

The situation appears to be similar in the technology sector as well. The price is currently in a sideways trend and is awaiting a breakout. These lines serve as robust support and resistance levels. Therefore, it’s prudent to wait for the price to break these levels to confirm the trend.

Communications:

XLC is exhibiting a strong upward trend, indicating confidence that the price may continue to rise. Overall, the trend remains bullish. we only need to worry when the trend line broken.

Utilities:

XLU, or the utilities sector, is performing well, with a noticeable robust upward trend evident from the chart. We can expect the price to continue its upward trajectory. It’s essential to keep an eye on the trend line to monitor any developments. If the trend line remains unbroken, it indicates that the bullish trend is still intact.

Real Estate:

Regarding XLRE, the price has retraced from the support level and is currently trading at the resistance level. If the price breaks above this resistance level, we can anticipate further upward movement. Additionally, there is another nearby resistance level to watch out for. If both of these levels are broken, the next major resistance is around 40. On the other hand, if the price retraces from its current position, we might expect it to return to the support level from which it retraced. If this support level is broken, the price could fall further down.

Disclaimer

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.