What is a balanced portfolio?

A balanced portfolio refers to an investment strategy that aims to achieve a mix of different asset classes in order to balance risk and return. The goal is to create a diversified portfolio that can potentially provide stable returns while minimizing the impact of market volatility.

In a balanced portfolio, various types of assets are included, such as stocks, bonds and cash or cash equivalents. Each asset class reacts differently to economic and market conditions, and by combining them, investors seek to benefit from the potential positive performance of some asset classes while mitigating the negative impact of others.

A balanced portfolio, often known as a traditional type of investment mix, is commonly recommended by banks and investment advisers. When you consult with them, they consider factors like your risk tolerance, age, and retirement plans. Based on these criteria, they suggest a combination of stocks and bonds in your portfolio.

They might recommend, for instance, 60% in stocks and 40% in bonds, or perhaps 20% in bonds and 80% in stocks. The allocation varies because bonds are less risky, providing stability, while stocks carry more risk but offer growth potential. If you’re younger and more willing to take risks, they may advise a higher percentage in stocks. On the other hand, if you’re older and prefer lower risk, a higher allocation in bonds might be suggested. you can learn more about asset allocation by age here.

Traditional portfolios aim to balance the risk and return by adjusting the mix of stocks and bonds. Stocks offer growth but with higher risk, while bonds provide regular interest payments with lower risk. The proportion in your portfolio is tailored to your individual circumstances and preferences, ensuring a mix that aligns with your financial goals and risk tolerance.

In simple terms, a balanced portfolio is made up of both stocks and bonds, and how much of each depends on how much risk an investor is comfortable with.

Performance of a balanced portfolio

Now, let’s check out how a balanced portfolio performs. You can use the Portfolio Visualizer website for this.

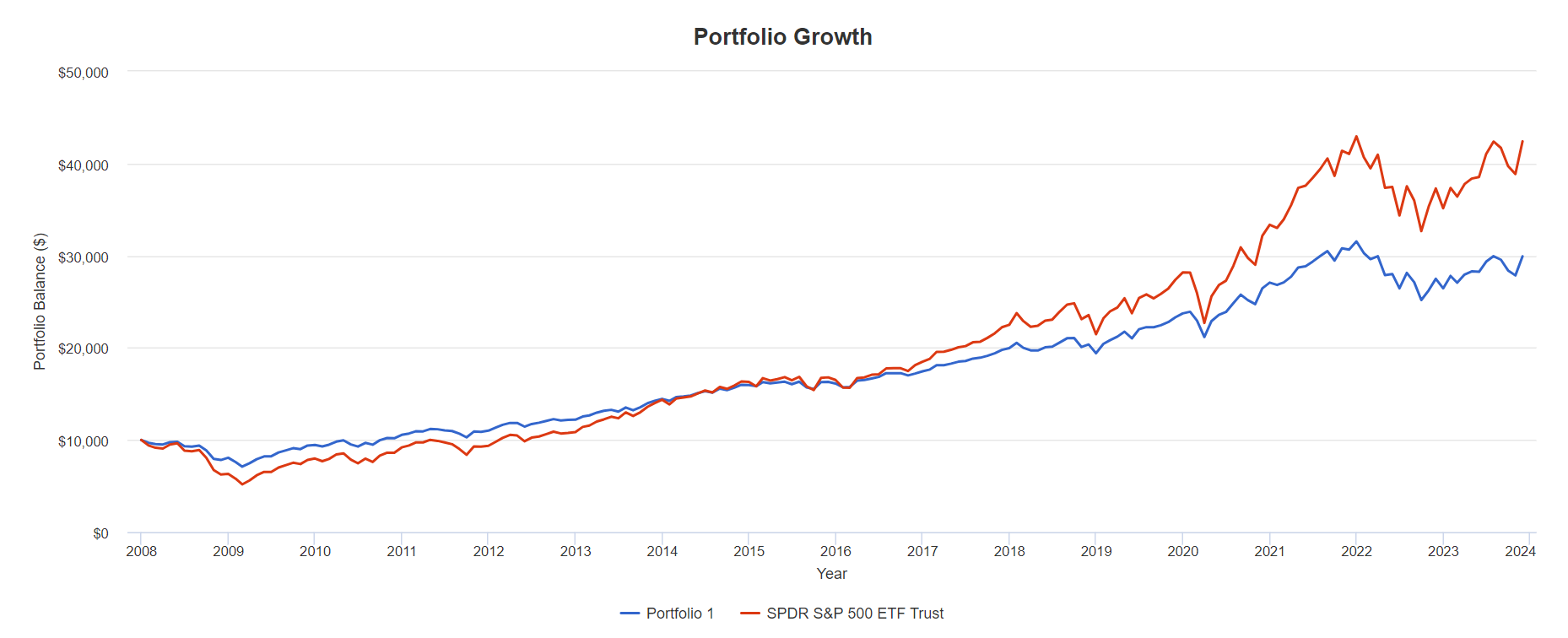

Let’s examine a portfolio that’s 60% invested in the S&P 500 (SPY) and 40% in the total bond market ETF (BND). We can then compare this to the performance of the S&P 500 alone.

We clearly understand that a mix of bonds and stocks won’t perform as well as a portfolio solely invested in stocks because, over the long term, stocks tend to outperform bonds. However, we also recognize that due to the bond portion, this portfolio is likely to be less risky. That’s why these portfolios are appealing, especially for those who prefer less risk. The less risk you’re willing to take, the less exposure you’d want in the stock market and the more you’d prefer to be in the bond market.

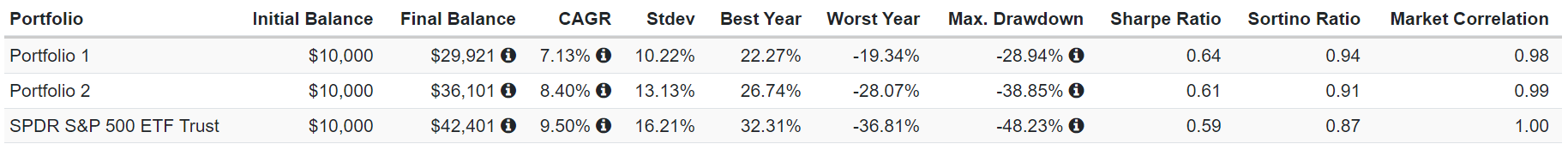

So, when we consider the long-term performance, the S&P 500 did better than our portfolio. The average return for the S&P 500 was 9.5%, while our portfolio had a 7.13% return. However, let’s look at the standard deviation, which measures how much our portfolio’s value fluctuates. For the S&P 500, the standard deviation is 16.21%, but for our portfolio, it’s 10.22%. Even though we sacrificed about 2.37% in returns, we significantly reduced our risk.

Looking at the graph, you can observe how our portfolio’s fluctuations are less severe. During market crashes, it dropped less than the market. Surprisingly, during the 2008 crash, our portfolio actually outperformed the market.

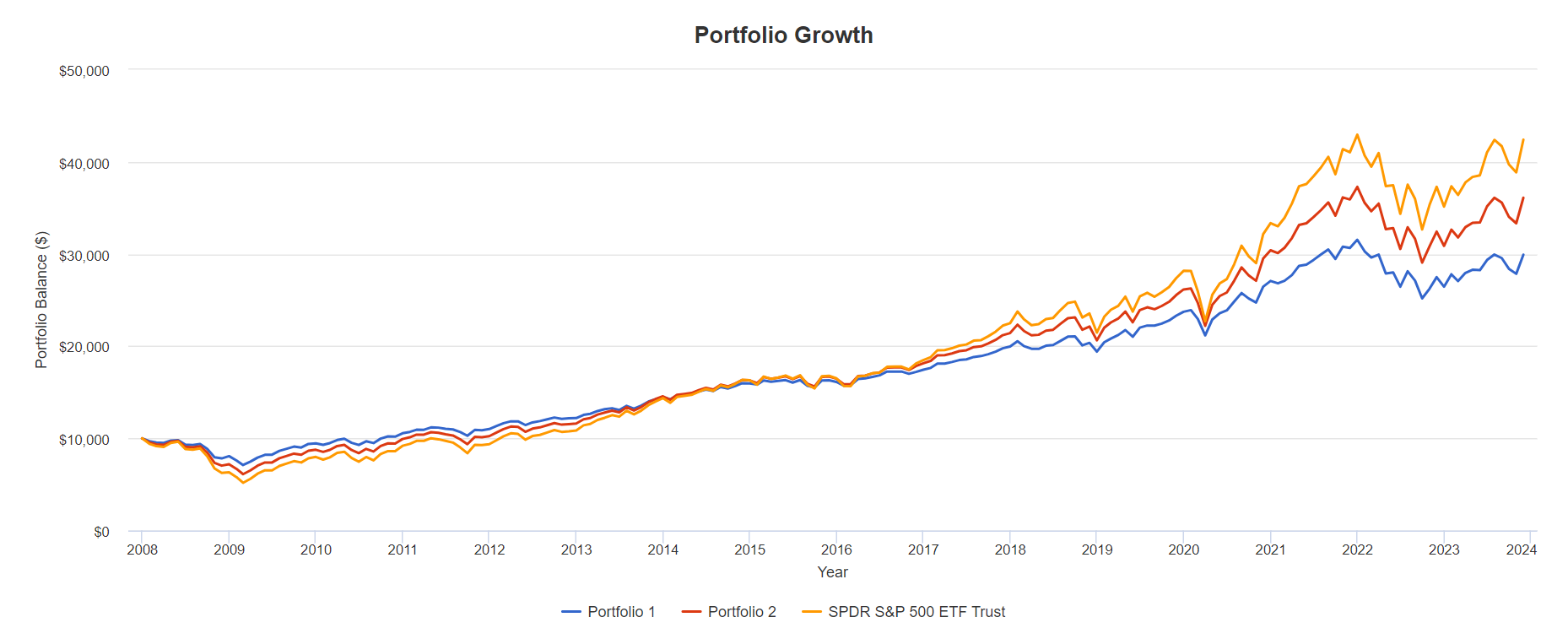

Now, let’s compare this with another portfolio that allocates 80% to the S&P 500 and 20% to BND.

So, here you can observe that the red portfolio, which includes only 20% in bonds, falls between the S&P 500 and our initial 60:40 portfolio.

So, you need to ask yourself, “What kind of risk am I comfortable with? Am I okay with holding onto risk for a long time? Will I retire in more than 20 years?” If that’s the case, you can consider going all-in on stocks because you can withstand that level of risk. However, if retirement is approaching sooner, you might notice that during market downturns, an all-stock approach performs poorly. In such cases, it might be a better idea to include some bonds to lower your risk. As you can see from the chart, the more bonds you have, the less risky or volatile your portfolio becomes.

It doesn’t end with a balanced portfolio; you can also do things like rebalancing and making tactical asset allocations to enhance how it performs.

Benefits of a balanced portfolio

1. Diversification

- Diversification is the cornerstone of risk management. By spreading investments across different asset classes, the impact of poor performance in one area is mitigated.

- Diversification also helps capture the potential upside of various market segments.

2. Risk mitigation

- Including less volatile assets, such as bonds, helps cushion the portfolio against market fluctuations.

- The balance between growth (stocks) and stability (bonds) reduces the overall risk of the portfolio.

3. Steady income and growth

- Bonds contribute regular interest payments, providing a reliable income stream.

- Stocks offer the potential for capital appreciation, contributing to long-term portfolio growth.

4. Adaptability to market conditions

- A balanced portfolio allows for flexibility and adaptability in different market environments.

- Investors can adjust their allocations based on changing economic conditions and their own financial goals.

Conclusion

In summary, a balanced portfolio offers a middle ground, combining stocks and bonds to manage risk and enhance returns. This approach caters to diverse investor preferences, aligning allocations with risk tolerance and financial goals. While it may not match the high returns of an all-stock portfolio, its strength lies in providing stability during market fluctuations. Ultimately, the balanced portfolio serves as a versatile strategy, allowing investors to navigate the dynamic nature of financial markets while pursuing long-term wealth growth.

For xlearn followers, the main takeaway from this post is that a balanced portfolio includes both bonds and stocks, and the allocation varies for various reasons. You’ll have the knowledge to make those decisions once you finish this investing module.