Active stock selection for a portfolio refers to the process of actively choosing individual stocks with the goal of outperforming a specific benchmark or the overall market. Unlike passive investing, which involves tracking a market index through instruments like exchange-traded funds (ETFs) or index funds, active stock selection requires research, analysis, and ongoing monitoring of individual stocks.

So this is an active portfolio management strategy. Active stock selectors engage in extensive research and analysis of individual stocks. This involves studying financial statements, earnings reports, industry trends, and other relevant data to assess the health and potential of a company. this also known as fundamental analysis. this may include examining earnings growth, revenue, profit margins, debt levels, and other financial metrics.

Active investors use various valuation methods to determine whether a stock is overvalued or undervalued. Common approaches include discounted cash flow (DCF) analysis, price-to-earnings (P/E) ratios, and benchmarking.

Analyzing securities is really tough, but that’s what big players in the market, like Warren Buffett, do. I can’t cover everything about it here, but you can check the link to learn more. In this post, I’m aiming to give you an idea of how investors pick stocks and how you can do it based on your skills and resources.

Before you choose the stocks you want to buy, you first decide how much of your money you want to put into different types of investments meaning the asset allocation. For instance, before picking any tech stocks, you figure out what percentage of your total investment you want to allocate to the technology sector. After that, you decide which tech companies you want to invest in. this helps with diversification.

Like I mentioned before, in active investing, you create your own strategies to outperform the market. This means you can choose any kind of investment and decide on the percentage you want, whether or not you diversify. However, it’s very risky, which is why having some plan for how you spread out your investments is advised. If you’re okay with more risk, you might decide to invest only in AAPL shares within the technology sector. However, it’s not usually recommended because it comes with a lot of risk.

Past performance of a stock does not guarantee future performance, so just because some stocks performed well in the past, you cant expect it to perform good in the future. so how do we choose stocks then?

How to choose stocks for investing?

As I mentioned, professional investors use “numbers” to choose their stocks. They do things like quantitative analysis, fundamental analysis, benchmarking, trend analysis, dividend discount models and more. But doing all of this is a big job, and it’s really tough to be accurate. I’m not saying it can’t be done, but it’s definitely challenging, and you need a lot of resources to do it well.

Let’s have an example.

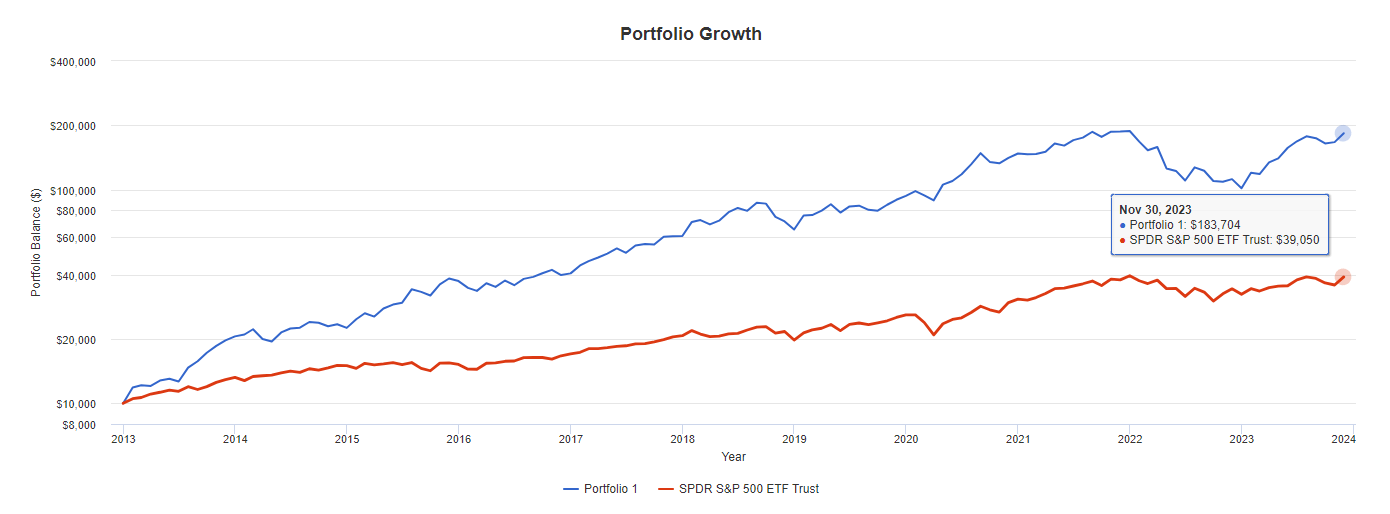

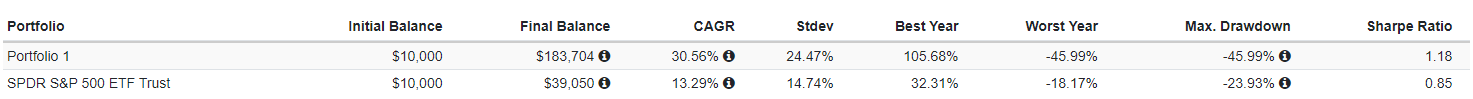

Let’s check out a portfolio compared to the market, where someone invested in the FAANG stocks. FAANG stands for Facebook, Amazon, Apple, Netflix, and Alphabet (GOOG) – these are five big American tech companies. Imagine someone decided to put 20% of their money into each of these stocks, making up 100% of their portfolio for the past few years. Let’s see how those stocks would’ve performed.

Looking at this investment set, if you put $10,000 in it over the last 10 years, in the S&P 500, you’d have had $39,050, with an average return of 13.29% per year. Now, if you had put that same $10,000 in the mentioned portfolio, it would have turned into $183,704, averaging a 30% return each year. Clearly, it’s more up and down than the general market – its best year saw a 105% increase, potentially doubling your money, while its worst year could have meant a nearly 46% loss in your portfolio. So, these five stocks outperformed the overall market, and there are folks who solely invested in FAANG stocks.

Now, the term FAANG hasn’t been around for too long; it became popular afterward. It’s like these stocks turned out to be the best performers. But what if, 10 years ago, people were asked if these were the top 5 stocks? Probably not. It’s always easier to look back now and say, “Yeah, these are massive companies, really popular; you should have invested in them instead of others.” But what about today? If we look at the current situation, are these still the best companies? Should you invest in them now because of their past performance? You can, but will their performance be the same as before? Nobody knows.

That’s why they say past performance doesn’t indicative of future performance, and that’s the reality of it.

So, how do you decide which stocks to pick if you want to choose your own investments? As I mentioned earlier, security analysis is a complex topic, not something you can fully grasp in just one article. However, you can check this link for more information on the fundamental analysis of stocks.

Now, some people still want to do their own security analysis and select their own stocks, and that’s perfectly okay. Individuals can sometimes make good decisions on which stocks to choose. Instead of following the path of security analysis used by portfolio managers, where they focus on “numbers,” individuals might look at a company and a new product and think, “Hey, I really like this product. It makes sense, and I believe a lot of people will start using it.” They preemptively realize that this company’s new product is likely to be successful, making it a good investment.

For instance, you might have started using Facebook early on and thought, “Everyone is going to use this in the future.” Or with Amazon, maybe when you received your first package, you thought, “This is a game-changer; everyone will start using Amazon.” Then, you might have had the idea to invest before mutual funds, portfolio managers, and large investors recognized that these companies were generating substantial income. Many individuals were able to figure out that a company was going to be great simply because they were early, saw their product early, and realized it would be a good company.

Conclusion

Choosing individual stocks for investment through active stock selection is a challenging task. Picking specific securities requires effort, and understanding a particular industry and being knowledgeable about specific companies can aid in making those choices.

Now, it’s important to realize that if you’re passively investing in an S&P 500 index fund, you’re already getting some exposure to these major companies because they’re part of the index. It’s just that you might not be getting as much. Another approach you can take is investing in an S&P 500 ETF and then deciding, “Alright, I’ll put 80% in that index, and for the remaining 20%, I’ll add some companies that I personally like.” For instance, let’s say I have AAPL in my ETF, but I want more exposure to AAPL, so I’ll add a few percentage points of that stock.

Before you dive into picking your individual stocks, begin with passive investing. Use a tool like Portfolio Visualizer to experiment with various assets in your portfolio and test their performance. If you find that your choices are doing well, then you can proceed with selecting your own stocks.