Ray Dalio’s All Weather Portfolio is an investment strategy designed to perform well in various economic environments, or “seasons.”

Ray Dalio is the founder of Bridgewater Associates, one of the world’s largest hedge funds, and he introduced the All Weather Portfolio in his book “Principles: Life and Work.”

The goal of the All Weather Portfolio is to provide consistent returns with lower volatility by diversifying across different asset classes that react differently to economic conditions.

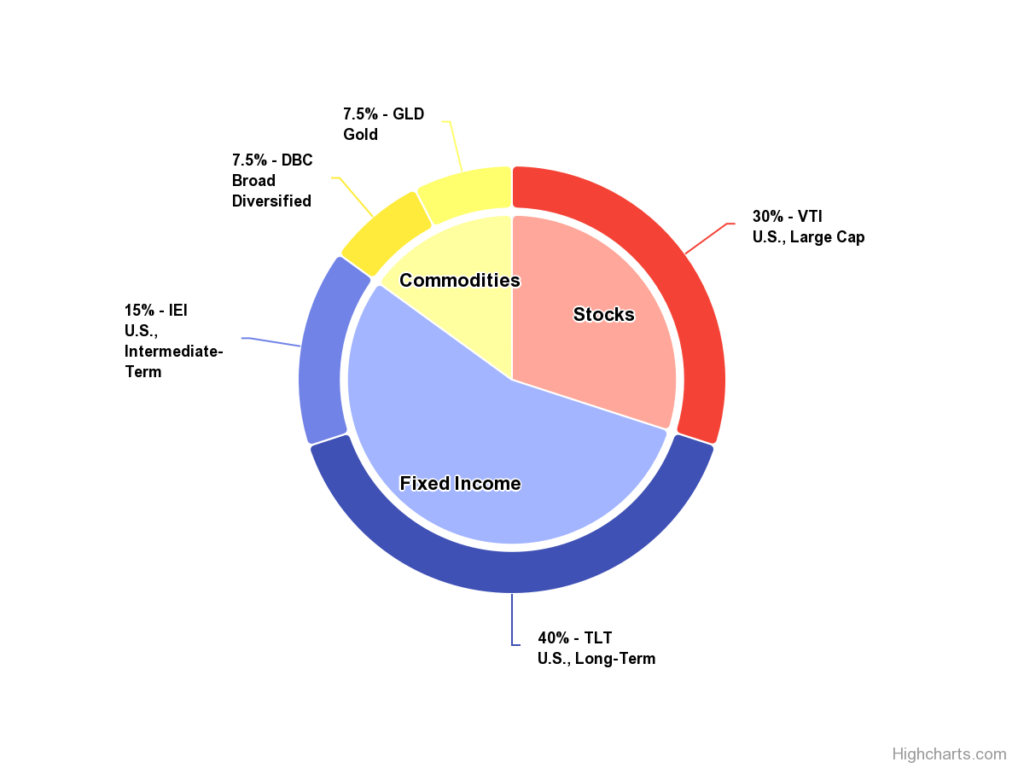

Asset allocation of “all weather portfolio”

While Ray Dalio’s All Weather Portfolio is a conceptually diversified strategy, it’s important to note that Dalio himself has not publicly disclosed the specific ETFs or individual securities he uses in the All Weather Portfolio. The exact ETFs used can vary based on an investor’s preferences, risk tolerance, and market conditions. However, I can provide some examples of ETFs that could potentially align with each asset class in the All Weather Portfolio:

You can use lazyportfolio to view this portfolio. and Portfolio Visualizer to backtest it.

1. Stocks (30%) – Equities:

- This portion typically includes a mix of US and international stocks.

- Stocks are expected to perform well during economic expansions or “growth” periods.

- Equities provide the potential for capital appreciation and are an essential component for achieving long-term returns.

- You can use VTI ETF for stock exposure.

2. Bonds (55%) – Fixed Income:

- The bond allocation is split between long-term and short-term bonds.

- Long-Term Bonds (40%):

- Long-term bonds tend to perform well during economic contractions or periods of economic uncertainty.

- They are more sensitive to changes in interest rates, which can provide capital gains during economic downturns.

- You can use TLT ETF for Long-Term Bond exposure.

- Intermediate-Term Bonds (15%):

- Intermediate-term bonds provide a balance, offering stability and some income.

- They are less sensitive to interest rate changes compared to long-term bonds.

- You can use IEI ETF to get Intermediate-Term Bond exposure.

3. Gold (7.5%) – Precious Metals:

- Gold is included as a hedge against inflation and economic uncertainty.

- Precious metals, especially gold, are expected to perform well during times of crisis or when traditional currencies may lose value.

- Gold is considered a store of value and a safe-haven asset.

- SPDR Gold Shares (GLD) is a popular ETF for Gold.

4. Commodities (7.5%):

- This category includes a diversified basket of commodities, such as agricultural products, energy, and metals.

- Commodities, in general, can act as a hedge against inflation and may perform well during periods of economic growth.

- This allocation provides exposure to the broader commodities market.

- Invesco DB Commodity Index Tracking Fund (DBC) is one of the ETF that provides commodity exposure.

Asset allocation principles

Risk Parity:

- One of the key principles of the All Weather Portfolio is risk parity. This means that each asset class is allocated in such a way that it contributes an equal amount of risk to the overall portfolio. This is different from traditional portfolios where assets are allocated based on market value.

- The goal is to prevent any single asset class from dominating the portfolio’s risk.

Balanced Exposure:

- The goal is to provide a balanced exposure to different economic environments. By diversifying across asset classes with different risk and return profiles, the portfolio aims to perform reasonably well in various market conditions.

Rebalancing:

- Regular rebalancing is a crucial aspect of the All Weather Portfolio. Periodic adjustments are made to maintain the target allocation percentages for each asset class.

- Rebalancing involves selling assets that have performed well and reallocating funds to assets that may be underperforming, ensuring that the risk parity principle is maintained.

Benefits of all weather portfolio

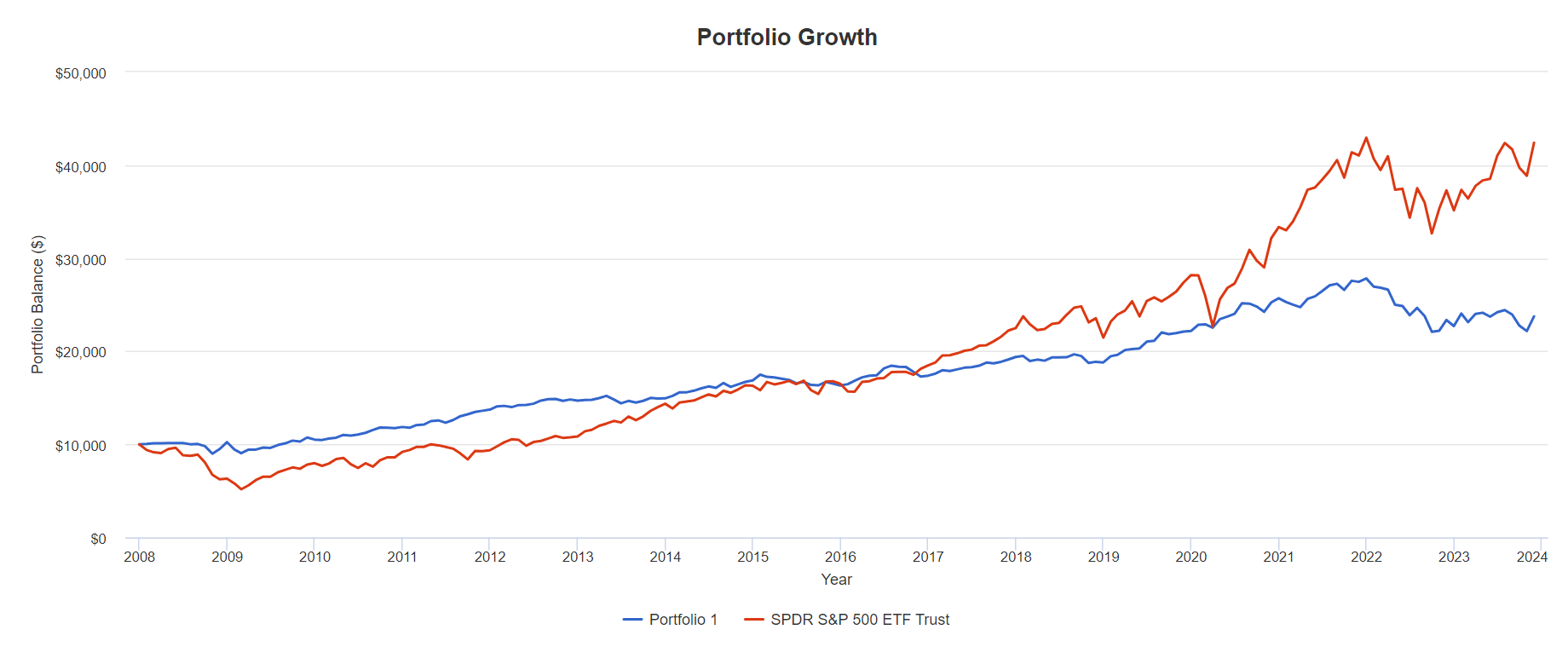

Look at this test comparing the All Weather Portfolio to the S&P 500. In the last two crashes in 2008 and the 2020 COVID pandemic, the portfolio didn’t go down; it stayed steady. Even after 2022, it didn’t drop as much as the market.

If you’re seeking a secure investment during challenging market conditions, opting for the All Weather Portfolio could be a wise decision.

It’s a very good portfolio for older people, and for someone who looking for a passive investment approach.

Drawbacks of all weather portfolio

While the All Weather Portfolio aims to provide stability and consistent returns, it doesn’t guarantee high returns during bull markets. Some critics argue that the strategy may underperform in periods of strong economic expansion when stocks tend to outperform other asset classes.

Investors considering the All Weather Portfolio should carefully assess their own risk tolerance, investment goals, and time horizon before adopting this strategy.

Conclusion

Ray Dalio’s All Weather Portfolio, through its carefully crafted asset allocation strategy, seeks to achieve consistent returns with lower volatility by navigating different economic environments. This approach aims to provide a more stable investment experience, but it’s important for investors to assess their own risk tolerance and financial goals before adopting this or any investment strategy.