![Stock Market Analysis Today [2024.07.03]: S&P 500 Uptrend and Sector Insights

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/Stock-Market-Analysis-2.png)

Hi, Welcome to Stock Market Analysis Today!

- S&P 500: In an uptrend, likely to reach new highs soon.

- Consumer Staples (XLP): Consolidating but in an uptrend. Watch for price moves from support.

- Energy (XLE): Broke resistance, indicating a potential new uptrend.

- Materials (XLB): In a downtrend after breaking support. Monitor for further drops.

- Industrials (XLI): Consolidating at support. Possible rise toward resistance, but watch for breakouts.

- Consumer Discretionary (XLY): In an uptrend, recently broke major resistance. Expect continued rise.

- Healthcare (XLV): Consolidating, pulling back from resistance. Monitor support levels.

- Financials (XLF): In an uptrend, attempting to recover after breaking support.

- Technology (XLK): Near all-time high, in an uptrend. Watch for resistance levels.

- Communications (XLC): Similar to tech, in an uptrend near high levels.

- Utilities (XLU): Crashing, heading towards the next support level.

- Real Estate (XLRE): Consolidating, moving toward resistance around 38.50. Watch for breakouts.

Stock Market Events Today

These events include important news that could impact the stock market, macroeconomic reports, and economic indicators. For more details, you can check the bloomberg calendar & yahoo finance.

- 8:30 AM ET: Initial Jobless Claims report released. Forecast: 234K, Previous: 233K.

- 9:45 AM ET: Services PMI report released. Forecast: 55.1, Previous: 54.8.

- 10:00 AM ET: ISM Non-Manufacturing PMI report released. Forecast: 52.6, Previous: 53.8.

- 10:30 AM ET: Crude Oil Inventories report released. Forecast: -0.400M, Previous: 3.591M.

- 2:00 PM ET: FOMC Meeting Minutes released, providing detailed insights on the committee’s recent policy-setting meeting. Traders examine these minutes for clues on future interest rate decisions.

Stocks with Earnings:

| BEFORE MARKET OPEN | AFTER MARKET CLOSE |

|---|---|

| STZ |

S&P 500

![SPY Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/SPY-D-1.png)

Looking at the S&P 500, it’s in an uptrend and is likely to reach new highs in the coming days.

![SPY Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/SPY-H-1.png)

Looking at the 1-hour chart, you can see the price is near the resistance level of 550. If the price breaks above this level, we can expect it to continue going up. Otherwise, it might pull back from this level for a correction.

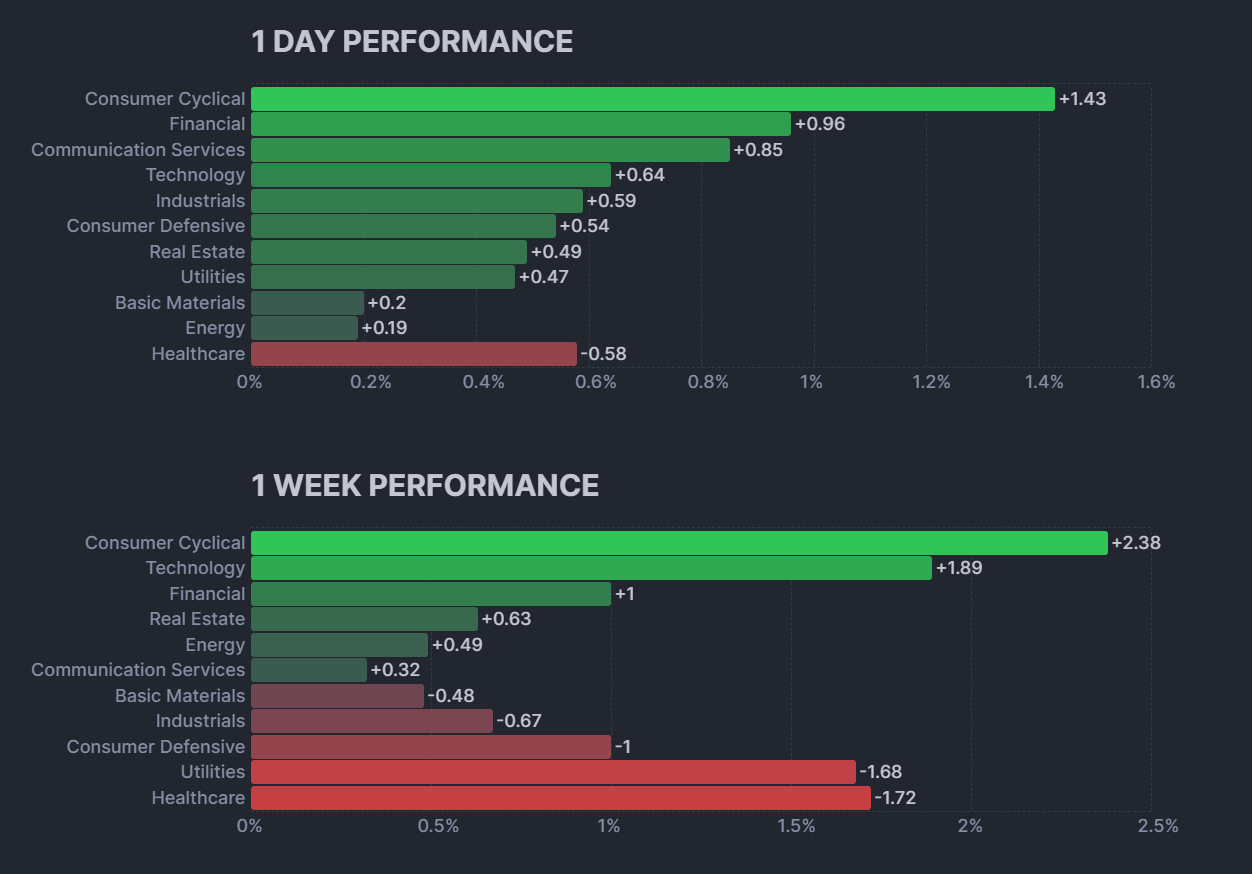

It looks like most of the stocks are up, except for NVDA and the healthcare sector. Tesla saw a 10% jump. The energy sector is also up, but not all stocks in this sector are performing well. Let’s look at the actual performance of each sector.

Consumer Staples Sector(XLP):

![XLP Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLP-D-1.png)

Looking at the consumer staples sector, it’s consolidating but remains in an overall uptrend.

![XLP Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLP-H-1.png)

Looking at the 1-hour chart, you can clearly see the consolidation phase. Right now, the price is pulling back from the support level. We can expect the price to continue going up, but watch out for the price breaking below this support.

Energy Sector(XLE):

![XLE Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLE-D-1.png)

The energy sector was trending down, but it recently broke the upper resistance level. This suggests it might start moving in a new upward trend.

![XLE Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLE-H-1.png)

Looking at the 1-hour chart, you can see that the price is above the resistance level. We can expect the price to continue going up from this level. However, if the price breaks below this level, it would indicate that the downward trend is still in play.

Materials Sector(XLB):

![XLB Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLB-D-1.png)

Looking at the materials sector, the price broke the support level, indicating that we can expect the price to enter a downtrend.

![XLB Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLB-H-1.png)

Looking at the 1-hour chart, you can see that the price is pulling back after the breakout. We can expect the price to retest the breakout level and potentially start dropping from there. However, it could also break above that level, so watch out for a breakout.

Industrial Sector(XLI):

![XLI Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLI-D-1.png)

Looking at the industrial sector, it is currently consolidating, and the price is at the support level.

![XLI Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLI-H-1.png)

Looking at the 1-hour chart, you can see the price pulling back up from the support level. We can expect the price to continue rising toward the resistance level from here. However, if the price breaks below this support, it could continue dropping and start a new downtrend. So, watch out for a breakout.

Consumer Discretionary Sector(XLY):

![XLY Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLY-D-1.png)

Looking at the consumer discretionary sector, it’s in an uptrend, and the price recently broke above the major resistance level. We can expect the price to continue going up from here.

![XLY Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLY-H-1.png)

Looking at the 1-hour chart, you can clearly see the uptrend. We can expect this momentum to continue. Watch out for round numbers, as they often act as support and resistance levels. The next resistance may be somewhere around those round numbers.

Healthcare Sector(XLV):

![XLV Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLV-D-1.png)

Looking at the healthcare sector, it’s consolidating. Right now, the price is pulling back from the resistance level.

![XLV Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLV-H-1.png)

Looking at the 1-hour chart, you can see that the price is near a support level. We can expect the price to pull back from this level and go up, or it could break below this level and continue to go down. So, watch out for a breakout.

Financials Sector(XLF):

![XLF Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLF-D-1.png)

Looking at the financial sector, it is currently in an uptrend. Although the price recently broke below the support level, it is now trying to get back into the trend.

![XLF Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLF-H-1.png)

The price is at a key level. If it is able to break above this level, we can expect the uptrend to continue. However, if it pulls back and starts dropping, we can assume that the upward momentum may be over.

Technology Sector(XLK):

![XLK Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLK-D-1.png)

Looking at the technology sector, it is also in an uptrend and is near its all-time high level.

![XLK Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLK-H-1.png)

Looking at the 1-hour chart for the technology sector, you can see that the price is pulling back from the support level. We can expect the price to move towards the resistance level. It may pull back from there or it could break above that level and continue to go up. So, watch out for reversal or breakout signals.

Communications Sector(XLC):

![XLC Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLC-D-1.png)

The communications sector is showing a similar pattern to the technology sector. It’s in an uptrend and near its high level.

![XLC Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLC-H-1.png)

Looking at the 1-hour chart for the communications sector, the price is pulling back up from a support level. We can expect the price to move towards the resistance level. It may pull back there, or it could break above that level and continue going up. Watch out for both reversal and breakout signals.

Utility Sector(XLU):

![XLU Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLU-D-1.png)

Looking at the utilities sector, it is crashing and currently heading towards the next support level.

![XLU Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLU-H-1.png)

Looking at the 1-hour chart for the utilities sector, you can see the price clearly trending down. We can expect this trend to continue to the next support level. The price may pull back from there or it could break below that level, but that might not happen today.

Real Estate Sector(XLRE):

![XLRE Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLRE-D-1.png)

Looking at the real estate sector, it’s currently consolidating.

![XLRE Market Analysis Today [2024.07.03]

xlearnonline.com](https://xlearnonline.com/wp-content/uploads/2024/07/XLRE-H-1.png)

Looking at the 1-hour chart for the real estate sector, you can clearly see the sideways trend with the price pulling back up. We can expect the price to move towards the resistance level around 38.50 or even higher before pulling back. However, be on the lookout for potential breakouts.

Conclusion & Disclaimer

Please provide your feedback on how we can improve this article. Thank you!

We discussed these sectors and markets because when the entire market or sector goes through certain movements, most of the stocks within that market will also experience similar movements. So, by understanding what the market is doing, you can conduct your own analysis on specific stocks.

These analyses are here to help you understand how to analyze the market. They’re not about giving buy or sell signals. It’s simply about observing price action market behavior. I don’t recommend when to buy or sell because trading doesn’t work that way. You need a strategy to guide your decisions about when to enter or exit positions. That’s the key to making consistent profits in the financial markets over time.

The information provided in this market analysis is for educational and informational purposes only. It should not be construed as financial advice or a recommendation to buy, sell, or hold any securities or investments.

All investments involve risk, and past performance is not indicative of future results. The analysis provided may not be suitable for all investors and should be used at their own discretion.

Readers are encouraged to conduct their own research.

Trading and investing in financial markets carry inherent risks, including the risk of losing invested capital. It is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

GOOD LUCK✌!!!