There are two main categories of companies: growth companies and value companies. While these categories can be further subdivided, they represent the two primary classifications of companies.

In this article we will talk about Value Companies vs Growth Companies in details.

What is a Value Company?

A value company is a company that is currently generating profits and is not expected to experience significant profit growth in the future. It operates at its current capacity and is projected to continue generating profits at that level.

Value companies do not typically introduce new products or undertake initiatives that would lead to exceptional rates of return or substantial growth.

What is a Growth Company?

A growth company is a company that may not be currently generating significant profits, but is expected to experience substantial profit growth in the future. These companies have the potential for significant expansion and are anticipated to grow at a faster rate compared to other companies.

While some companies eventually reach a point where they operate at their maximum capacity, certain industries such as technology or biotech tend to continuously pursue growth opportunities and remain in a state of ongoing expansion.

How to Identify the Category of a Company?

A value company can be recognized by its low price-to-earnings (P/E) ratio, indicating that the price paid for its earnings is relatively low compared to a growth company with a higher P/E ratio. Additionally, value companies often have a high dividend yield, as they allocate their profits to dividends rather than reinvesting them for further growth, since they are already operating at their maximum capacity.

A growth company typically exhibits a high price-to-earnings (P/E) ratio since it is currently generating lower earnings but is expected to experience significant profit growth in the future. This anticipation of future earnings growth leads to a higher valuation relative to its current earnings.

Growth companies often have a lower or no dividend yield as they prioritize reinvesting their earnings into expanding the business rather than distributing them to shareholders. This approach allows them to allocate resources towards fueling their growth potential.

Why it’s Important to Identify the Category of a Company?

Due to the varying nature of companies, different strategies will yield better results depending on the specific type of company.

There are two main types of strategies in trading: mean reversion strategies and momentum strategies. Momentum strategies focus on taking advantage of price movements in a specific direction, while mean reversion strategies aim to capitalize on price fluctuations that tend to revert back to their average or equilibrium levels.

When dealing with a value company, which typically lacks significant price volatility. so what type of strategies should be applied to a value company?

If a stock of a value company starts to rise, the expectation for it to continue rising is often low. This is because value companies typically do not introduce new products or engage in market-disrupting initiatives that would cause the stock price to significantly surge. Instead, value companies generally generate stable income and distribute dividends. As a result, mean reversion strategies tend to be suitable for value companies.

If the stock price increases, it is more likely to revert back down, and if it experiences a significant decline, it is more likely to bounce back up. Therefore, when implementing a mean reversion strategy, it is advisable to focus on identifying value companies.

Conversely, when dealing with a growth company and its stock price rises by 10%, the expectation for it to subsequently decline is typically low. This is because growth companies have the potential to experience substantial price surges or significant declines. Therefore, implementing a mean reversion strategy may not be suitable for a growth stock.

However, a momentum strategy, where stocks are bought based on the expectation that they will continue to rise, can be more appropriate for growth stocks. This is because growth stocks often exhibit significant price movements. So it is advisable to seek out growth stocks for the purpose of implementing momentum strategies.

Its very important. because once you decide on which strategy you gonna use, then the next step is to find stocks that this strategy is gonna work well.

While it is possible for value companies to occasionally exhibit momentum-like movements and for growth companies to demonstrate mean reversion movements, the general probability suggests that value companies are more inclined to display mean reversion characteristics, while growth companies are more prone to exhibit momentum-driven movements.

How to Screen Stocks by Types of Companies?

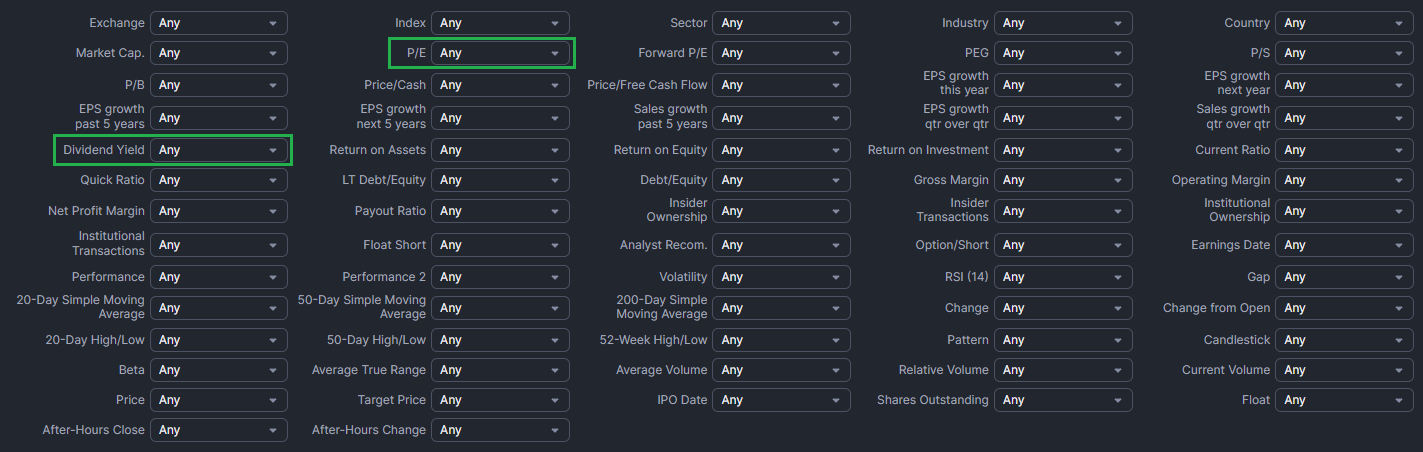

As previously mentioned, value companies are typically characterized by low P/E ratios and high dividend yields, while growth companies tend to have high P/E ratios and no or low dividends. By inputting these parameters into finviz’s screeners, you can effectively filter and identify stocks that align with the characteristics of value companies or growth companies.

Conclusion

In conclusion, Value companies prioritize stable profits and dividends, making them suitable for mean reversion strategies, while growth companies focus on expansion and reinvestment, aligning with momentum strategies. By identifying companies based on key metrics such as P/E ratios and dividend yields, investors can strategically allocate their portfolios and capitalize on the unique opportunities each category offers.